Open Banking is going to do for the banking industry what the introduction of the Apple smart phone did for cell phones.

What is Open Banking?

Open banking transforms the way financial data is shared and accessed, allowing third-party data providers and other banks to access financial data in traditional banking systems through application programming interfaces (APIs). Traditionally, banks hoarded financial data, sharing it sparingly on a need-to-know basis.

CFPB Regulation Advances Open Banking

The Consumer Financial Protection Bureau (CFPB) has proposed Rule 1033 to implement open banking, requiring “…depository and non-depository entities to make available to consumers and authorized third parties certain data related to consumers’ transactions and accounts; establish obligations for third parties accessing a consumer’s data; including important privacy protections for that data, provide basic standards for data access; and promote fair open and inclusive industry standards.”

The agency proposed the rule in the Federal Register on October 31, 2023, accepted public comments on the regulation though December 29, 2023, and is expected to pass the final regulation with minimal changes in mid-2024.

Impact on Consumers

The implications of the CFPB’s regulation on open banking will be enormous for consumers, banks, and data providers. Without open banking, consumers struggle to switch between bank deposit and lending offerings. For example, switching checking accounts to one with a better interest rate involves resetting direct deposits and recurring bill-paying, printing new checks, and obtaining a new ATM card. Mistakes resulting in overdrafts are costly both financially and to one’s credit score and reputation.

READ MORE

- Transaction Accounts: Analyzing Deposit Stickiness in the Current Interest Rate Environment

- Retail Deposits: Analyzing Deposit Stickiness in the Current Interest Rate Environment

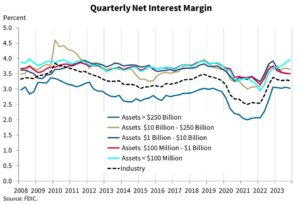

As a result, larger banks have a much smaller net interest margin, as shown in the chart below. In addition, the stickiness of deposits causes a considerable lag between when a bank raises deposit rates and when deposit balances increase proportionately.

Once open banking, as mandated by CFPB Rule 1033, takes effect, consumers will be able to switch credit cards within seconds while retaining terms and rewards of their current account, and transfer deposits and multiple years of transaction history into a new checking account.

Impact on Data Providers

Data providers, including digital wallet providers, will be able to move on from “screen scraping” and instead provide API-driven real-time balances, transaction history and reward balances to their retail customers. Of course, providing this “new and improved” service will require re-writing front ends and processing engines to provide the necessary data in a timely manner.

Impact on Banks

As noted by Perficient Financial Services Chief Strategist Scott Albahary:

“Banks and their affiliates must look toward building an open, larger ecosystem amid the continued digital transformation, accepting that this includes determining golden sources of data, data migration, and then designing, building, and testing multiple channels to what will hopefully be a single back-end database. This work will be a challenge, but necessary for banks looking to grow as collaboration and cooperation drive revenues and banks unable to satisfy their borrowers or lenders will find it a challenge to compete in an ever-challenging financial landscape.”

Albahary concluded, “There should be little doubt that open banking will expand and is here to stay. Open Banking is going to do for the banking industry what the introduction of the Apple smart phone did for cell phones.”

Readers may view the CFPB’s release on open banking and Rule 1033 here: Required Rulemaking on Personal Financial Data Rights | Consumer Financial Protection Bureau (consumerfinance.gov).

Perficient is Prepared

As always, members of Perficient’s Financial Services Risk and Regulatory Center of Excellence will continue to monitor the regulatory space and share coming changes in blogs, such as this one.

If you would like to speak to Perficient about your firm’s compliance with Rule 1033, contact us to discuss your specific risk and regulatory challenges.