Brand Breakdown Series

Welcome to the Brand Breakdown series, a monthly deep dive into the marketing strategies of leading global brands.

We’ll be exploring the winning, and losing, strategies that are pushing the boundaries of traditional marketing through the lens of owned asset optimization (OAO), a new approach to building consumer connection.

Subscribe today for unique insights straight to your inbox, exploring how the world’s most recognizable brands are connecting with consumers.

OpenAI changed the world with ChatGPT. The brand gained 100 million users in two months, it’s on track to reach one billion dollars in annual revenue, and it launched the artificial intelligence (AI) industry on a trajectory to reach $1.8 trillion in market value by 2030.

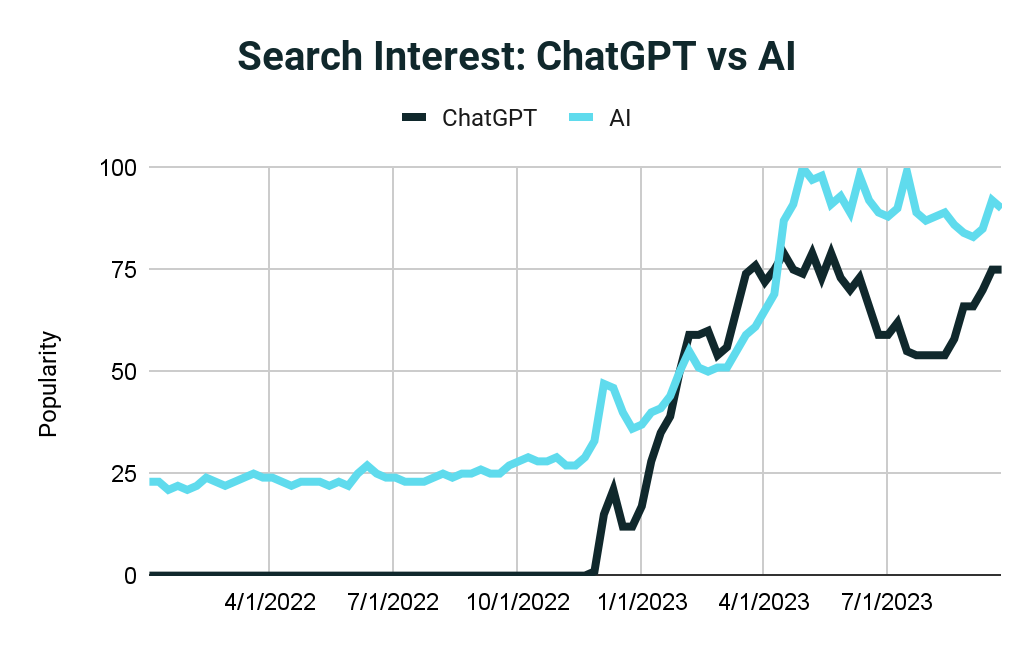

According to Google Trends data, global consumer interest in ChatGPT even surpassed interest in AI shortly after the software launched.

What does that mean for OpenAI and other brands entering the AI space?

In this edition of Brand Breakdowns, We’ll reveal what drove OpenAI’s success, which AI topics consumers care most about, and how OpenAI could expand its proverbial “moat” even further.

What makes ChatGPT different?

OpenAI didn’t invent artificial intelligence. The term was coined in the 1950s by John McCarthy. And consumers have been using AI applications like Alexa, Google Assistant, and Siri as far back as 2010.

Furthermore, GPT-3 was released nearly two and a half years before ChatGPT. Although it was impressive, it didn’t change consumer behavior.

Why is ChatGPT different?

Its conversational interface makes it effortless to use, and it is uncannily good at generating human-like content. ChatGPT can have a lengthy conversation, write songs, do your kid’s homework, and even pass the bar exam.

In other words, ChatGPT is revolutionary because it is free to access, simple to use, and has nearly limitless use cases for text generation.

FOMO ignites demand

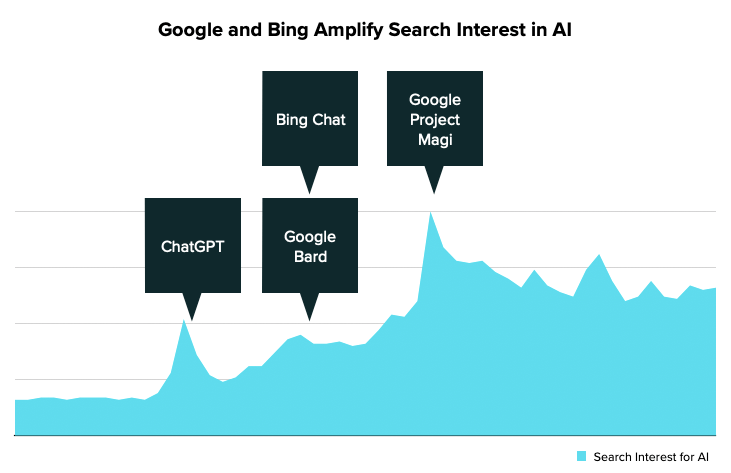

OpenAI sparked a revolution in AI capabilities and competition. Less than three months after ChatGPT was released, Bing announced its new chat-based generative AI search engine powered by OpenAI’s GPT-4.

Not to be outdone, Google quickly countered with its own generative AI announcements, Bard and Search Generative Experience (SGE). Although based on different technology, Google’s software has a conversational interface similar to ChatGPT.

With nearly two trillion dollars on the table, generative AI has stoked lawsuits, strikes, fears, and unprecedented FOMO. Here are just a few statistics that highlight the consumer adoption of AI:

- 75% of consumers trust content written by generative AI — Capgemini

- 64% of consumers would purchase a product recommended by generative AI — Capgemini

- 49% of U.S. adults say they use AI to search for information, and 44% use AI to learn new things — Ipsos

With both businesses and consumers taking the leap, brands can’t afford to stay on the sidelines.

But which AI topics are driving consumer interest? Is OpenAI still the market leader, or is it losing ground to Google, Microsoft, and other brands entering the space?

See Who’s Winning in Your Industry

Our proprietary technology is driving unique, industry specific insights for our clients.

Learn More

Analyzing consumer interest and brand influence

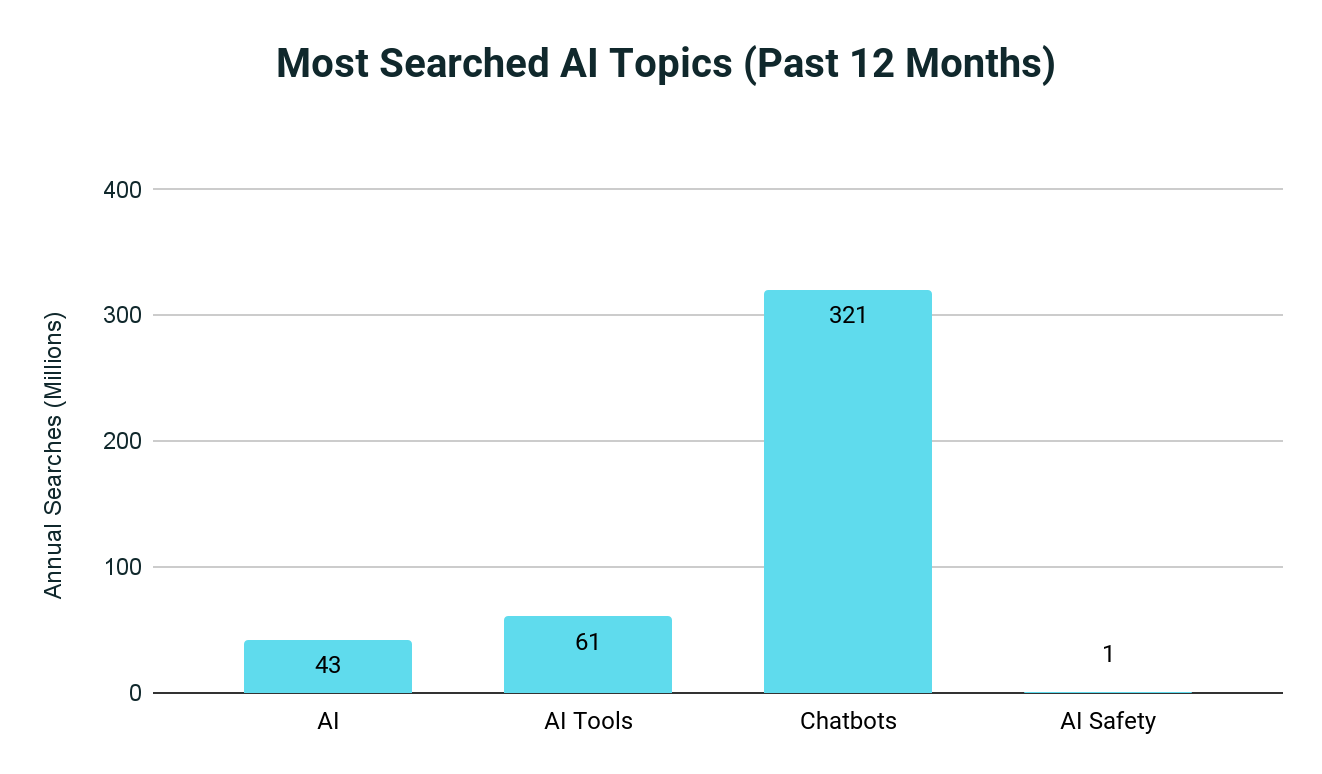

425.1 million. That’s how many people searched for information about artificial intelligence topics in the past 12 months.

Terakeet analyzed those 425 million searches and grouped them into four themes:

- Understanding Artificial Intelligence (42.5 million annual searches)

- AI Tools (61.2 million annual searches)

- AI Chatbots (320.5 million annual searches)

- AI safety and regulation (0.9 million annual searches)

Consumer interest in chatbots is exploding, while almost nobody asks questions about safety and regulations — which is, admittedly, a little concerning.

And if we dig into the AI tools category, we see consumer interest focused mostly on text and image generation with the rest of the tools grouped into a miscellaneous category.

- Image and video generators (35.8 million annual searches)

- Text generators (12.5 million annual searches)

- All other AI tools (12.8 million annual searches)

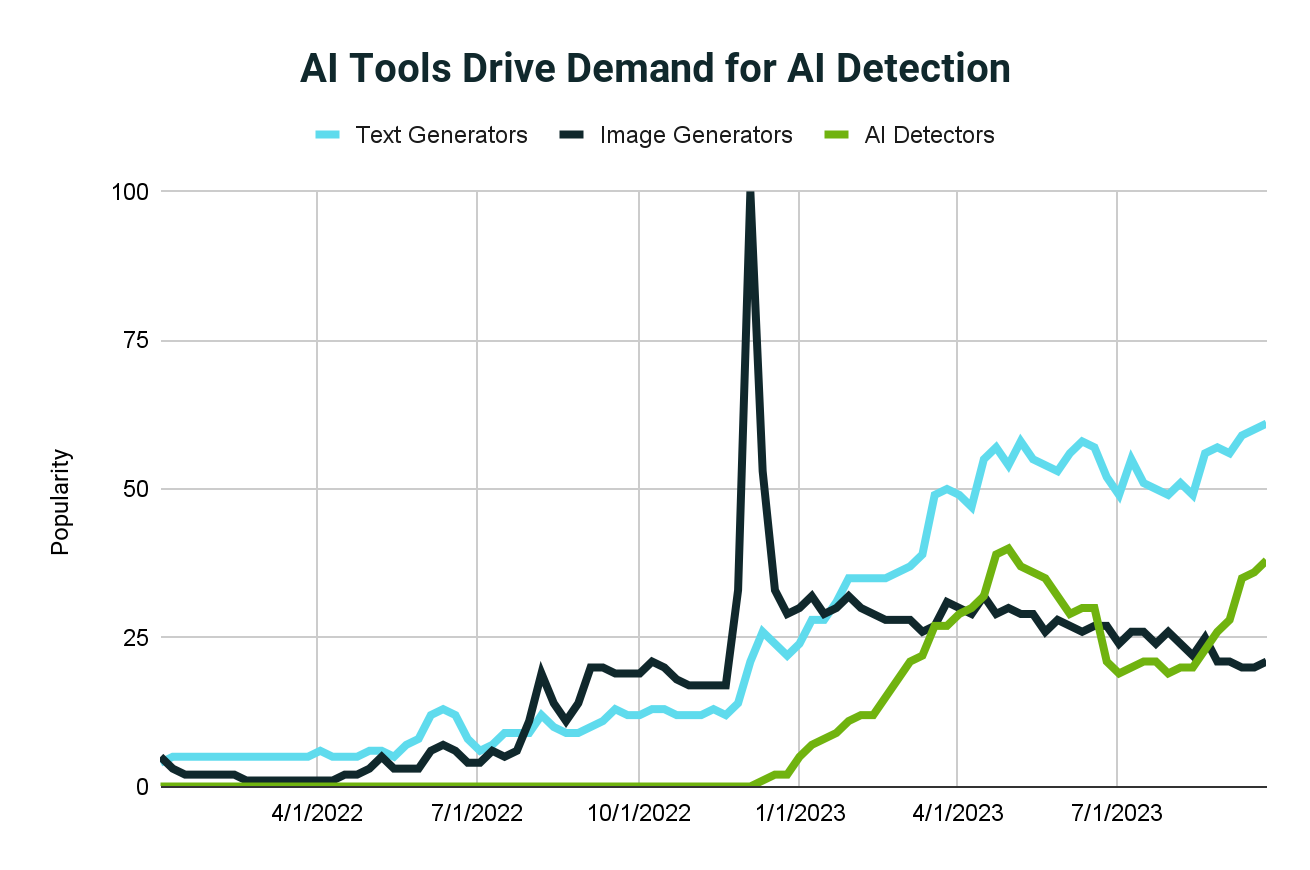

Interestingly, Google Trends data reveals a spike in search interest for AI detection software that aligns with the rise in popularity of generative AI tools, indicating a lack of trust in generative AI.

Which brands are in control?

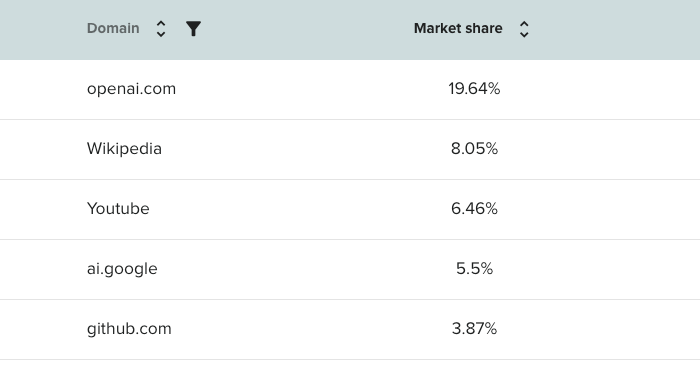

We analyzed each of the themes above with Terakeet’s proprietary software to see which brands control the most organic search market share — and it wasn’t always OpenAI.

Sometimes brands controlling the conversation are AI companies like OpenAI, CharacterAI, and Hotpot. Other times brands like Apple, Google, and Zappier held prominent positions.

Here’s what we found among the top 20 market shareholders for broad questions about AI:

- Brands outperformed publishers with 42.9% of the market share vs 27.1%

- The average website had 153 pieces of content about this topic

- OpenAI had more than 2x the market share of any other website for this category

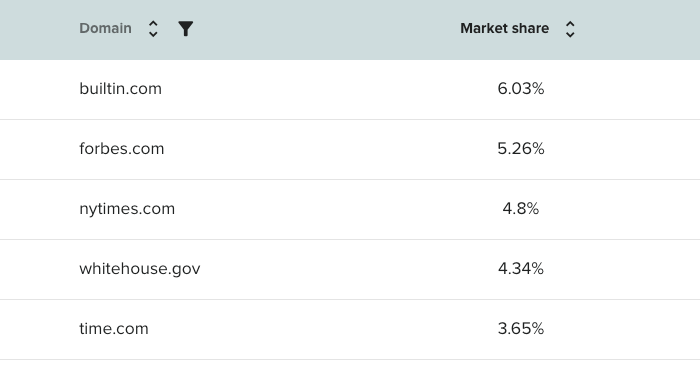

For questions about safety and regulations, publishers and media outlets took the lead:

- Publishers earned 37.1% of the market share vs 15.1% for brands

- 4 of the top 5 market shareholders are publishers, including Time, NY Times, and Forbes

- OpenAI didn’t even make the top 20 market shareholders for this category

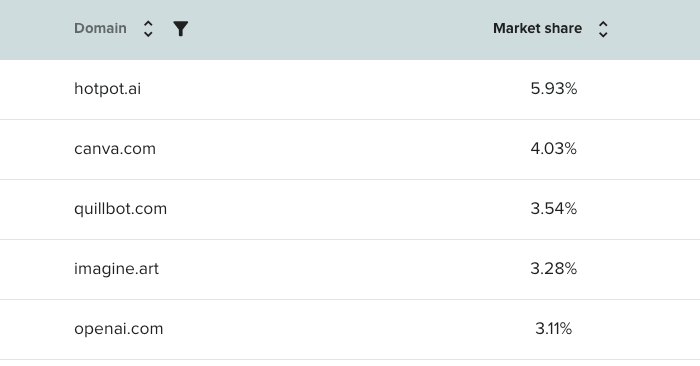

For questions about generative AI tools like text, video, and image, but excluding chatbots, AI companies pulled ahead, while OpenAI slipped:

- 19 of the top 20 market shareholders were brands

- Brands controlled 43.7% of the market share, vs 1.4% for publishers

- OpenAI dropped to position 5 with only 3.1% of market share

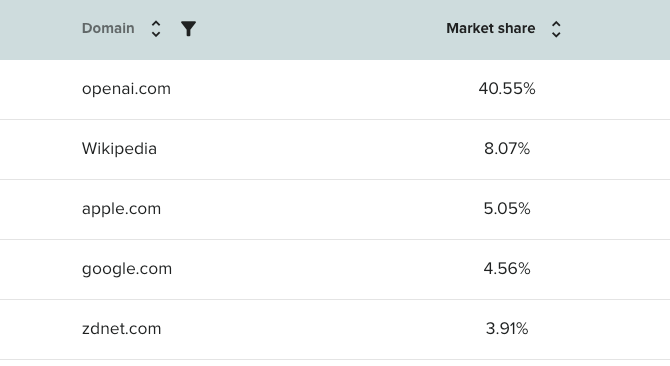

For questions about AI chatbots, OpenAI was the clear leader:

- Brands hold nearly 60% of the market share led by OpenAI (41.8%)

- OpenAI holds more market share than the next 13 brands and publishers combined

- Although brands are winning, publishers like ZDNet, TechTarget, and PC Guide are gaining ground

Companies are innovating at breakneck speed to advance new AI capabilities. Although OpenAI has a commanding presence across the entire search landscape, they’re starting to lose ground in two key areas: text and image generation and AI safety and regulations.

How can OpenAI stay ahead of the fray and defend their market share dominance? Let’s take a look at how they used their owned assets to connect with consumers — and how they can build an even deeper moat around their online market share.

Is OpenAI the Kleenex of Artificial Intelligence?

Have you recently Googled something? Asked for a styrofoam cup? Bought Kleenex for a school supply list? These brands have been immortalized because they became synonymous with their product category.

Given the popularity of OpenAI’s conversational app, there’s a good chance you’ll be ChatGPTing things before long. (Ok, they might need to rebrand the tool with a snappier name, but you get the idea).

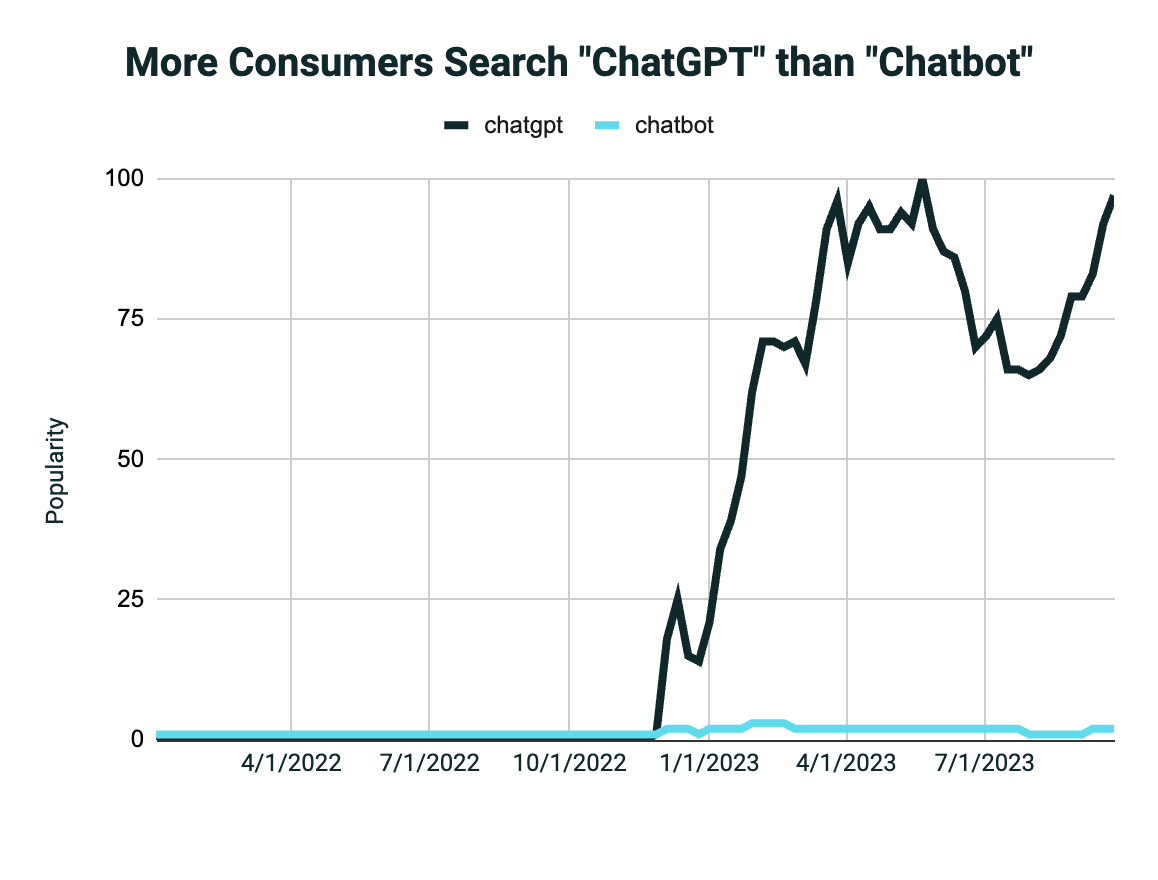

The truth is, when we compare consumer search data for ChatGPT vs chatbot, there’s no question which phrase is more popular.

This indicates that OpenAI is the clear category king, and it has a strategic advantage over its competitors.

The more consumers associate ChatGPT with the product category, the more brand equity OpenAI accumulates. But brand equity isn’t indelible.

Although market leaders have the upper hand, they still need to continuously work to deliver value to consumers in their moments of need.

Here’s how they’re doing it.

OpenAI leverages owned assets to connect with consumers

Given the popularity of ChatGPT, consumers have a lot of questions.

- What is ChatGPT?

- How can I access ChatGPT?

- What can I do with ChatGPT?

- Is ChatGPT down?

Hundreds of millions of consumers asked questions like these in the past year. And OpenAI does a phenomenal job of being first in line with many answers.

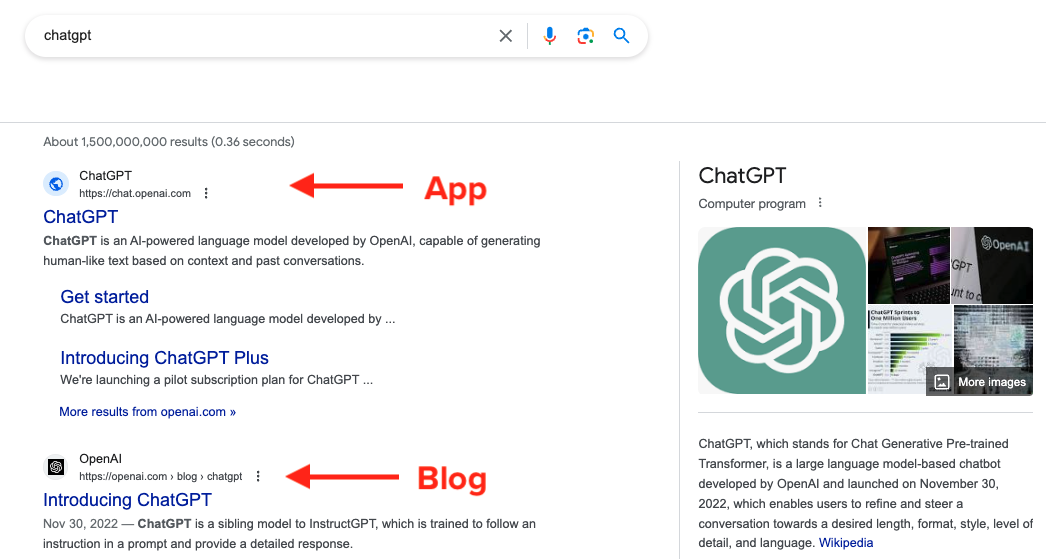

Here are just a few of the ways they connected with consumers throughout the journey:

- Blog content that answers informational questions and discusses product updates

- App and product pages that connect with customers with transactional intent (sign-up or subscribe)

- Community and help sections that solve problems and spark ideas

- The Platform section that guides developers building apps and plugins

In other words, OpenAI engages its audience throughout the journey within its own ecosystem rather than ceding ground, and control, to third-party websites.

And they could do even more.

Expanding their moat

OpenAI is sitting on a goldmine of information within its community section. These are real questions and solutions sourced from existing customers. Every day, this highly engaged audience is troubleshooting, answering questions, and suggesting new use cases for the software.

OpenAI could actively analyze data collected from community forums to publish new content on its help section or blog. The new content could highlight the best answers from the forum to lift up the most helpful community members.

By analyzing consumer questions, listening to consumer needs, and publishing helpful content that’s optimized to rank in Google Search, OpenAI could reach significantly more people.

Furthermore, they’ll own the conversation, ensuring the answers are accurate and favorable.

Owned Asset Optimization (OAO) | The Foundational Guide

May 1, 2023

Read Article

Finally, OpenAI could optimize the Safety section on its website to show up in Google Search. Currently, the brand isn’t visible at all among the top 20 market shareholders for safety and regulation queries.

Although the overall interest among consumers is low at the moment, this presents OpenAI with an opportunity to lead the conversation and public opinion in this critical area.

Today’s consumer is in the driver’s seat, and they want to engage with brands on their own terms. To reach these empowered consumers, leading brands like OpenAI are shifting away from old marketing ****** and embracing reception marketing — listening to their consumers’ needs, and meeting them online with unique, valuable answers and content.