So, here at the Pi Intelligence Unit we’ve put together a report for the UK insurance sector focussing on 12 major insurance providers and comparison sites, and tracking their brand searches over the last 36 months in Google UK.

UK Insurance Brands Selected:

- Admiral

- LV

- Compare The Market

- Go Compare

- Hastings Direct

- Esure

- Direct Line

- Aviva

- Axa

- Money Supermarket

- Confused

- Legal and General

Share of Search Methodology

We tracked the above brands (single term) in Pi datametrics SEO platform, which delivered 36 months of volume data. Together with the single term we added in additional specific services, as well as general user terms:

So it would be “brand”+ …

- “Brand” + insurance

- “Brand” + car insurance

- “Brand” + log-in

- “Brand” + travel insurance

- “Brand” + health insurance

- “Brand” + home insurance

- “Brand” + claim

- “Brand” + business insurance

- “Brand” + app

Background of the UK Insurance market

The UK insurance sector is the biggest in Europe and the 4th largest in the world. It contributes over £16bn to the UK economy in taxes and over 320,000 people are employed in the sector. In short, it’s big, lucrative and therefore extremely competitive. Most of us need insurance (68% of us have car insurance, 69% have contents) and most of us need to purchase new products relatively regularly. So the prominence of the brands within the sector and their relative media coverage is key to gaining market share for products which are ultimately intangible.

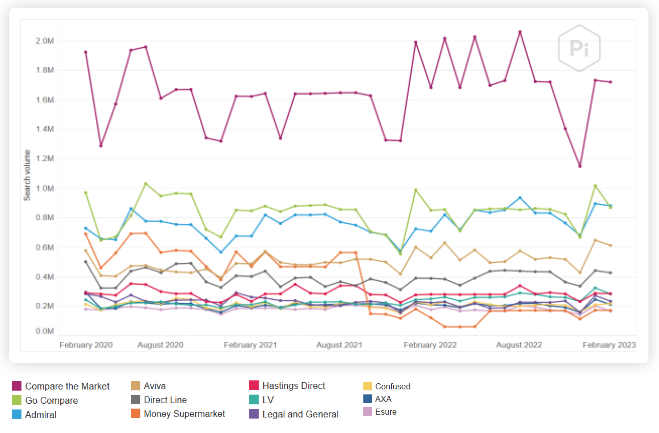

Search volume for UK Insurance brands 36 months

We put together the above search terms into collective categories across the 12 brands and collected the search volume for the previous 36 months…

UK Insurance brands – Google UK (Mobile)

Compare The Market dominates brand searches in the UK Insurance market, with Gocompare and Admiral in 2nd and 3rd.

Admiral, Aviva and LV all saw a double digit percentage growth in searches over the period. Moneysupermarket decreased by 76% in the same period for brand searches.

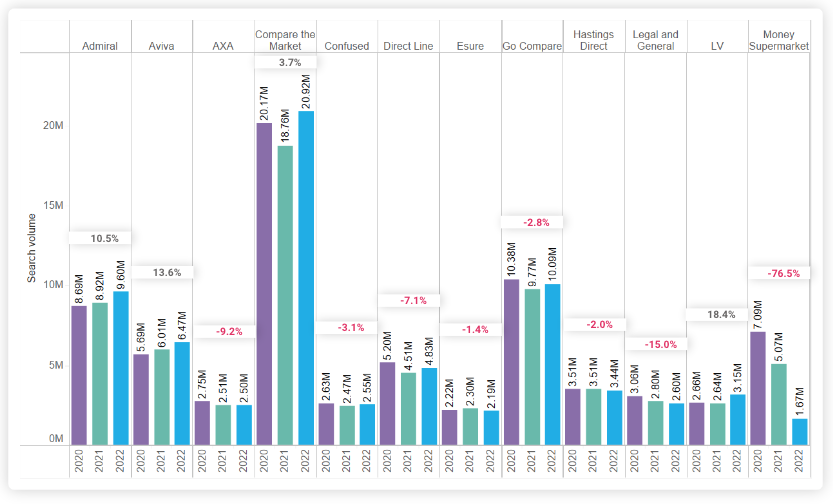

Total annual search volume 2020-2023 – UK insurance sector

Annual brand searches and growth: Google UK 2020, 2021, 2022. % = growth 2020 – 22

Above are 12 of the largest insurance providers and comparison sites’ brand search volume and growth

By hitting around 20m searches a year from 2020 to 2023, Compare the Market was a clear market leader for UK insurance in search. Second place is Go Compare which attracted around half the amount of its competitor comparison site.

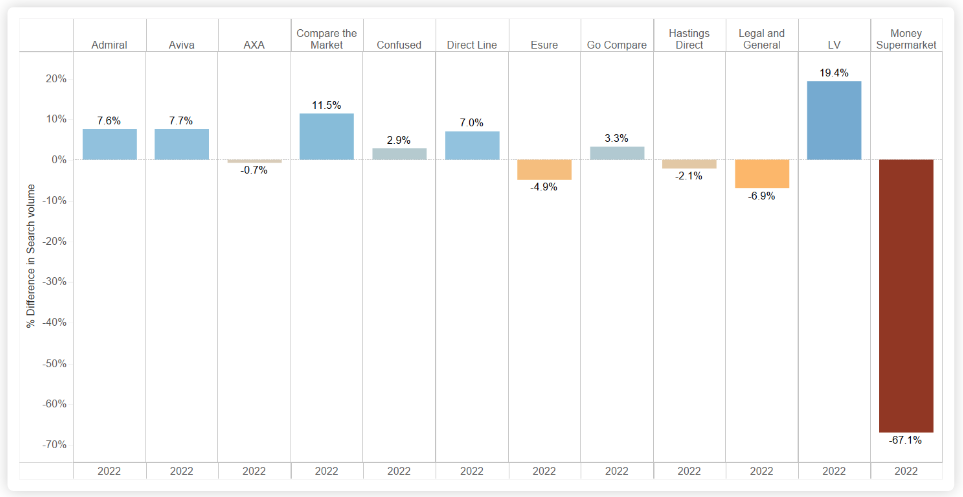

Growth and decline of search volume UK insurance market 2020-2023

The stand out brand in our growth chart is MoneySupermarket. Based on our data, brand (and additional brand searches) declined significantly by 67% from 2021 to 2022. Despite it already being dominant, Compare The Market enjoyed 11% increase over the same period, galvanising its number one spot.

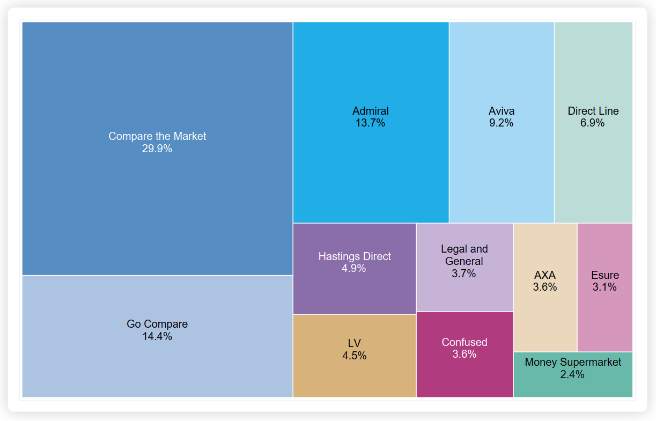

Share of Search 2022-23 UK Insurance market

As you can see comparison sites dominate share of brand searches (comparison sites don’t actually sell their own insurance packages, but refer the customer to the best available deals from their partners).

The data above shows share of brands’ performance across 70m searches in Google UK for 2022. With relative dominance of these comparison sites, is it correct to assume that the UK consumer cares more about cost than about which brand when it comes to purchasing insurance products?

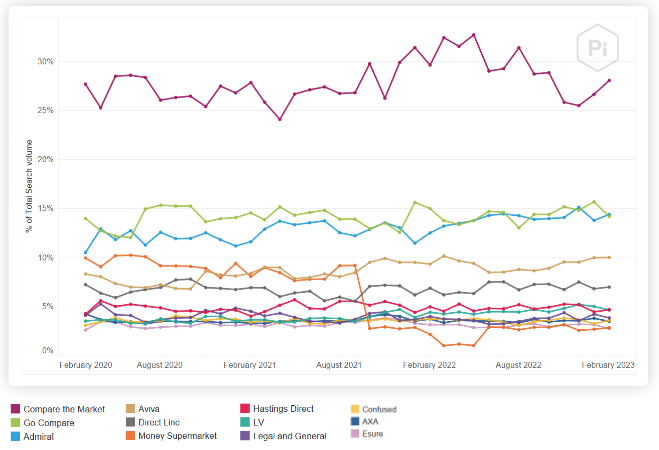

Share of UK insurance brand search timeline 2020-2023

UK Insurance brands | Google UK (Mobile)

Compare The Market’s share of brand has remained dominant throughout the previous 36 months.

Moneysupermarket’s suffered a sharp decline in volume over the period, which sent it’s share of brand search also plummeting.

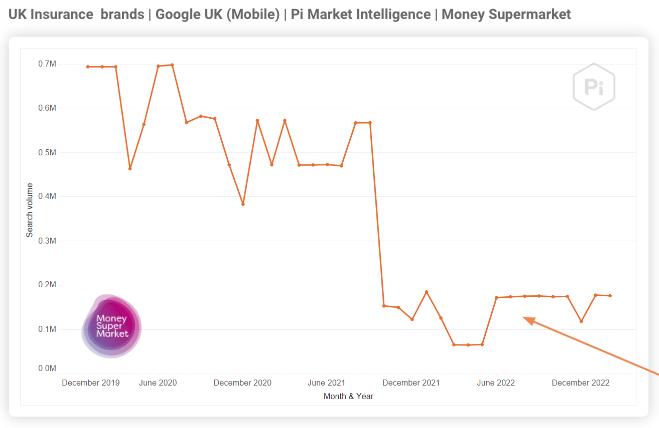

So what happened to Moneysupermarket brand search?

Brand demand is directly affected by the level of media spend and quality.

Above is Moneysupermarket’s search volume.

After reaching a peak of 700K monthly searches in the summer of 2020, Moneysupermarket has seen a consistent, and at times sharp decline. Culminating in enjoying just under 200K searches per month in Q1 2023.

This decline equates to a 47% reduction in searches from Jan 2020 to Dec 2022 based on the terms we tracked. (see appendix of report for full terms).

However, Moneysupermarket’s overall SEO is extremely good, performing 2nd in SOV with 12.5% share. The non-branded terms are greater than the branded terms for volume.

“We have seen an encouraging increase in our share of branded search traffic,” said chief executive Peter Duffy. (The Drum: July 2022).

For a fuller view of our UK Insurance sector report, including share of search as well as SEO share of voice, download the report or get in touch with [email protected].