In our previous article, “Transaction Accounts: Analyzing Deposit Stickiness in the Current Interest Rate Environment,” Perficient’s Financial Services Risk Management and Regulatory Capabilities Center of Excellence (CoE) explored the sharp decline in transaction account balances over an 18-month period. Now, we will delve into the stability of retail deposits from the same bank over the same timeframe, determining whether they were resilient compared to transaction accounts.

Retail Deposits Defined

The FDIC classifies retail deposits as demand or term deposits placed within an FDIC-supervised institution by a retail customer or counterparty, excluding brokered deposits.

As transaction accounts primarily comprise demand deposits, which can be withdrawn without notice, and retail deposits include both demand deposits and less liquid savings and time deposits (certificates of deposit) subject to penalties for early withdrawal, it is reasonable to anticipate that the decline in retail deposits would be less pronounced than the 23% decline observed in transaction accounts.

Deposit Balances Over Time

Data for the publicly traded multi-state bank was sourced from US Bank Locations. This bank maintained stable interest rates on transaction accounts including savings accounts but adjusted rates on deposit certificates during the review period. No mergers or branch openings/closures occurred during the study.

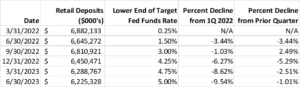

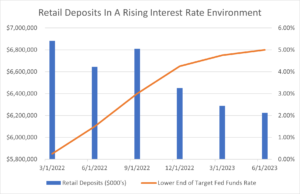

As illustrated in the table below, retail deposit balances experienced a decline in every quarter, albeit not as sharply as transaction accounts. The most significant quarterly drop (in the fourth quarter of 2022) was just over 5 percent. Throughout the entire period, retail deposits decreased by less than 10 percent. While the decline persisted, the right-most column in the table indicates a gradual slowdown in the rate of decline.

Stability Confirmed

Stability Confirmed

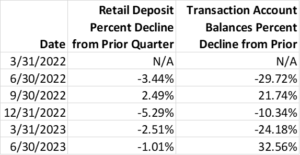

Our prediction that the time deposit structure of retail deposits and associated penalties for transferring them to higher interest-bearing accounts would render retail balances far more stable than transaction accounts holds true, as evident from the table below:

- Transaction account balances moved downward (i.e., 2Q 2022, first quarter 2023) and upward (3Q 2022) far more sharply than retail deposits.

Our analysis reveals that, despite facing a decline, retail deposit balances proved more stable than transaction accounts over the 18-month period. This insight provides valuable information for financial institutions navigating the complexities of deposit management in a changing interest rate landscape.

Unlock Financial Expertise by Reaching out to Perficient!

Make Perficient your go-to partner for informed decision-making in the face of changing interest rates. Understanding these trends is crucial for staying ahead in the dynamic world of financial services. For tailored solutions to your financial service questions and comprehensive marketing expertise, look no further than Perficient’s Financial Services Risk Management and Regulatory Capabilities CoE. Our team is ready to guide you through the complexities of deposit management and provide valuable insights into the ever-evolving financial landscape.

Contact us today!

See also: An Introduction: Generative AI Use Cases for the Financial Services Industry