What Is a Competitor Analysis?

A competitor analysis is the process of identifying your competitors and researching their strengths, weaknesses, products, and marketing strategies to identify potential opportunities for your own business. It helps in understanding the market landscape and making informed decisions to improve your position in the industry.

Depending on your business, you can analyze competitors in many ways. But we’ll cover the basic steps you need to know.

Including how to:

- Understand your industry and competitive landscape

- Find different types of competitors

- Understand your market and audience

- Use your findings to create benchmarks

- Evaluate your current marketing strategy (and even develop a new one)

Let’s get started.

How to Do a Competitive Analysis

Perform a competitor analysis with these four steps.

1. Identify Your Competitors

First, build a list of key competitors to watch out for. This allows you to see who might be competing for your audience’s attention and gives you an idea of who to focus on throughout your competitor analysis.

We’ll walk you through how to find your competitors in these four key areas:

- Your industry

- Organic search

- Paid search

- Your community

At the very least, you should find competitors within your industry and organic search.

If you don’t run paid ads or don’t have a physical storefront, skip the “Finding your Paid Search Competitors” and “Finding Local SEO Competitors” steps.

Let’s start with identifying industry competitors.

Finding Your Industry Competitors

Your industry competitors sell similar products or services to yours.

Focus primarily on direct competitors, though. Meaning brands that fill a similar gap within your niche.

An example of direct competitors is Abercrombie & Fitch and Aritzia. Both fashion brands focus on trendy women’s clothing, popular with Generation Z and younger millennials. They occupy the same position in the market.

An example of indirect competitors is video game creators. Animal Crossing and Mortal Kombat are both video games, but their audiences likely differ.

You should also consider your business’s size and competition level.

For example, a local Toyota dealership may rank for similar keywords as the overarching Toyota brand.

This doesn’t mean they will directly compete. The local dealership’s competition would be other local dealerships, instead. Keep context in mind as you use competitor analysis tools.

Here are a few ways you can identify who your direct competitors are:

- Market research: Study the market to find companies selling similar products that fulfill the same purpose. Talk to your sales team to find out which companies often come up in their sales process.

- Customer feedback: Once customers decide on your product, ask them what other products they were considering. This will help you identify closely related companies.

- Social media and online communities: Many people seek recommendations on social media or forums like Reddit and Quora. Investigate customer conversations on these sites to find potential competitors.

For a more general view of your digital competitors in your industry, you can also use a competitor analysis tool like Market Explorer.

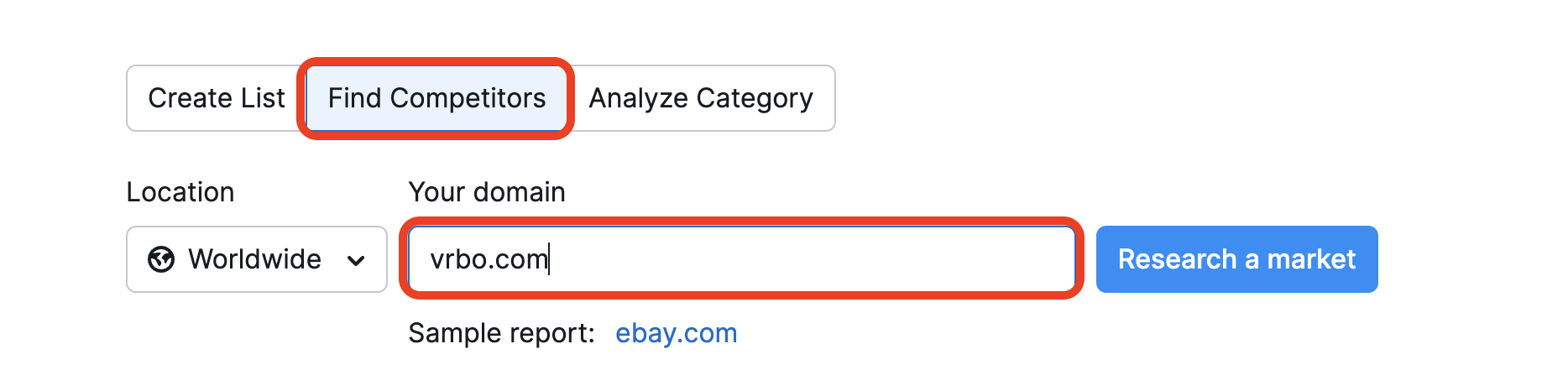

First, select “Find Competitors” and enter your domain. For this competitor analysis example, we will use Vrbo.

This will automatically generate a list of the major players in your space.

The “Overview” tab will show you who you’re competing with online. It will also visualize their relative market share, audience size, and growth rate.

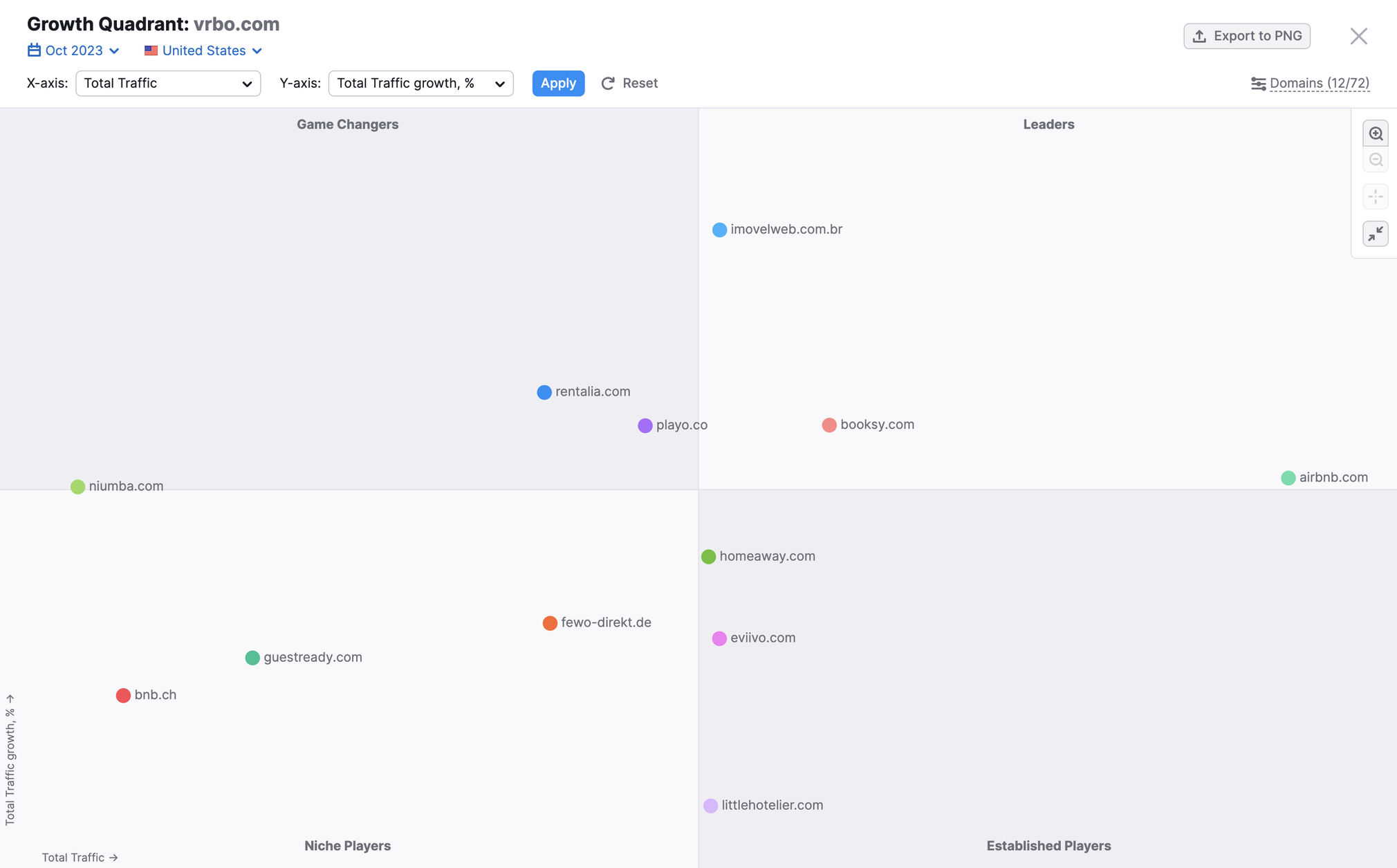

Scroll to the “Growth Quadrant” widget.

The Growth Quadrant chart breaks down you and your competitors into four basic categories:

- Niche Players: New or small companies with smaller audience size and a low growth rate

- Game Changers: Emerging companies with a comparatively smaller audience size but that are growing quickly

- Established Players: Companies with large, established audiences

- Leaders: Companies with both a large audience and a rapid growth rate

Note where each competitor stands. And how their audience and traffic growth compare to yours.

Which players occupy the same quadrant as you? Which are you most concerned about?

Also, manually search for more details about your competitors. Including:

- When they were founded and major milestones

- How they’re structured

- What differentiates them from the pack

- Where they operate

Once you’ve identified your key competitors in your industry, research their online presence through organic, paid, and local searches.

Finding Your Organic Competitors

Next, identify your competitors in organic search. These are brands that target the same SEO keywords as you in their digital content.

These can differ from industry competitors. They may not have the same type of business you do. But they still compete with you in Google’s search results.

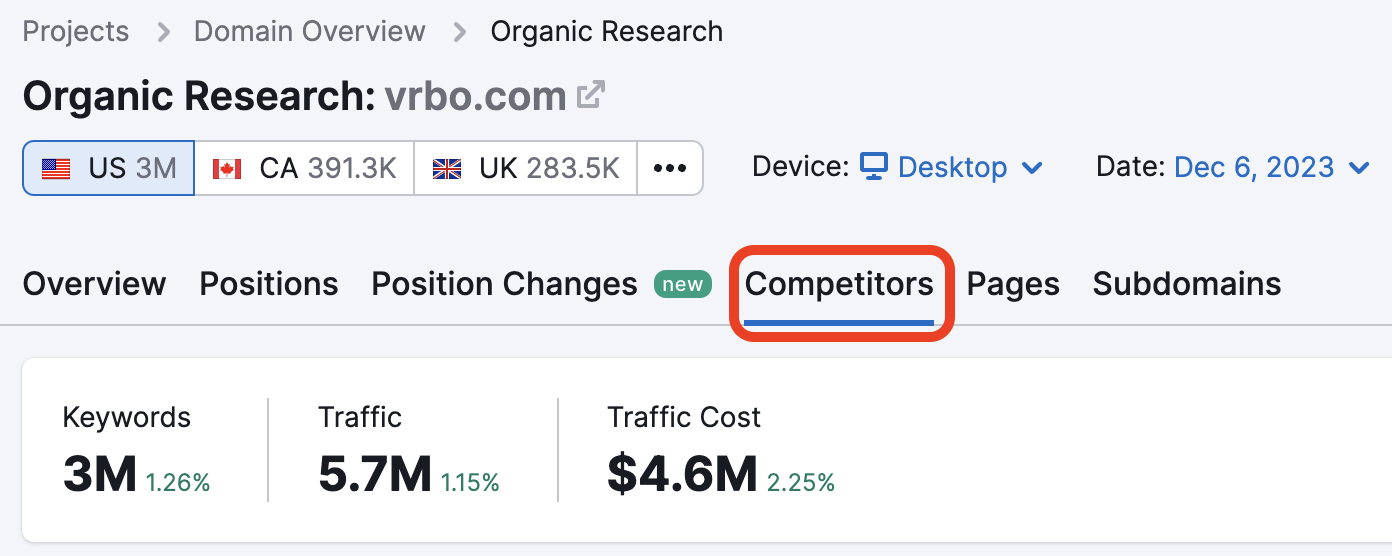

You can easily find organic competitors with the “Competitors” report in Semrush’s Organic Research tool.

Start by entering your domain and clicking “Search.”

Next, click on the “Competitors” tab.

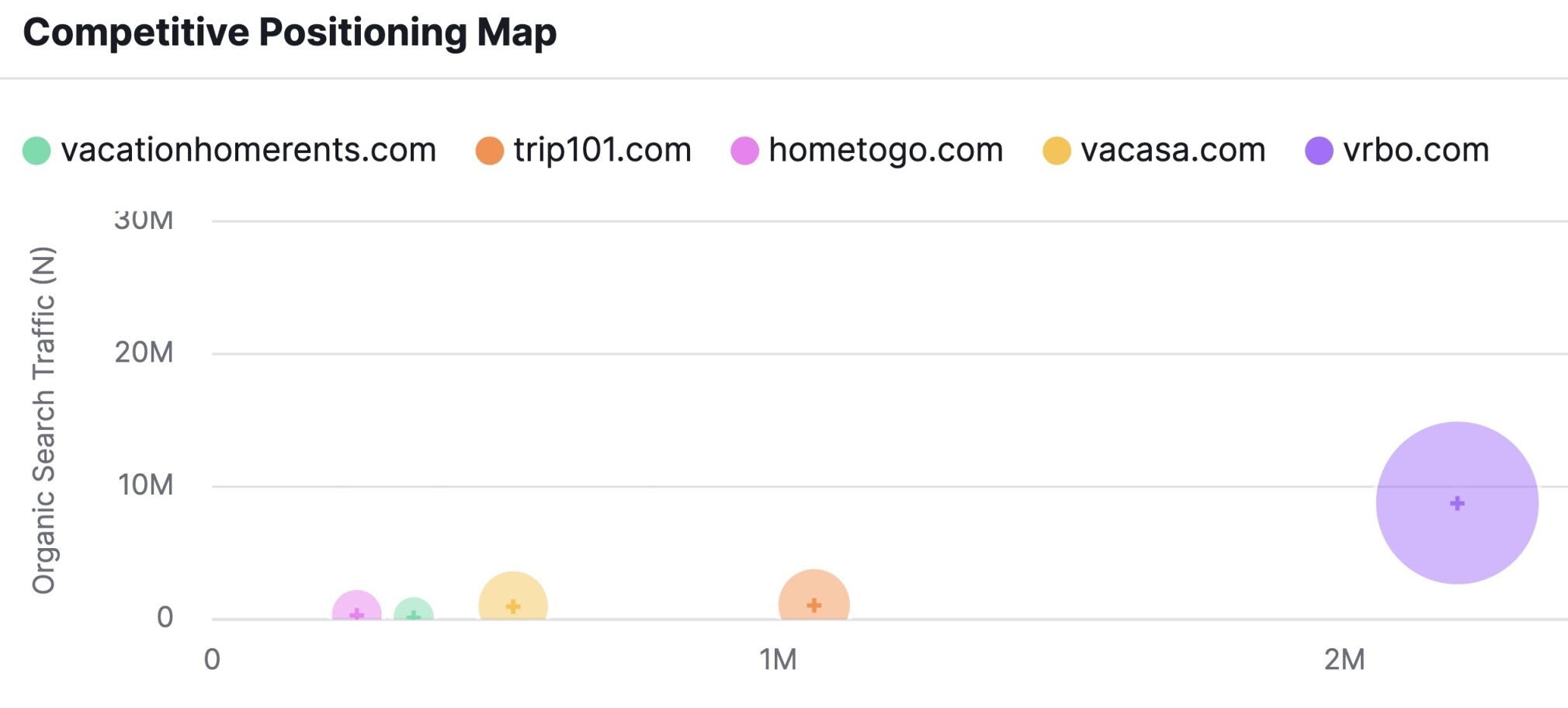

Here, you’ll find the “Competitive Positioning Map.” This illustrates how powerful each competitor is in your space based on their traffic (y-axis) and the number of keywords they rank for (x-axis).

Under the map, you’ll also find a complete list of organic competitors sorted by Competition Level. This metric is based on the number of keywords a competitor ranks for. And the number of keywords you and the competitor share.

Note your biggest organic search competitors and any new names that did not appear in Market Explorer.

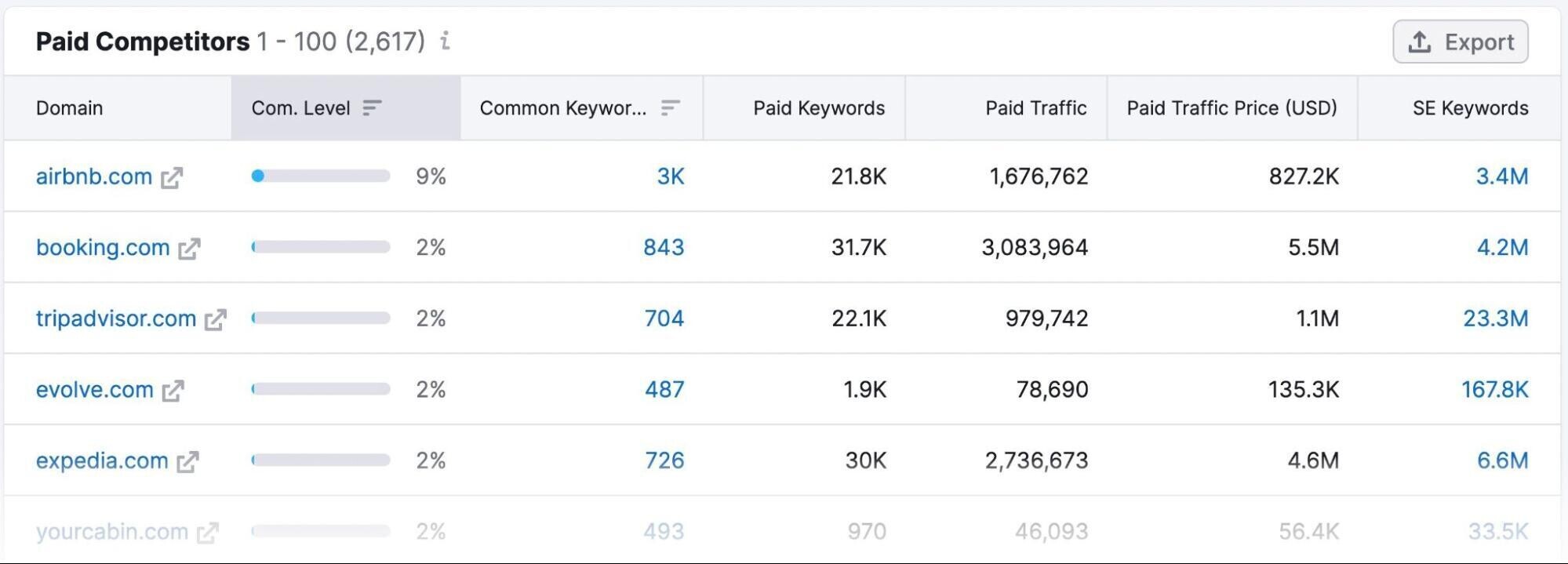

Finding Your Paid Search Competitors

Next, look for your paid search competitors. These are businesses that show up for the paid keywords you’re targeting.

Ads that show up for users depend on many factors, including location, device, and context of the search term.

A tool like Advertising Research can help you identify who your paid competitors are. And how their paid ads perform.

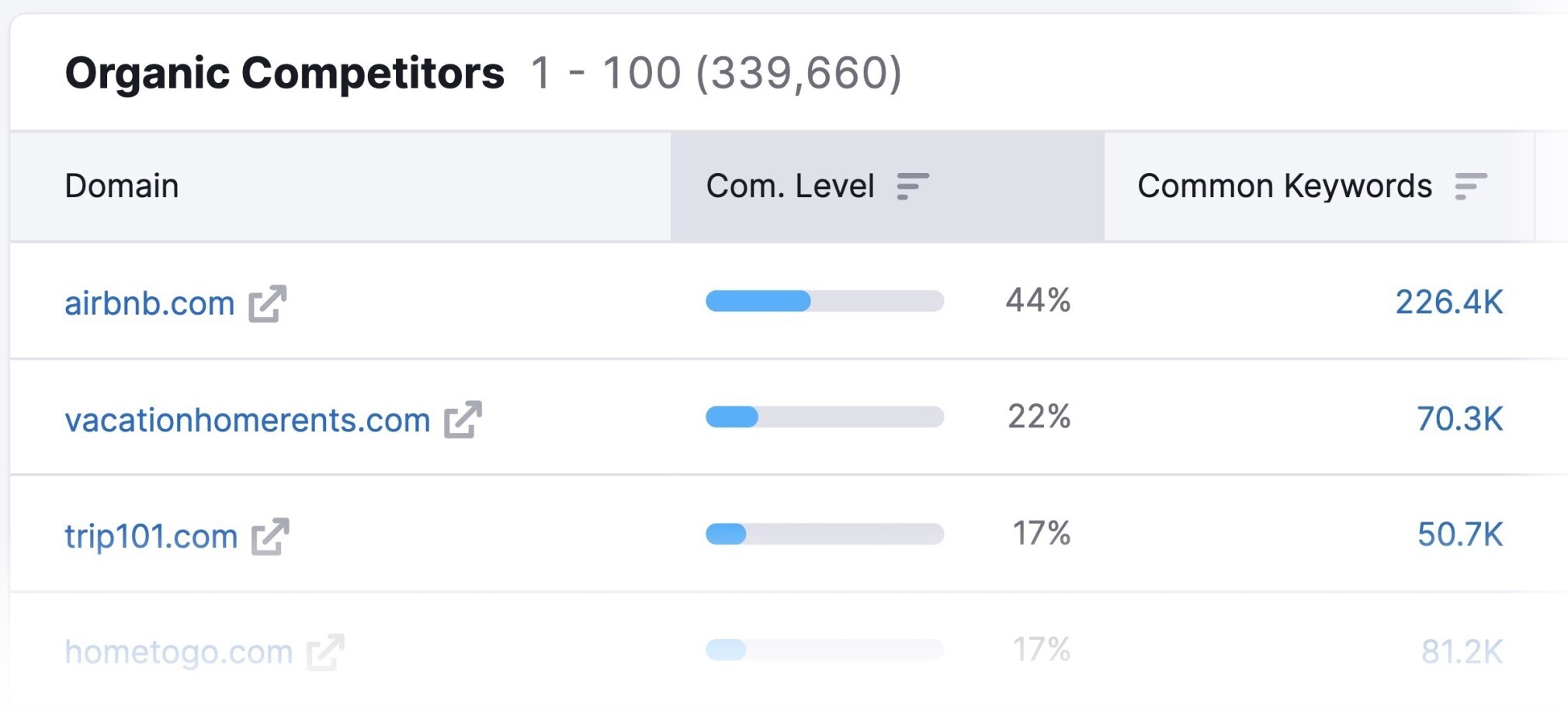

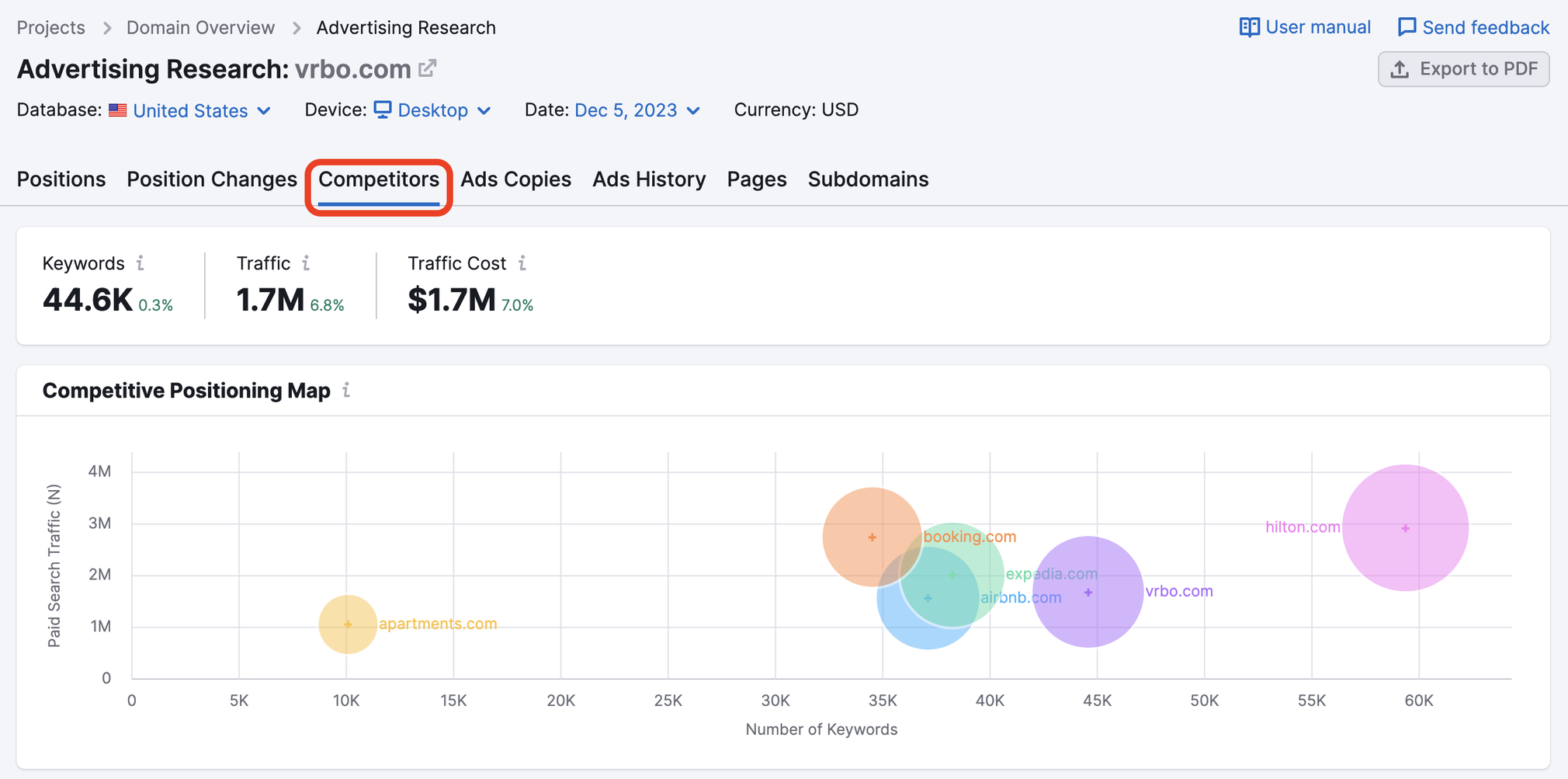

To get started, enter your domain and hit “Search.”

Next, head to the “Competitors” tab.

You’ll see a map like the one from the Organic Research Competitors report. However, this map shows your biggest paid search competition instead. Scroll to see your full list of paid search competitors, sorted by competition level:

You can also see how many paid keywords you have in common, how much paid traffic your competitors’ ads drive, and how many paid keywords your competitors rank for.

Click any of the blue linked numbers to view more detailed reports. For example:

- Clicking a number under the “Common Keywords” column will open the Keyword Gap tool. You can find keywords your competitors show up for that you don’t.

- Clicking a number under “SE Keywords” (Search Engine Keywords) will open the Positions report in Organic Research

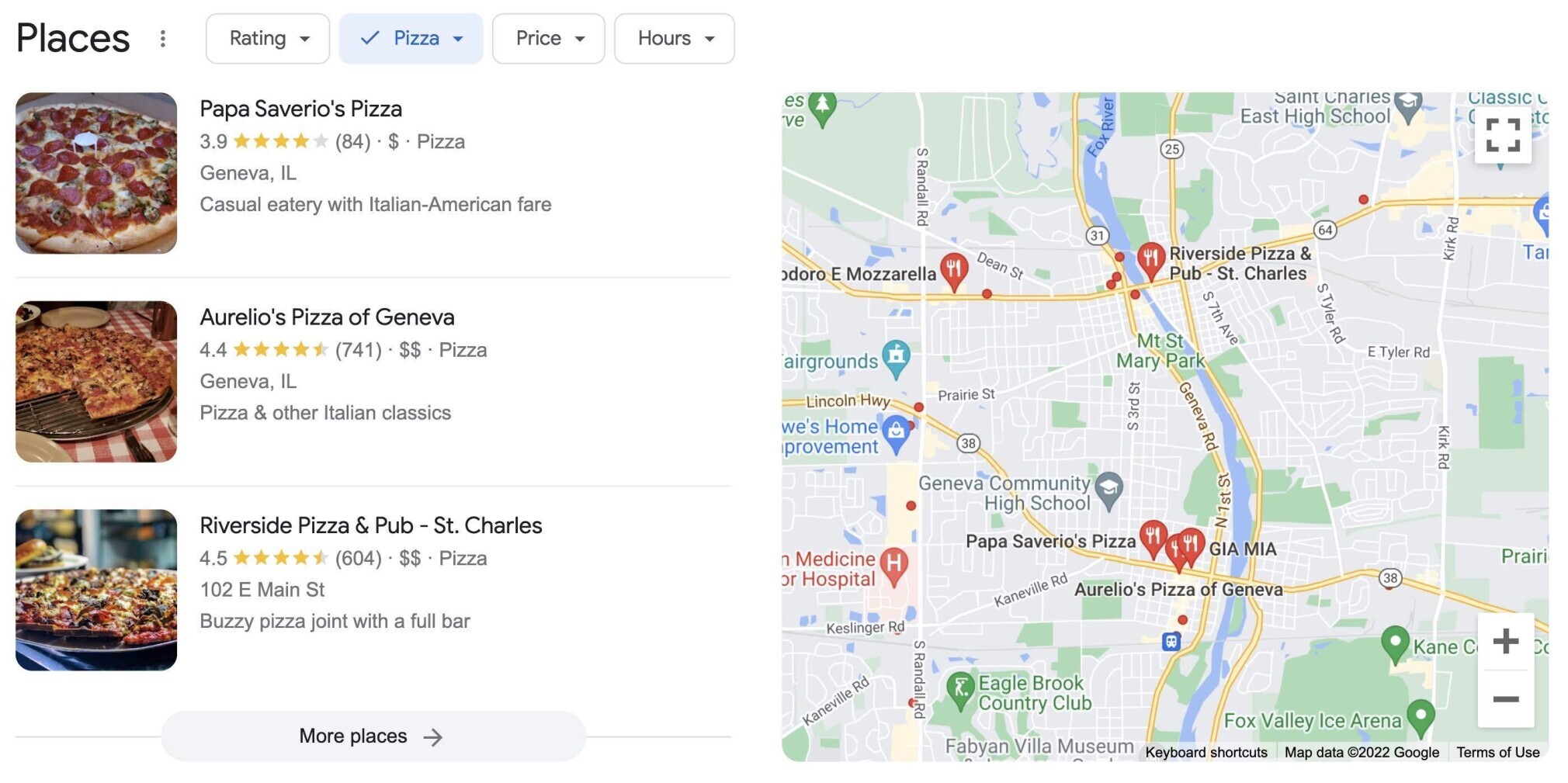

Finding Local SEO Competitors

If you run a business with a physical storefront, you must identify your local competitors (both online and offline).

These are competitors who offer a similar product or service (that fills the same gap in the market) within your geographic area.

To do that, track important local keywords and compare your business’s proximity with other sites that rank for those keywords.

And you’ll want to make sure your website ranks prominently on Google for location-specific keywords. That means optimizing your site for local search.

So that you’ll appear in local search results. Like so:

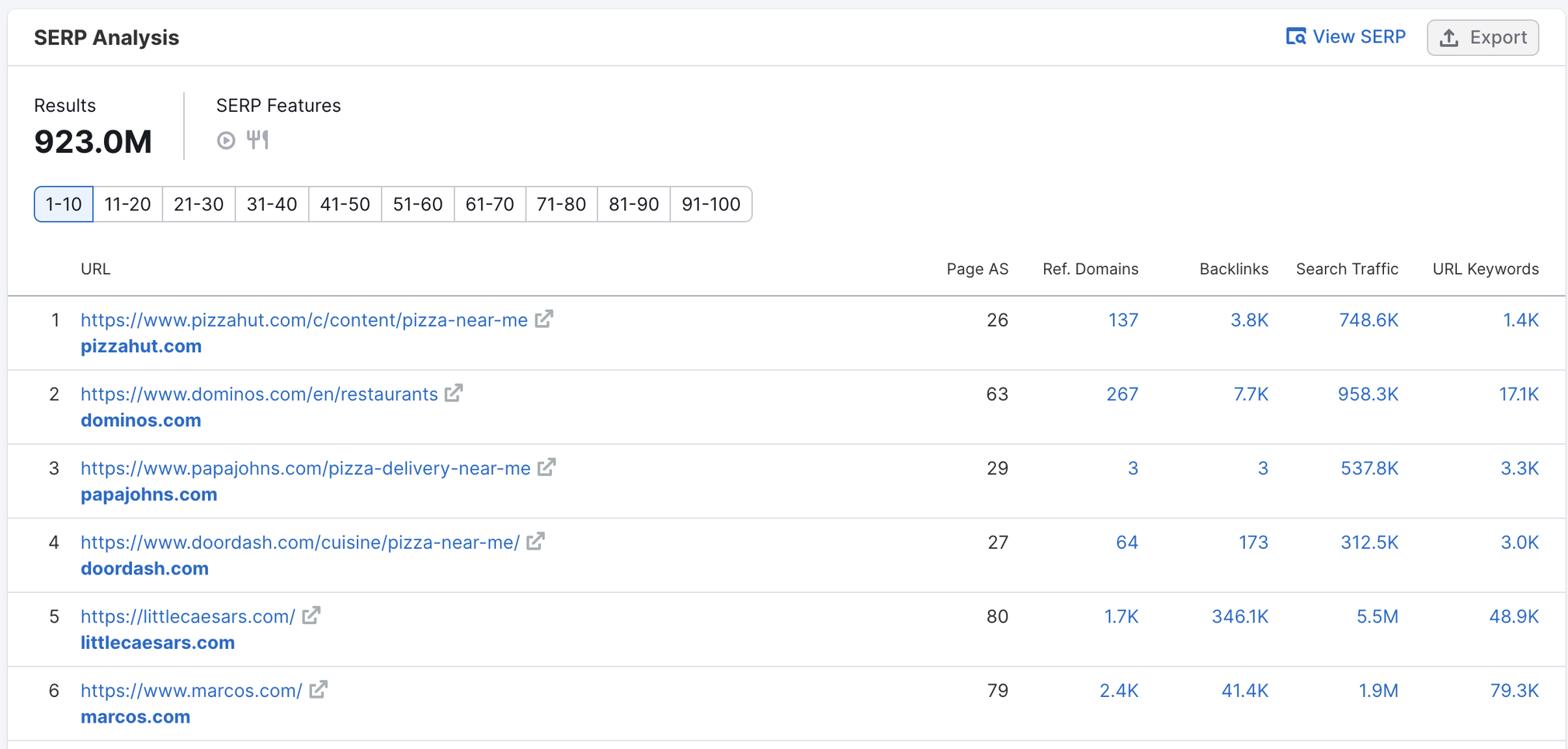

You can start your research by using the Keyword Overview tool to see what the SERP (search engine results page) looks like for keywords like “pizza near me.”

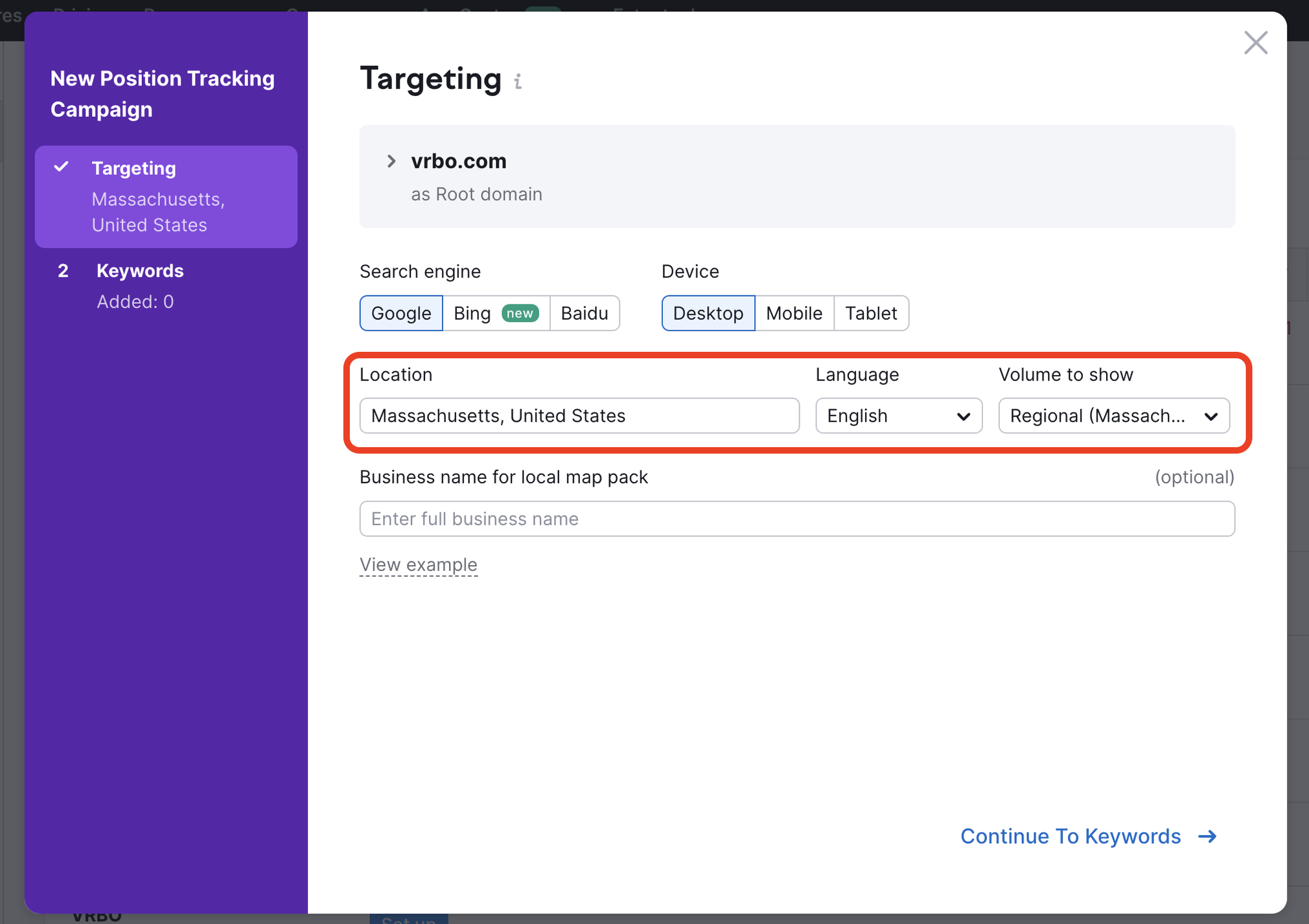

To track important local keywords and find local competitors, use the Position Tracking tool.

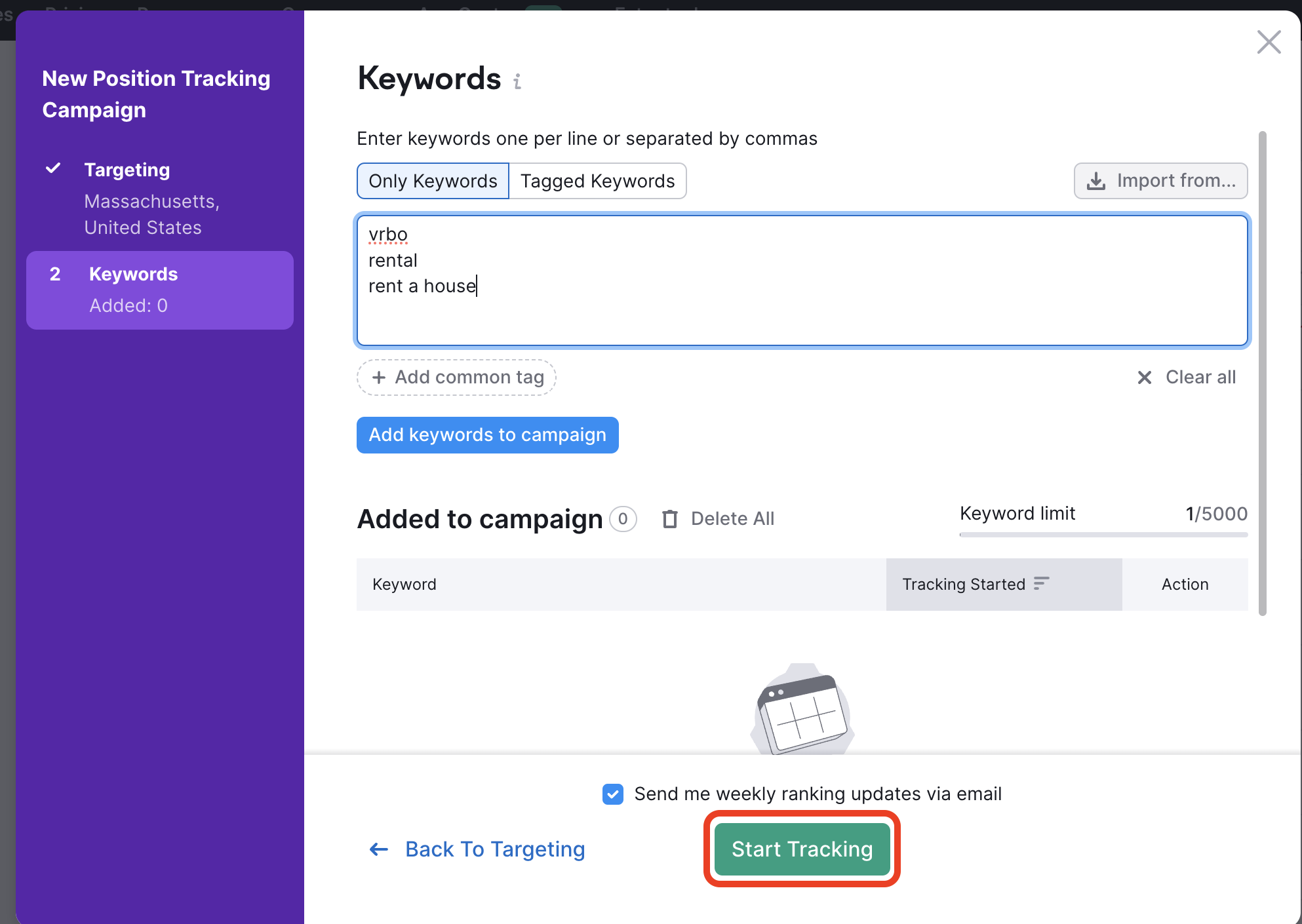

If you haven’t already, start by setting up a Position Tracking campaign for your site.

Enter your domain in the Position Tracking tool. Then, click “Set up tracking.”

Set a local target (e.g., the city or state where your company operates).

On the next page, you can add the keywords you’d like to track and click “Add keywords to campaign.”

Now, you’re ready to “Start Tracking.”

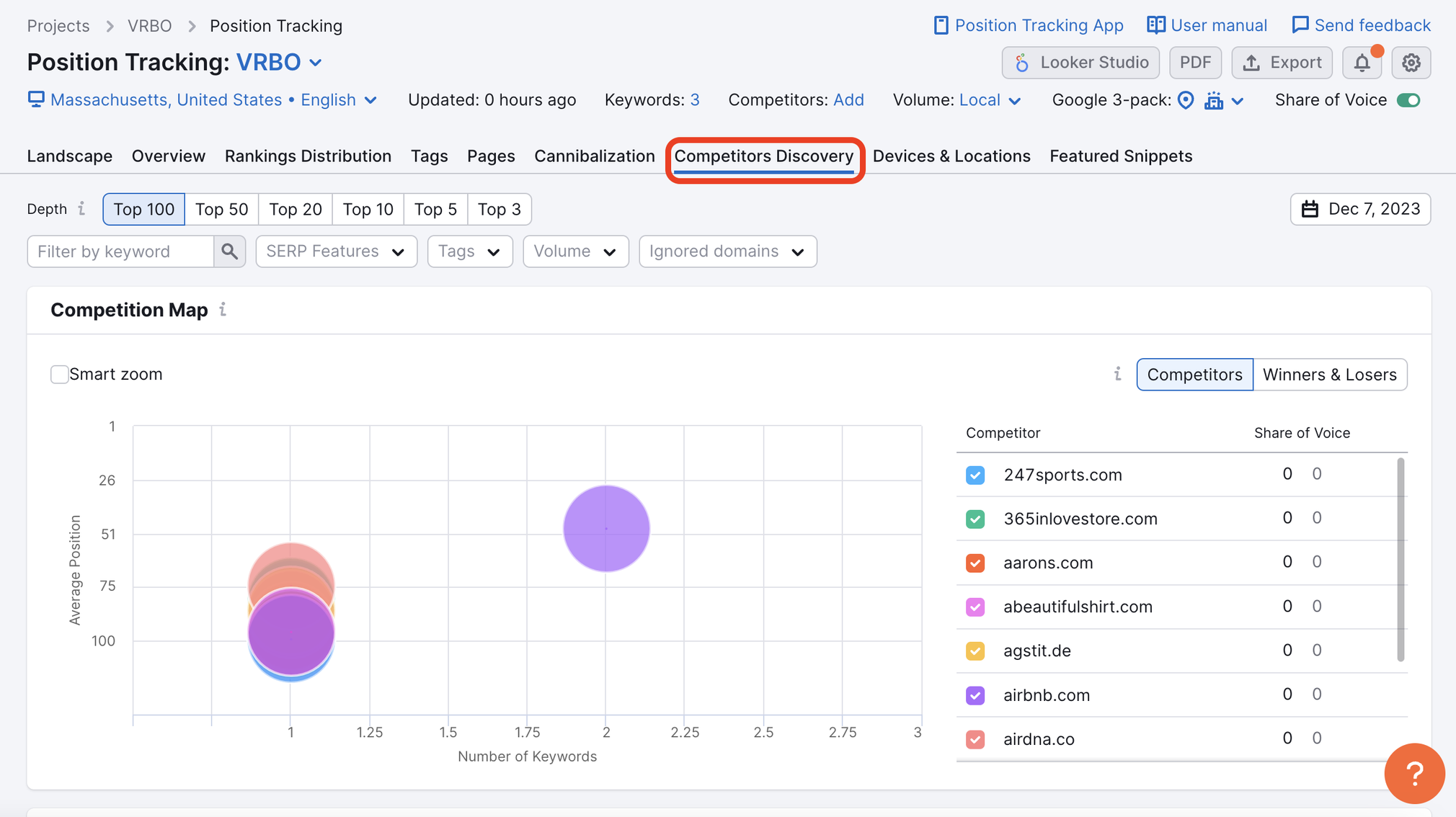

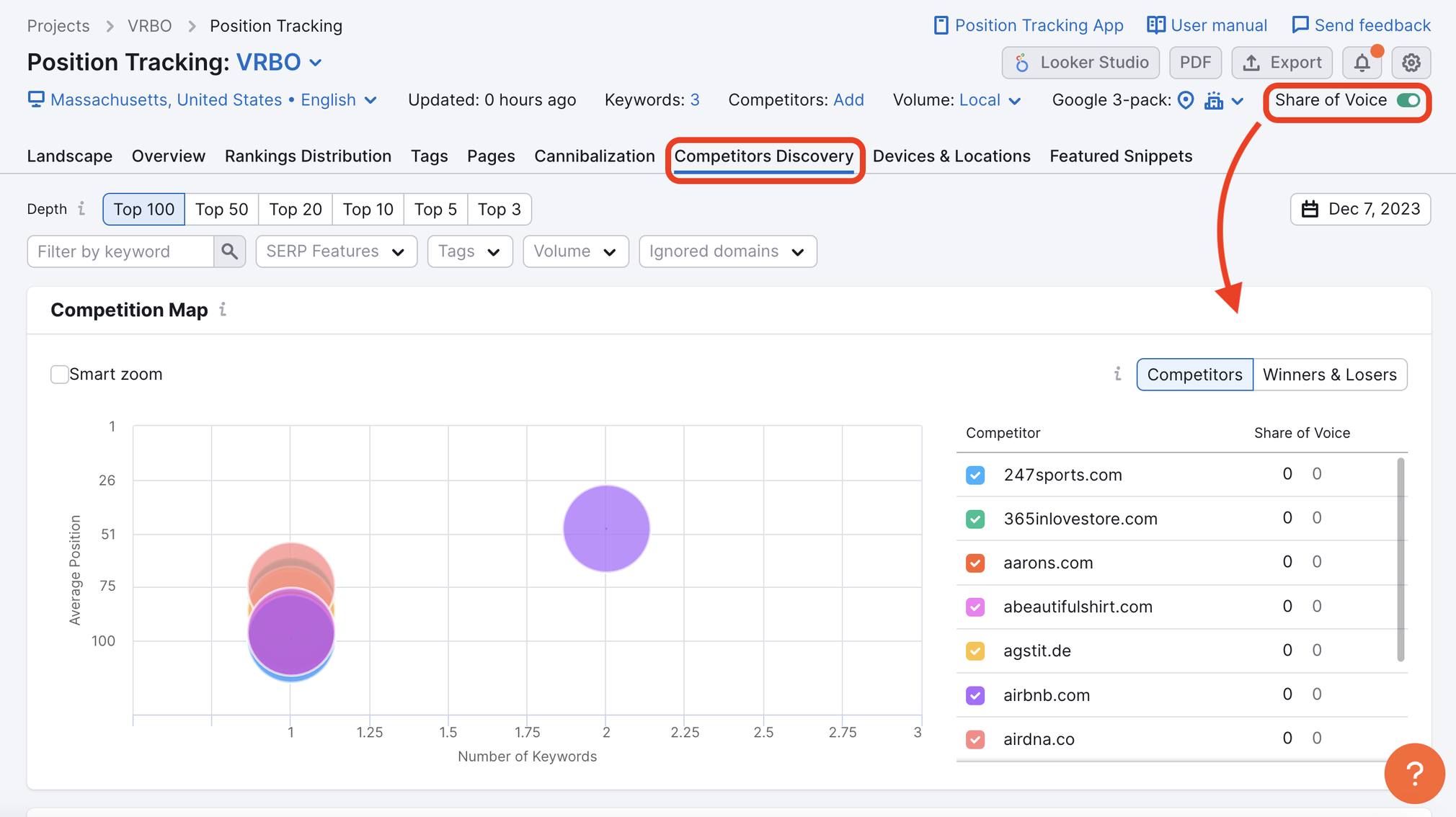

Once your campaign is ready, visit the “Competitors Discovery”tab to identify your local competition.

Here, you’ll see a Competition Map once again—this time highlighting local competition. These competitors’ positions on the map are based on the number of keywords they rank for and average ranking position.

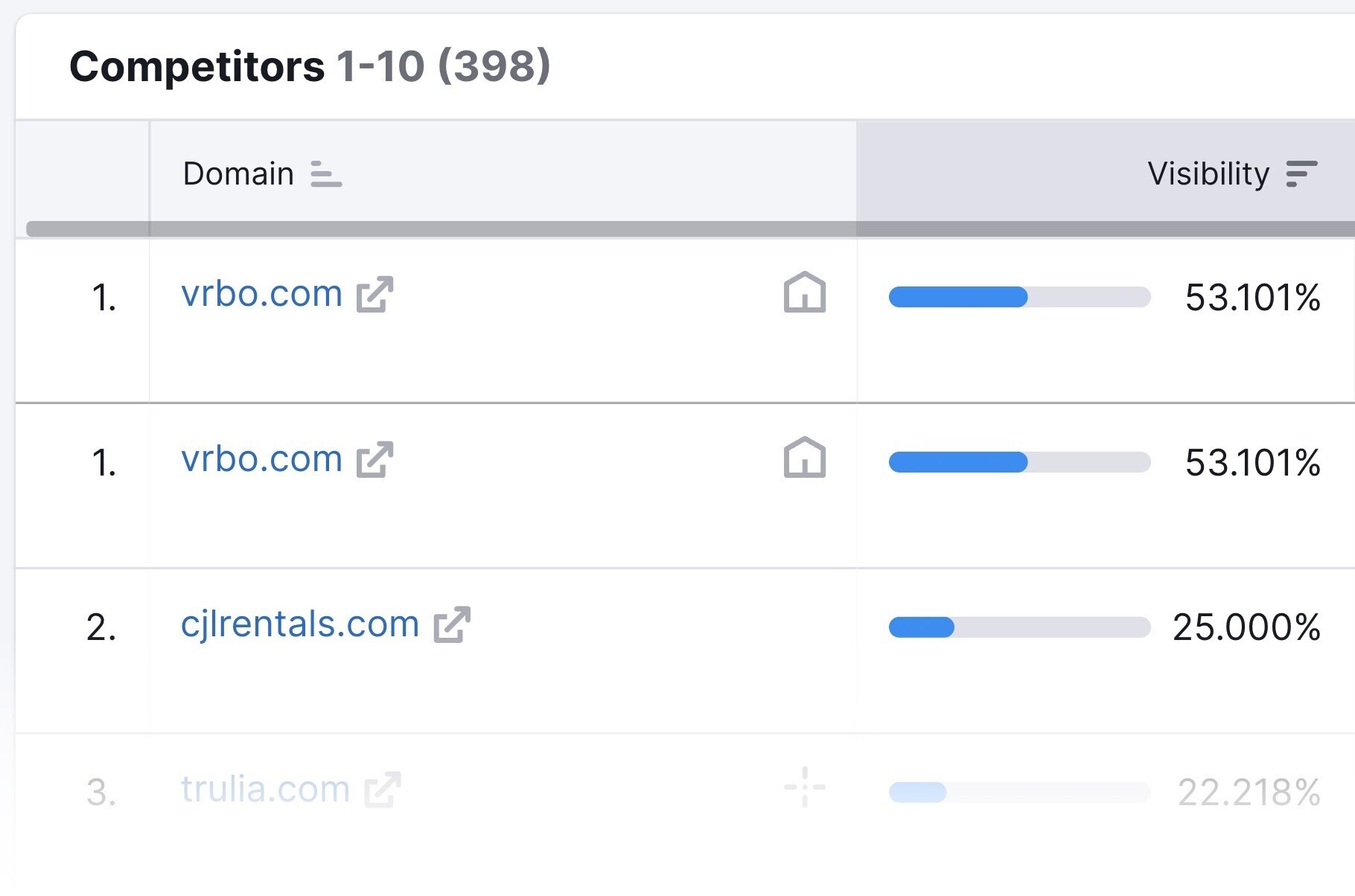

Beneath that, you’ll see a full list of competitors. This time sorted by “Visibility.”

Visibility is based on click-through rate (CTR) and shows a website’s progress in Google’s top 100 ranked webpages for keywords in the current tracking campaign.

Pro tip: You can also sort by “Share of Voice” if you have a Business subscription. This metric takes the total combined value of all your keywords and tells you the ratio of traffic each site gets. It represents how often you show up out of every search. (Not just every keyword.)

Take note of competitors who are dominating the local conversation.

Then, make sure your website is optimized for local search with up-to-**** address and contact information across all your platforms (especially your Google Business Profile).

For more local SEO tips, read our Google Business Profile guide.

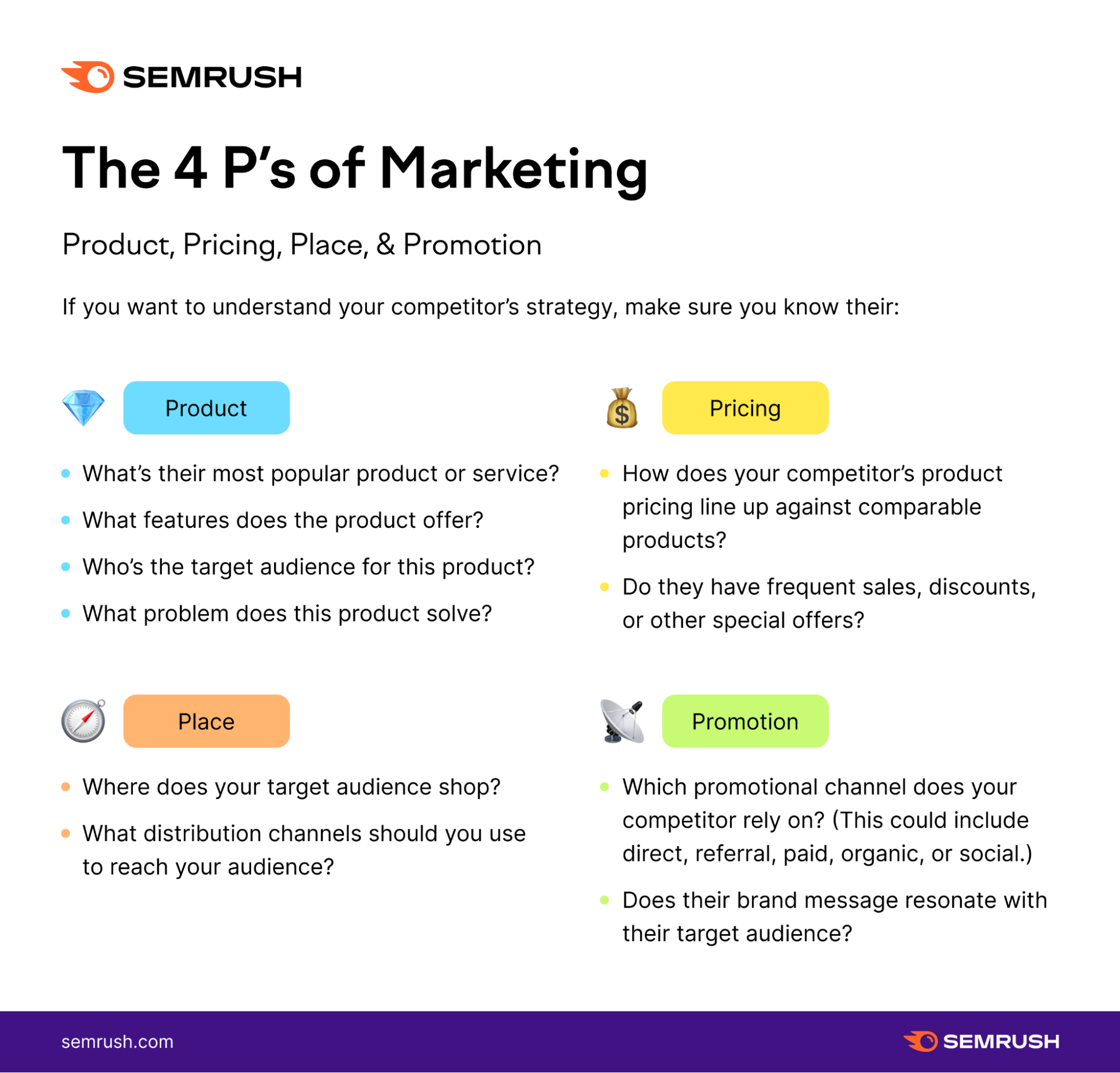

2. Research Your Competitors’ Product, Pricing, Place, and Promotional Strategies

Once you have all the preliminary insights, it’s time to explore “the four Ps” of marketing: product, price, place, and promotion.

Let’s break it down:

- Product: How the product meets customers’ needs

- Price: How much their product or service costs

- Place: Where customers are looking for the product

- Promotion: How they advertise to their customers

Finding out this information about your competitors will give you a deeper understanding of their marketing strategies.

Product

Begin by visiting each competitor’s site and asking yourself the following:

- What’s their most popular product or service?

- What features does the product offer?

- Who’s the target audience for this product?

- What problem does this product solve?

Take notes on your findings in the template.

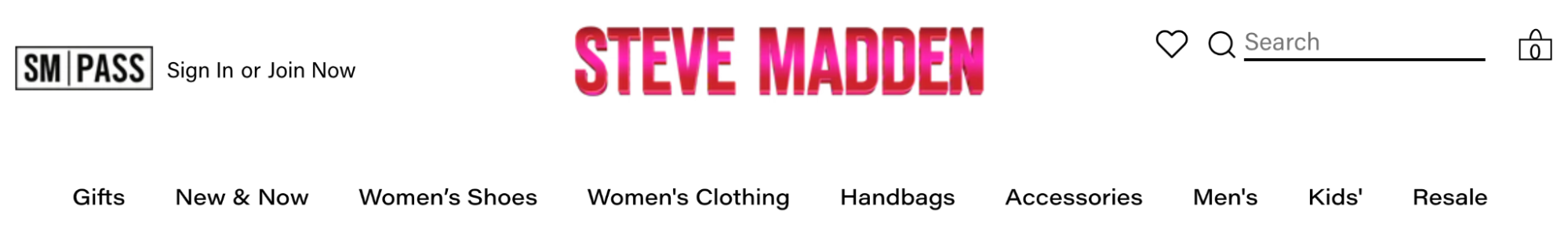

Your competitor’s website will give you good insights into which products they prioritize. And which products they heavily promote or prominently display in their navigational menus.

Steve Madden, for example, heavily prioritizes women’s apparel and accessories. They have several main navigation drop-downs for these topics: ”Women’s Shoes,” “Women’s Clothing,” “Handbags,” and “Accessories.”

If we scroll further, we can also see that they are promoting what is probably a popular product right on the homepage:

This is why manual investigation is important—you can get clear insights into what your competitor prioritizes just by navigating their site.

Price

Once you’ve identified popular products in the previous step, pay attention to the pricing.

Here are some things to take note of in your competitor analysis:

- How does your competitor’s product pricing line up against comparable products?

- Do they have frequent sales, discounts, or other special offers?

Of course, you need to make a profit. But if you notice that your competitors price similar products lower or constantly offer discounts, you may need to adjust your pricing strategy.

Place

The third P refers to the place your product or service is available. This can be a physical storefront, an online store, or both.

If you place your product somewhere—in person or online—where your target audience doesn’t shop, you probably won’t see great results.

To start, here are a couple of questions to consider:

- Where does your target audience shop?

- What distribution channels should you use to reach your audience?

Here’s an example of place in action:

Celebrity makeup artist Patrick Ta is known for his famous clients and luxury makeup line. So it makes more sense that he sells his products in Sephora stores rather than affordable retail chains like Walmart or CVS.

Place also applies to where you market your product.

Say your company offers financial planning services. Your core audience probably skews a little older. So it wouldn’t make much sense to market your services on Snapchat, which has a notoriously young audience without as much buying power.

Promotion

Promotion is all about where customers find out about your product. This includes both advertising channels and brand messaging.

Here are a couple of things to consider when researching your competitors’ promotion strategies:

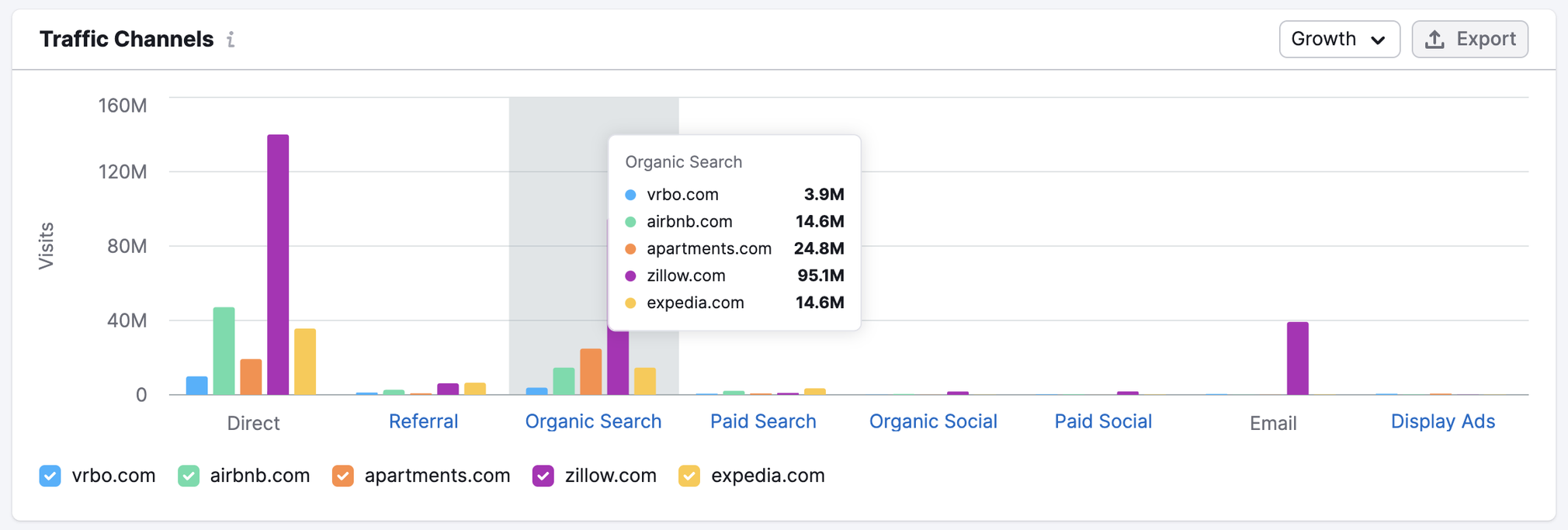

- Which of your competitor’s promotional channels perform best? (This could include direct, referral, paid, organic, or social.)

- Does their brand message resonate with their target audience?

Here are a few conclusions you may draw from competitors’ best-performing channels:

- Direct: Direct traffic is when users navigate to a website directly, without the push of ads or links. So your competitor probably has strong brand awareness. They may also be conducting offline marketing.

- Referral: Referral traffic is when users arrive on a website through another source, like a link on another domain. So your competitor likely has a strong backlink profile or places banner ads on other sites. They also probably have a strong digital PR presence.

- Search: Your competitor prioritizes SEO and content. You can analyze their content marketing and identify their top pages.

- Social: Your competitor likely has a solid social media presence with an engaged audience. Investigate which platforms they use most.

- Paid: Your competitor probably has a strong advertising budget, particularly for paid search. Investigate which keywords they’re bidding on and analyze their ad copy with our Advertising Research tool.

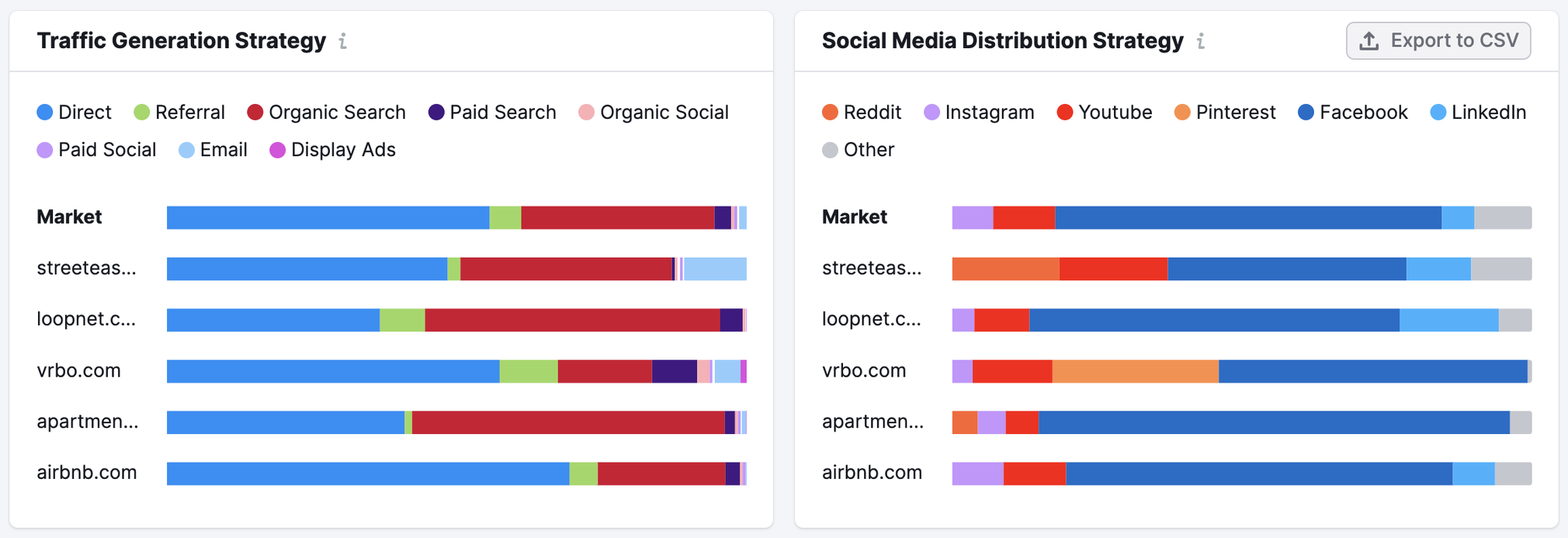

To get an idea of how your competitors generate their traffic, head to the “Benchmarking” report in Market Explorer.

Here, you can compare traffic generation and social media distribution for up to five competitors at once. And benchmark those strategies against the market as a whole.

Record your findings in the template.

3. Create Competitor Profiles

Now that you know who your competitors are, it’s time to learn more about them.

Building a profile for each of your main competitors allows you to benchmark important details, including market share and audience demographics.

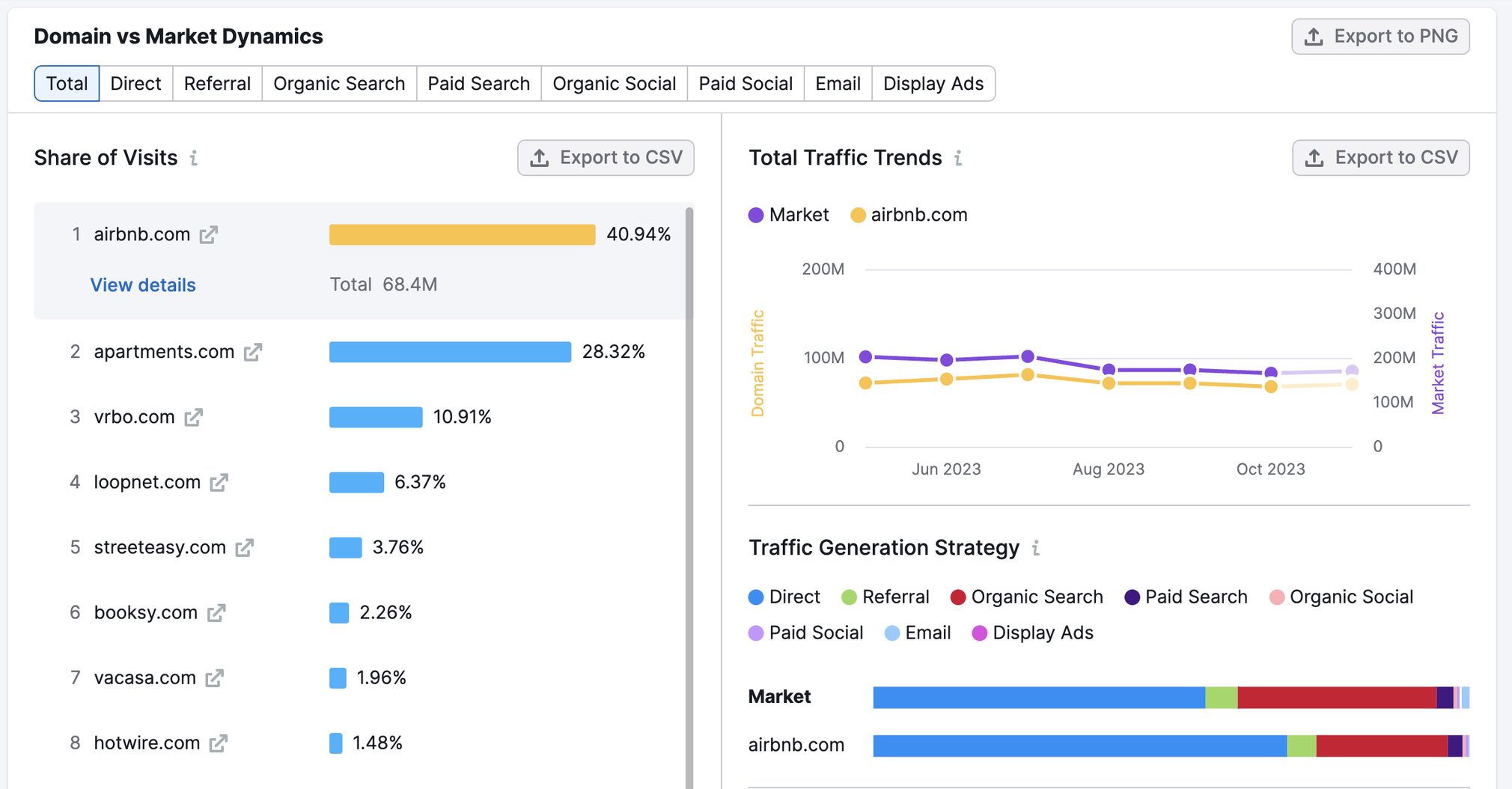

Let’s begin by analyzing market share, or the influence a brand has within their industry.

Analyzing Market Share

Market share is a percentage of a company’s sales or revenue out of the total sales or revenue for its industry. In a digital context, market share could also represent the percentage of a total market’s traffic that goes to a specific domain.

Understanding your market share can help you understand the health of your business. And the health of your competitors’ businesses.

To unpack digital market share, you can use the Overview Report in the Market Explorer tool. The Domain vs. Market Dynamics report includes the market’s top domains and their market share.

Publicly traded companies are required to state their earnings every quarter. Many private companies are, too.

So you can get a lot of background information on competitors by searching “[company name] quarterly report” or “[company name] annual report” in Google.

Besides public earnings reports, you can also consider estimations from trusted business publications.

For example, Yahoo Finance reports on a lot of this information for public companies.

Here’s some of the market share information for Apple:

To calculate market share, divide the total company revenue by total industry sales.

Here’s how to do so step by step:

- Select a fiscal period (usually quarterly or annual)

- Calculate a company’s total sales for that period

- Calculate the industry’s total sales for that period

- Divide the company’s revenue by industry sales

- Multiply that number by 100 to find the market share percentage

Here’s an example:

Toyota sold 2,332,262 vehicles in the U.S. in 2021.

And 15 million total vehicles were sold in the U.S. during the same period.

If we divide Toyota’s total sales (2,332,262) by the industry’s total sales (15,000,000), we get 0.155.

If we multiply that by 100, we get 15.5%. Which is Toyota’s market share for 2021.

We recommend completing this step for your main direct competitors. This will help you benchmark your success within your industry.

Understanding Audience Demographics

Market share shows you which competitor has the biggest influence over your audience. But it doesn’t tell you who that audience is.

Understanding audience demographics can help you connect with your customers while also creating products and services that effectively address their needs.

You can send your audience surveys to learn more specific information. But using a competitor analysis tool like Market Explorer helps you save time while you’re trying to learn the basics.

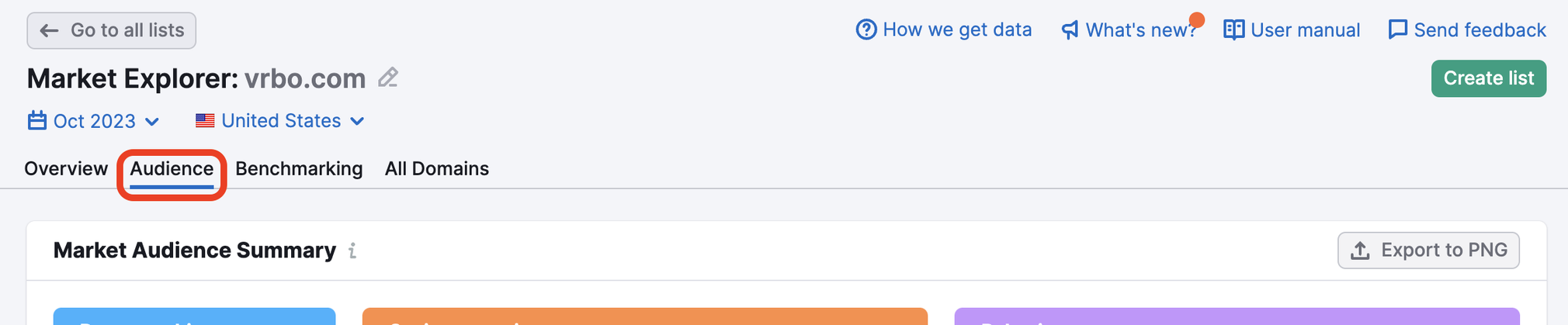

Open Market Explorer again and head to the “Audience” report.

This report provides a high-level overview of the audience demographics in your niche. This includes:

- Age and ***

- Social Media Preferences

- Audience Interests

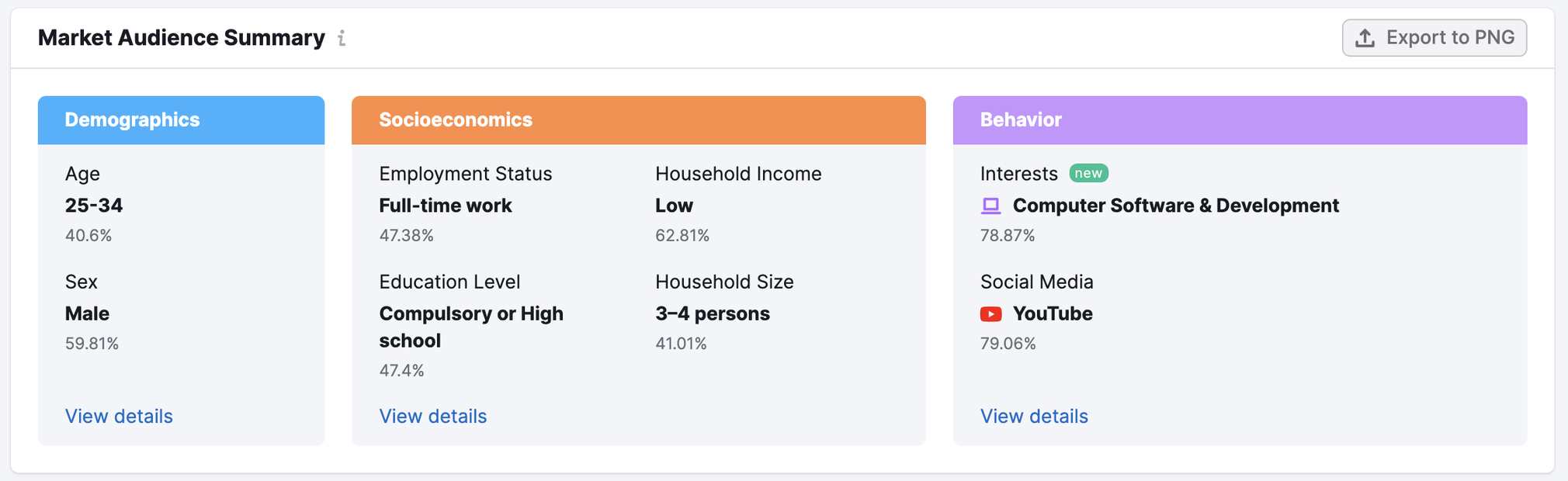

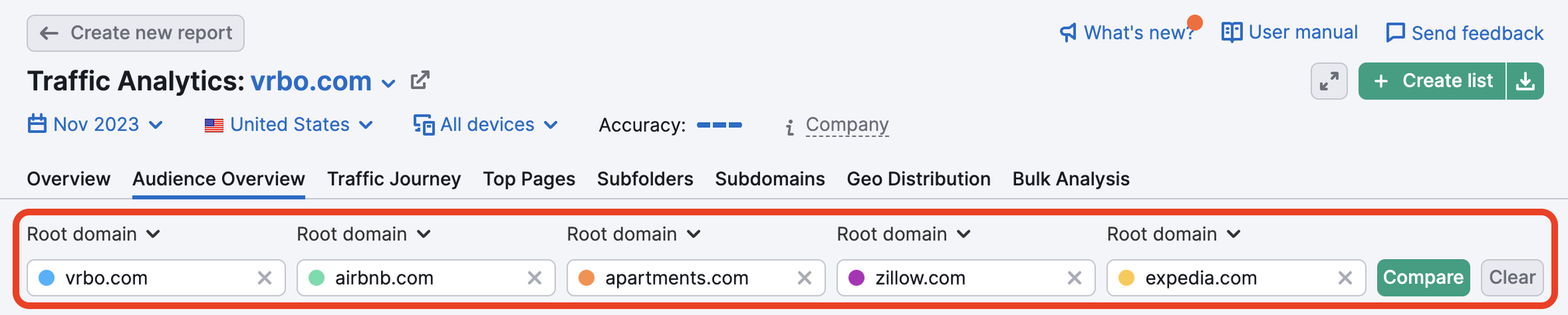

Next, find out how your audience compares to and overlaps with your closest competitors. You can do this with Traffic Analytics.

Enter the domains and click “compare” to the right. Then navigate to the “Audience Overview” tab. Scroll to the “Audience Overlap” graphs. This shows how your audiences compare. If you hover over different sections of the diagram, you can see how big each segment of the audience is:

If you click on a segment, the tool will take you to the “View full report” button, the tool will direct you to the Audience Insights table in the Market Explorer tool, where you can gather additional insights.

Here, you can see which websites are popular with each segment of your shared audience.

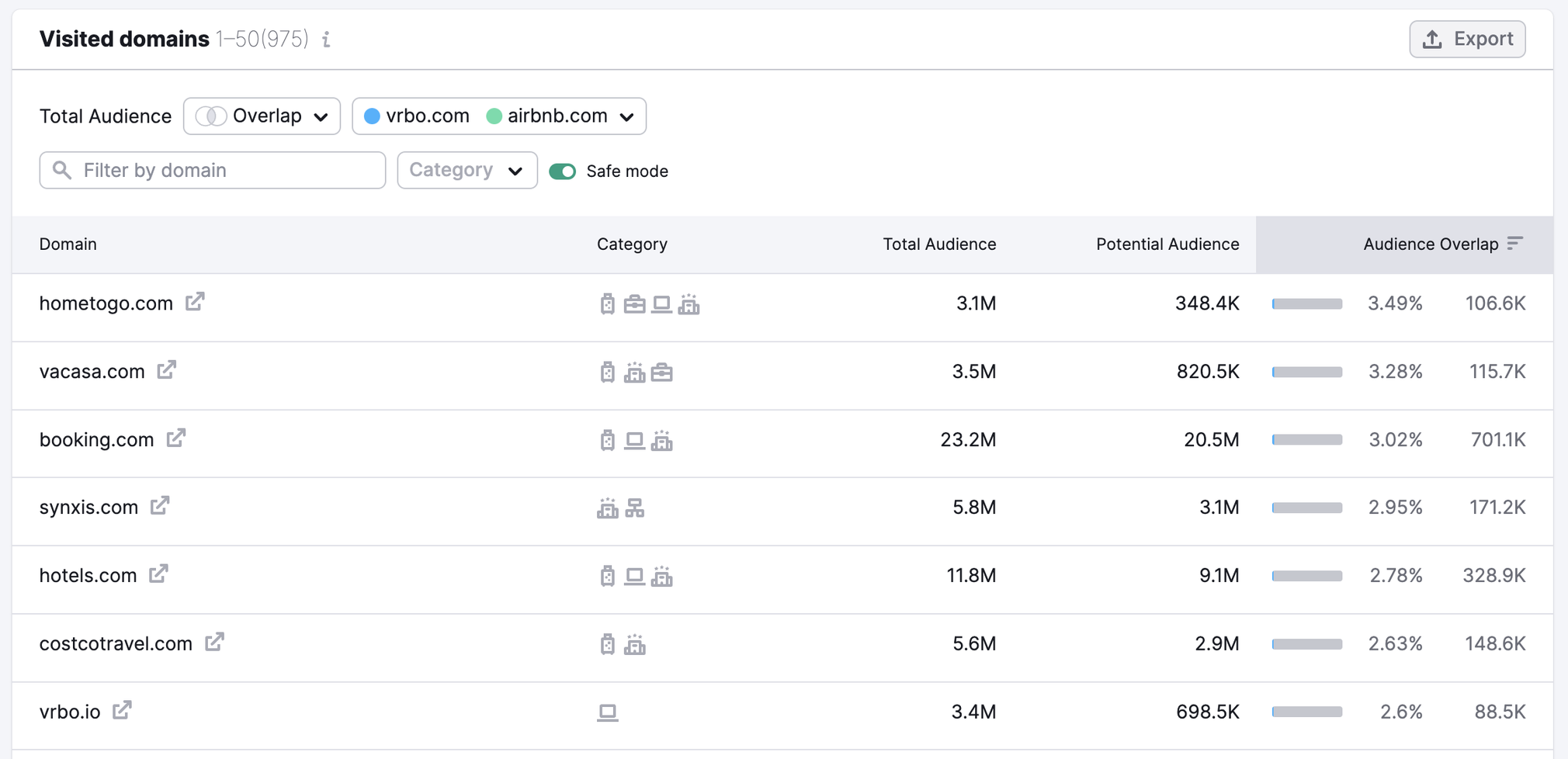

In this example, we can see which domains your audience segment also visited:

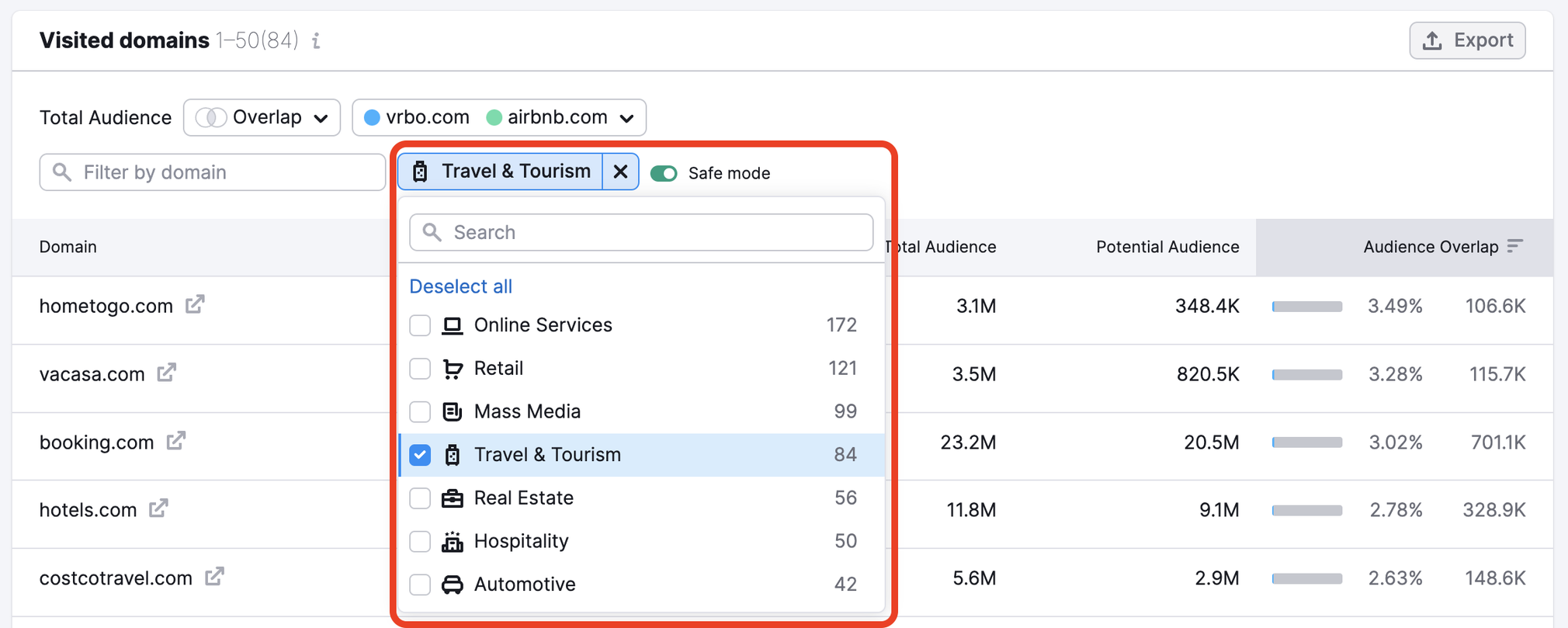

Choose a category to see more information about individual sites’ audiences:

Make a note of any relevant websites you don’t compete with, as these could be good places to advertise or even partner with.

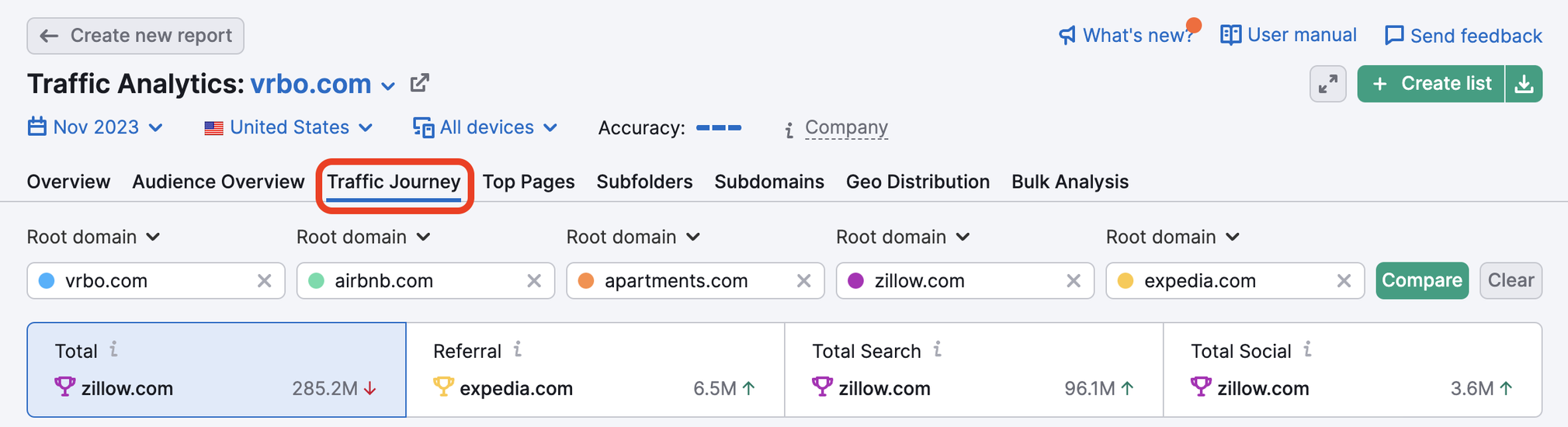

Next, move to the “Traffic Journey”report.

Here, you can find out:

- Which channels each competitor uses to drive traffic

- The top traffic sources for each competitor

- Which websites the audience will most likely visit after they leave a competitor’s domain

This report tells you how your audience finds your competitors and where else your audience may be looking for products or services.

Building Your Competitor Profiles

Now that you know more about your competitors’ audience and market share, it’s time to round out your competitor profiles by filling in basic company information.

This provides context that could help you analyze your findings and build a more competitive marketing strategy.

For example, one of your competitors may have only been around for a few years. But if they’ve raised millions in funding rounds, they may be a bigger threat to you than a larger, more established competitor.

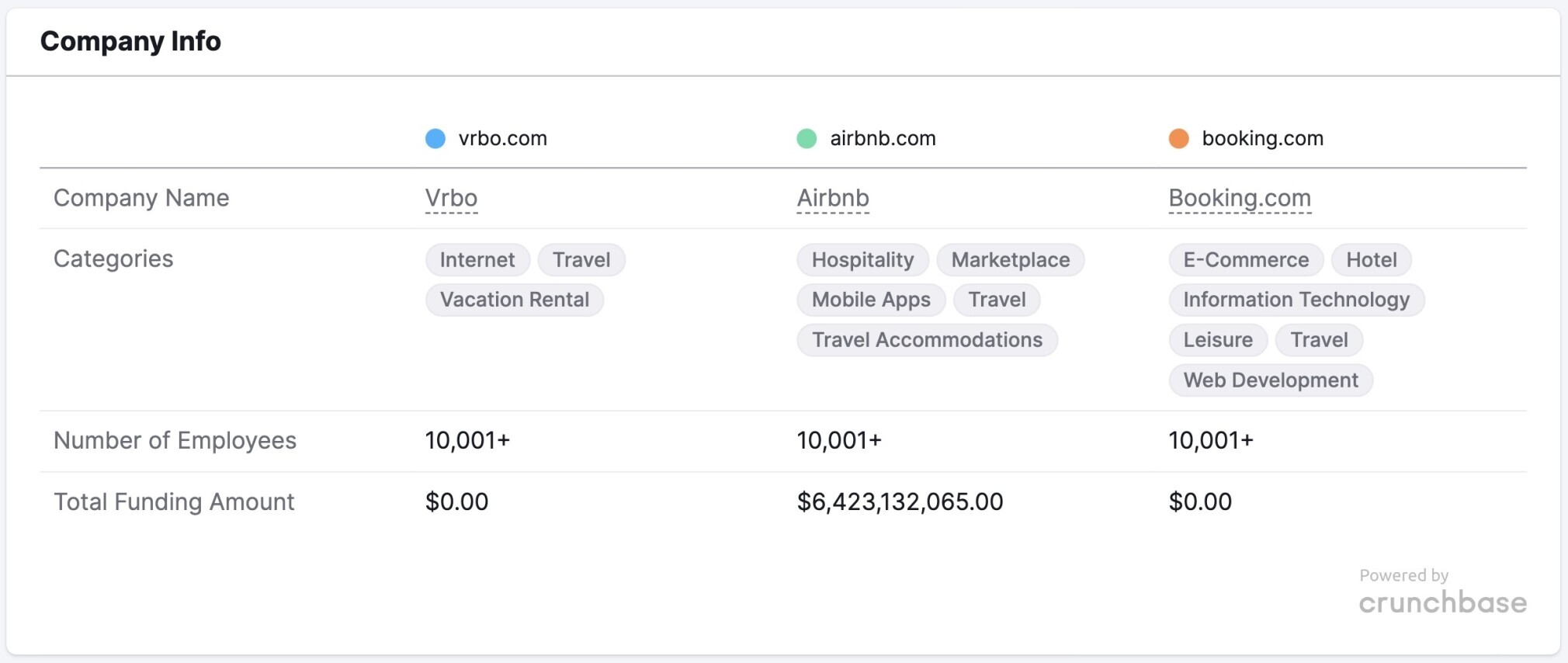

You can find basic information about your competitors in the “Company Info” section of the Traffic Analytics “Overview” report.

This includes which categories they operate in, their funding amount, and how many employees they have.

Pro tip: You can also research competitors’ social media accounts to learn more about them. Then, compare them to your audience. Get analytics information about your audience from Social Media Analytics.

Maintain consistent information for each competitor to make it easier to compare and analyze. However, if you find a key detail that really stands out, don’t hesitate to include it in your profile.

4. Identify Your Strengths, Weaknesses, Opportunities & Threats

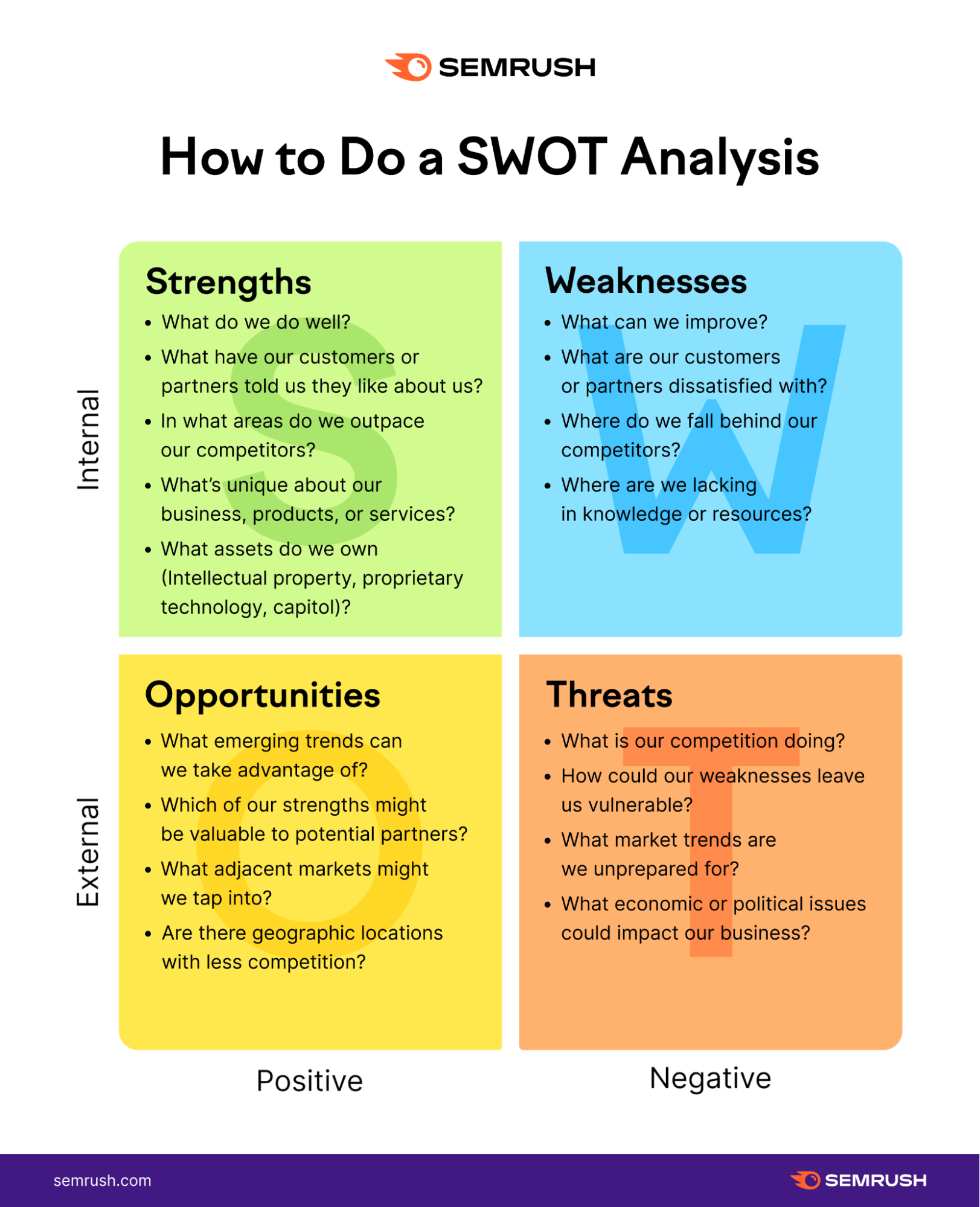

After completing your competitor analysis template, turn your observations into actionable insights by performing a SWOT analysis.

SWOT stands for strengths, weaknesses, opportunities, and threats. A SWOT analysis looks like this—you’ll fill in each quadrant for your brand based on your competitive analysis findings:

If you fill out a SWOT analysis for both your brand and your competitors, you can compare the answers to the above questions to see where each brand excels.

This will help you identify where you’re doing well and where you can improve.

On the other hand, if you prefer a more in-depth approach, you might use Porter’s Five Forces Model.

Check out our blog post on competitive analysis frameworks and tools if you want to learn more.

Download Our Competitor Analysis Template

Be sure to analyze your competitors regularly to update your findings. This way, you can stay on top of trends and excel against the competition.

Download our competitor analysis template below to discover, track, and better understand your competitors so you can navigate your market with ease.

![YMYL Websites: SEO & EEAT Tips [Lumar Podcast] YMYL Websites: SEO & EEAT Tips [Lumar Podcast]](https://www.lumar.io/wp-content/uploads/2024/11/thumb-Lumar-HFD-Podcast-Episode-6-YMYL-Websites-SEO-EEAT-blue-1024x503.png)