From the C-suite down, Share of search can help reflect a brand’s performance and media impact against their competitors and peers. Understanding how many people search for a specific brand name versus the sector as a whole, helps executives understand whether what they are doing is actually working.

Here at the Pi Intelligence Unit we’ve put together a report for the UK sports ******** sector focussing on 11 major sports ******** providers and affiliates, and tracking their brand searches over the last 36 months in Google UK.

UK sports ******** Brands Selected:

- Bet365

- Skybet

- Paddy Power

- Ladbrokes

- Betfair

- Bet Victor

- William Hill

- Coral

- BetFred

- OddsChecker

- 888

Share of Search Methodology

We tracked the above brands (single term) in Pi datametrics SEO platform, which delivered 36 months of volume data. Together with the single term we added in additional specific services, as well as general user terms:

So it would be “brand”+ …(examples)

“Brand” + app

“Brand” + online

“Brand” + bets

“Brand” + horses

“Brand” + football

“Brand” + ********

“Brand” + ****

“Brand” + tips

“Brand” + sign up

“Brand” + online ********

Background of the UK online ******** market

The online ******** sector in the UK generates around £6.9bn in revenue each year (stats from 2020), and makes up 61% of all ********. Sports ******* makes up around £2.6bn of the online revenue.

The pandemic significantly affected the ******** sector in the UK. During that time sports events were cancelled and bricks and mortar stores were closed. However, since then the industry is seeing a resurgence, helped by the biggest recurring events of The Grand National and The World Cup.

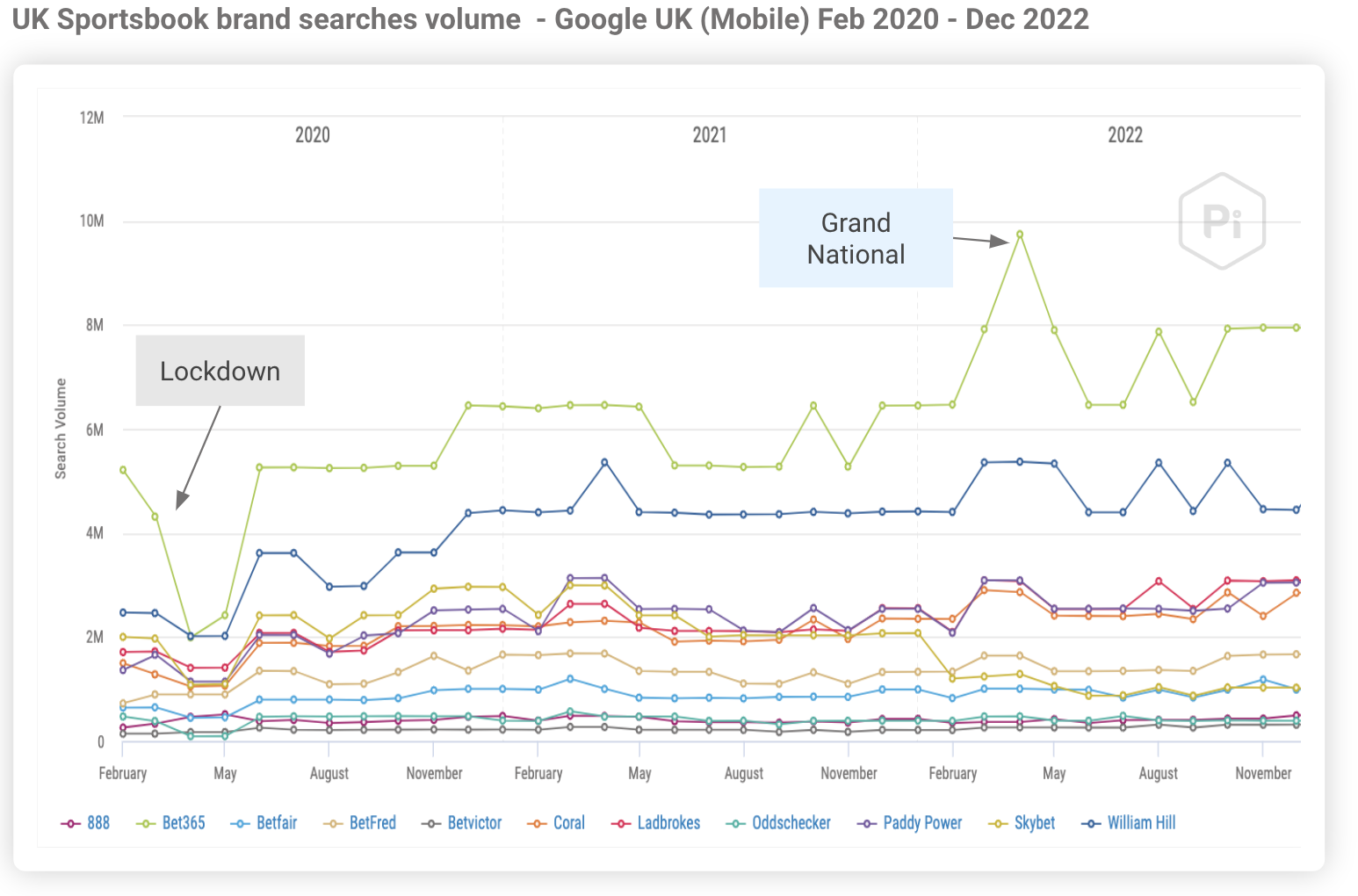

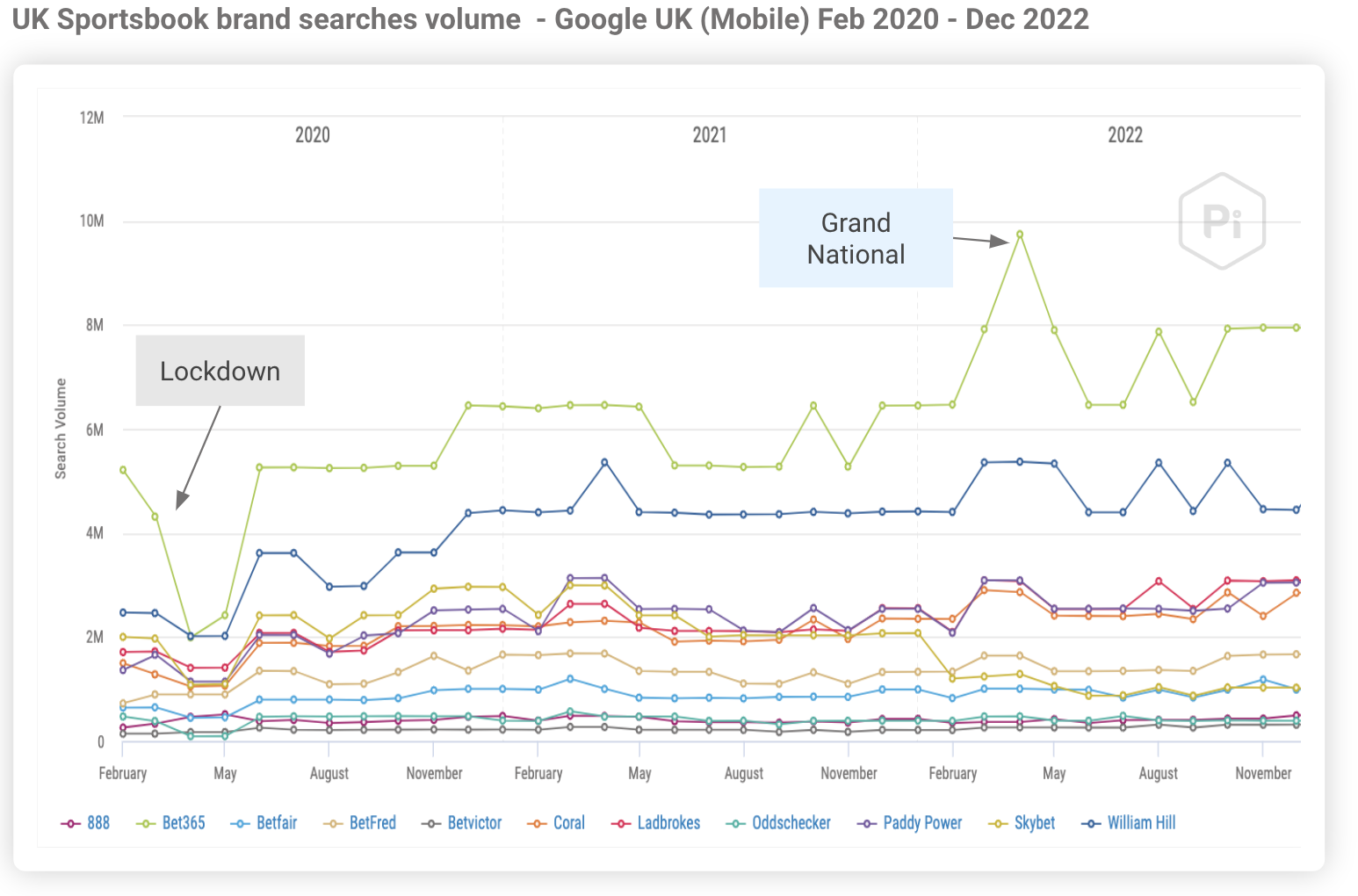

Search volume for UK sports ******** brands 36 months

We created the search term categories across the 11 brands, started tracking the results in Pi Datametrics, and collected the search volume for the previous 36 months…

Here we look at 11 of the most popular sports ******* brands in the UK. Using Pi we track the search volume for their brand terms over the last 36 months.

Bet365 leads for brand searches, reaching a peak of 9.74m searches per month in April 2022. William Hill shadows the leaders, until the last few months.

See the significant dip during the first lockdown of March 2020. With no sports being played demand obviously dropped, but the brands still managed to push many millions of searches between them.

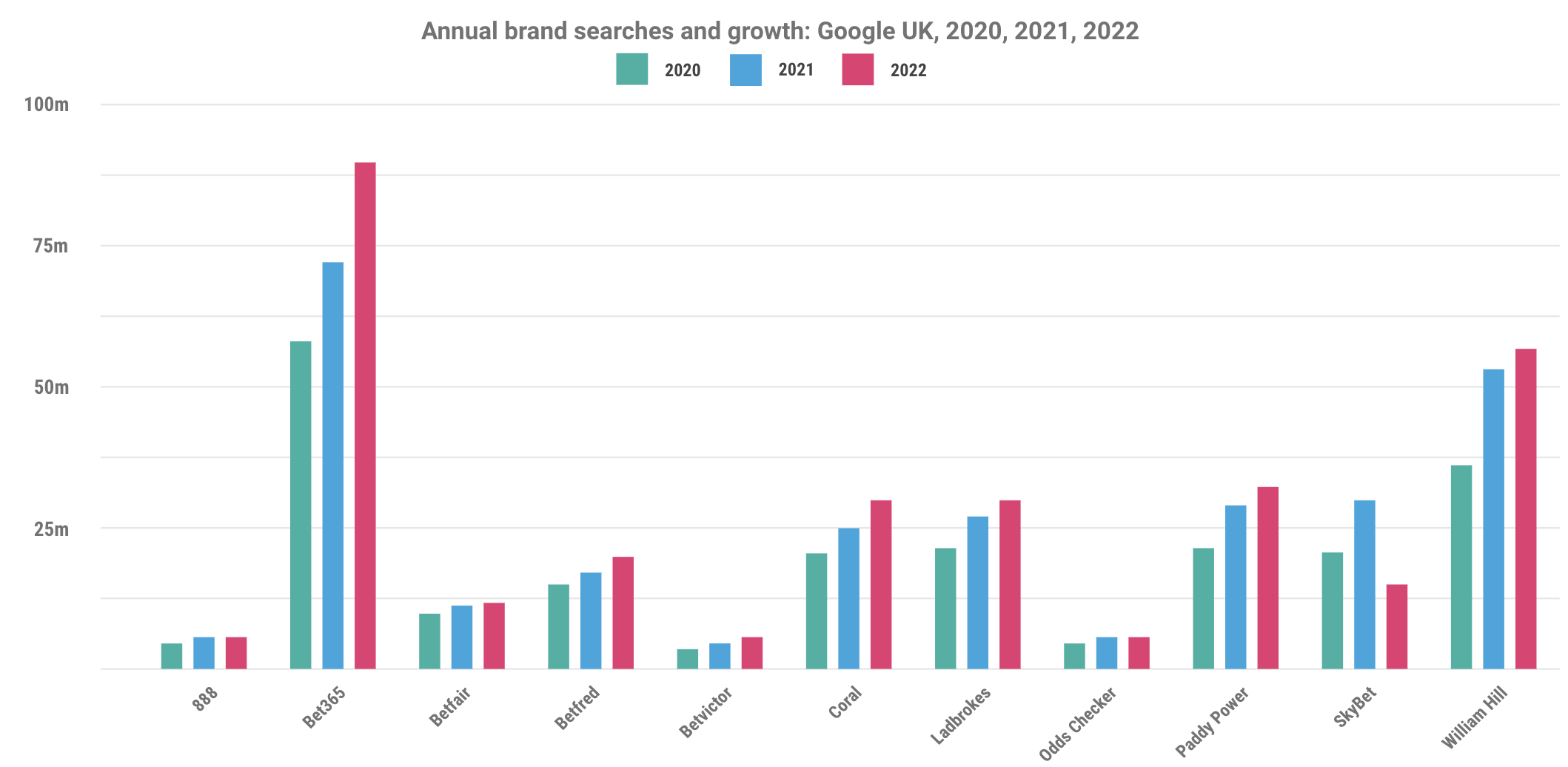

Total annual brand search volume 2020-2023 – UK Sports ******** sector

Using Pi datametrics search data, we see 10 of the 11 sports ******** brands are growing in search from 2020-21

By hitting over 50m brand searches per year from 2020 (with over 80m in 2022), Bet365 was a clear market leader for UK sports ******** in search. Second place is William Hill, reaching that 50m mark in 2021.

Growth and decline of search volume UK ******** market 2020-2023

Multiple brands saw impressive growth from 2020 to 2022, with many enjoying 40%+ growth rates in their brand searches.

However, the one that stands out the most is SkyBet, which was the only brand to decline in brand searches over the period and declined significantly by 47% from 2020 to 2022. Despite it already being dominant, Bet365 enjoyed a 57% increase over the same period, solidifying its number one spot.

Share of Search 2022-23 UK ******** market

Based on the brand searches we included (these are the single brand term, as well as additional terms of “brand” + “XXX”) 299m searches were made in Google UK during 2022, with Bet365 accruing a share of 29.9% of this total figure.

Bet365’s share actually increased from 2021 by 4 percentage points, with William Hill and Ladbrokes in 2nd and third places.

Share of UK ******** brand search timeline 2020-2023

Just before lockdown and the pandemic affecting major sporting events in 2020, William Hill and Bet365 were neck and neck in terms of brand share of search for the sports ******** sector.

However, from that point onwards, Bet365 pulled away and is now several furlongs ahead of the chasing pack.

So what happened to Skybet’s brand search?

Brand demand is directly affected by the level of media spend and quality.

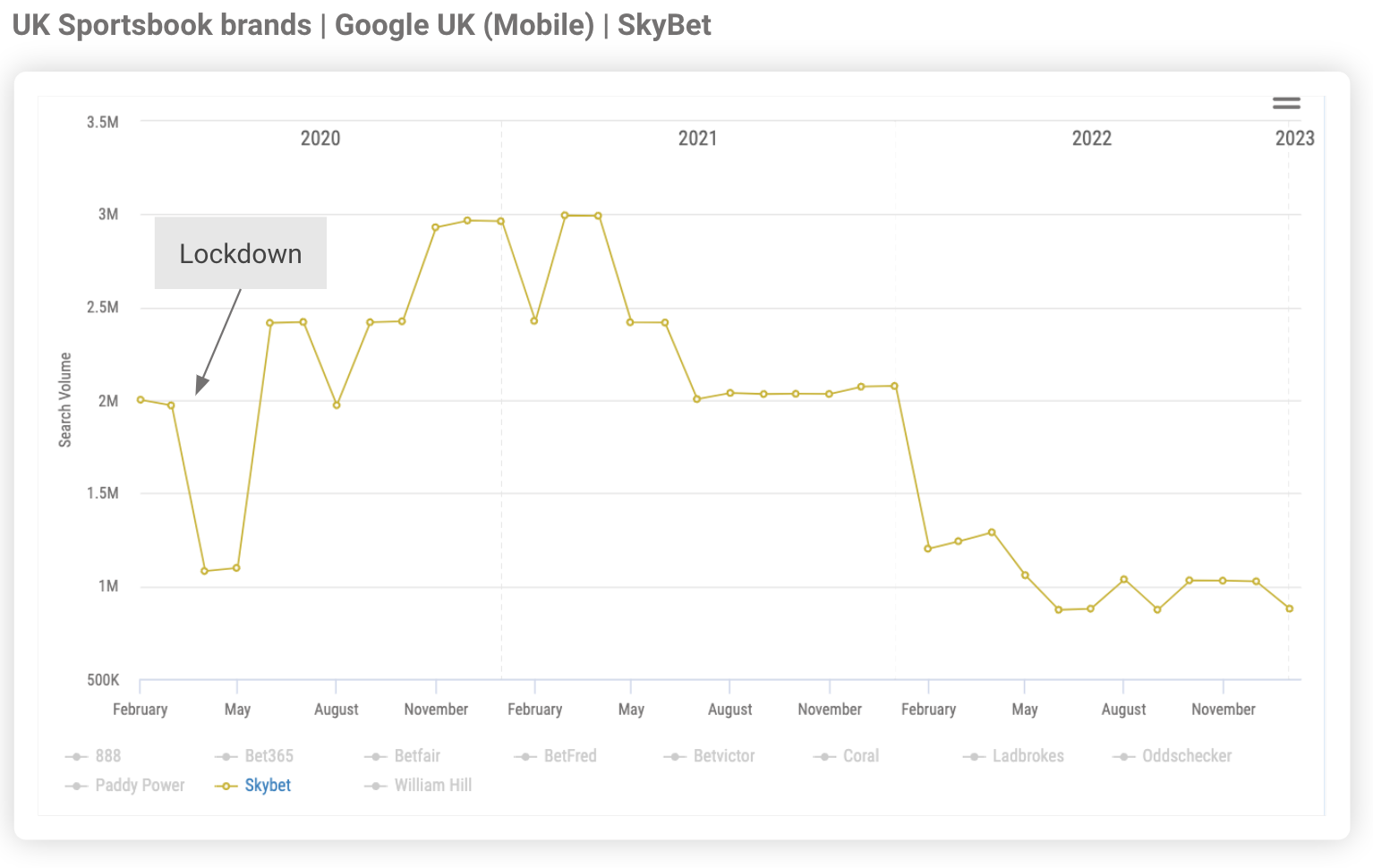

Above is Skybet’s search volume over the period.

After reaching a peak of 3m searches a month in April 2021, Sky Bet has seen a consistent, and at times sharp decline, culminating in achieving just 800K searches per month.

This decline equates to a 47% reduction in searches from Jan 2020 to Dec 2022, the only brand of the selected 11 to decline over this period.

However, Sky Bet’s overall SEO is very good, performing 3rd in the non-branded table with a Share of Voice of 6%

For a fuller view of our UK ******** sports sector report, including share of search as well as SEO share of voice, download the report or get in touch with [email protected].