Monopoly: A Ruling Against Google Could Benefit The Open Web

Image Credit: Lyna ™

Image Credit: Lyna ™Boost your skills with Growth Memo’s weekly expert insights. Subscribe for free!

4 years after the DOJ lawsuit against Google started, Judge Amit Mehta declared Google guilty of monopolizing online search and advertising markets. The most successful startup in history is officially an ******* monopoly.

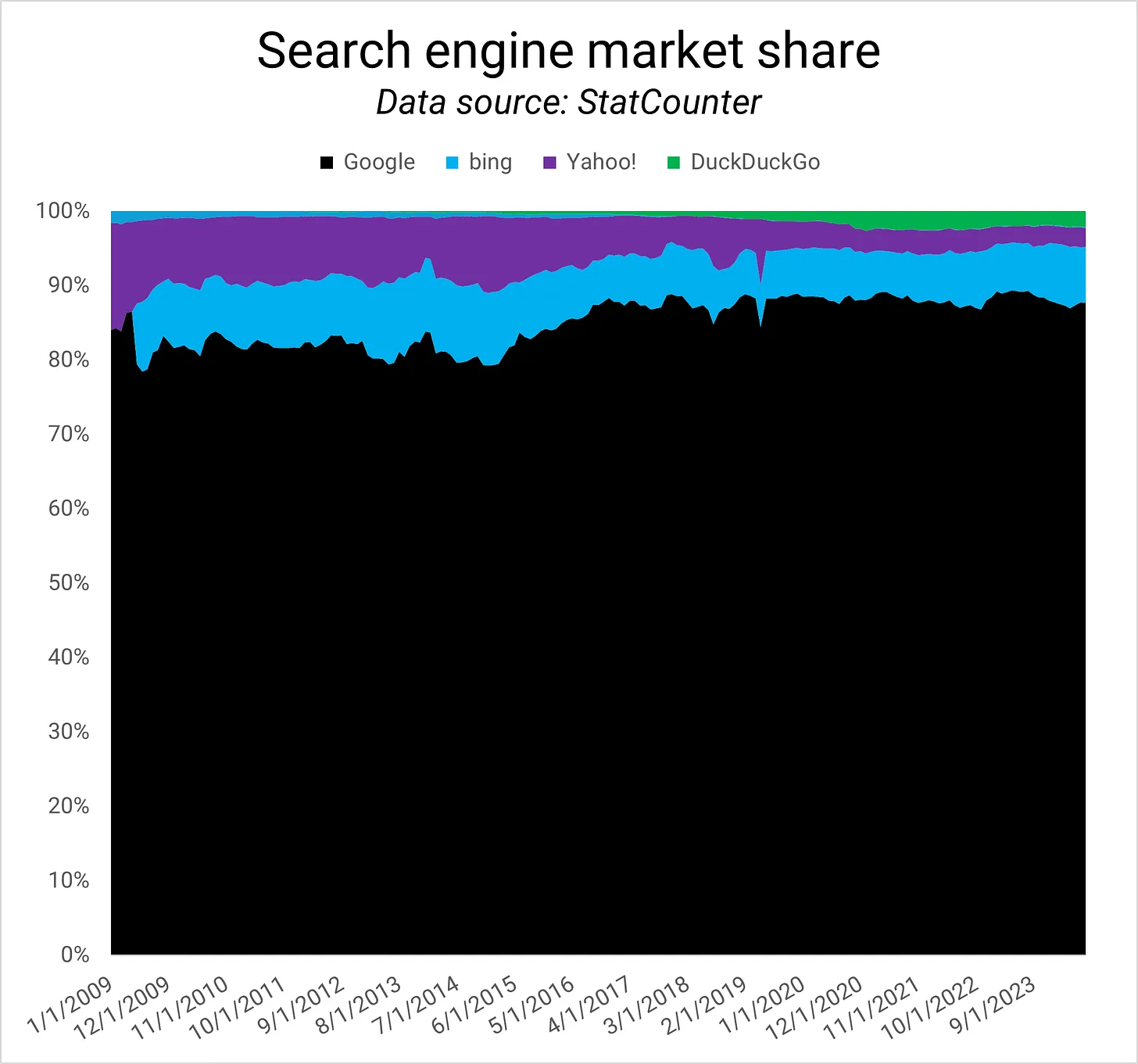

Google’s search engine market share (Image Credit: Kevin Indig).

Google’s search engine market share (Image Credit: Kevin Indig).The ruling itself is big, but the fat question in the room is what consequences follow and whether there is an impact on SEO.

I can’t look into the future, but I can run through scenarios. There is a good chance it will affect SEO and the open web.

Before we dive in, remember:

- I’m not a lawyer or legal expert.

- I solely rely on documents and insights from the court case for my opinion.

- When I refer to “the document”, I mean Judge Mehta’s opinion memorandum.1

Scenarios

Scenario planning is the art and science of envisioning multiple futures.

Step one is framing the key question: What might the remedies (consequences) of the lawsuit against Google be, and what potential consequences could result for SEO?

Step two is identifying the driving forces affecting the key question:

- Legal:

- Judge Mehta concludes that Google is an ******* search monopoly, not an advertising monopoly. This is important.

- The defining precedent lawsuit against Microsoft in the 90s didn’t lead to a break-up of the company but the opening of APIs, sharing of key information and a change in business practices.

- Economic:

- Google faces competition in advertising from Amazon, TikTok and Meta.

- Google has superior market share in search, browsers, mobile OS and other markets.

- Exclusivity and revenue share agreements between Google, Apple, Samsung, Mozilla and other partners delivered massive traffic to Google and profits to partners.

- Technological:

- Apple agreed not to innovate in search, spotlight and device search in return for revenue share.

- Large Language ****** are in the process of changing how search works and the dynamics between searchers, search engines and content providers.

- Social: Younger generations use TikTok to search and social networks to get news and other information.

- Political:

- The sentiment of “big tech” has turned largely negative.

- After almost two decades of no anti-competitive action against tech companies, the Google lawsuit could start a wave of tech regulation.

Step three is defining scenarios based on the key question and driving forces. I see 3 possible scenarios:

Scenario 1: Google must end its exclusivity deals immediately. Apple needs to let users choose a default search engine when setting up their devices. Google could get hefty fines for every year they keep the contract with Apple going.

Scenario 2: Google gets broken up. Alphabet must spin off assets that prevent it from gaining and holding more power in search and keep other players from entering the market.

- YouTube is the 2nd largest search engine (Google is the largest text search engine, according to the judge). Running both at the same time creates too much power for one company to own.

- Chrome and Android – maybe Gmail – need to be divested because they habituate users to choose Google and provide critical data about user behavior. A good example for the “damage” or habituation is Neeva, which failed because it couldn’t convince users to change their habit of using Google, according to founder Sridhar Ramaswamy.

- Alphabet can keep Maps because there is competition from Apple.

Scenario 3: Google must share data like click behavior with the open market so everyone can train search engines on it.

Scenarios two and three are messy and could potentially harm consumers (privacy). Scenario 1 is the most likely to happen. To me, the argument “If Google is the best search engine, why does it need to pay to be the default on devices?” checks out.

Polygamy

Let’s look at the consequences for Google, Apple, and the web under the lens of scenario 1: Apple needs to end its monogamous relationship with Google and let users choose which search engine they want as default when setting up their phones.

1/ Consequence For Google

Apple’s impact on Google Search is massive. The court documents reveal that 28% of Google searches (US) come from Safari and makeup 56% of search volume. Consider that Apple sees 10 billion searches per week across all of its devices, with 8 billion happening on Safari and 2 billion from Siri and Spotlight.

“Google receives only 7.6% of all queries on Apple devices through user-downloaded Chrome” and “10% of its searches on Apple devices through the Google Search App (GSA).” Google would take a big hit without the exclusive agreement with Apple.

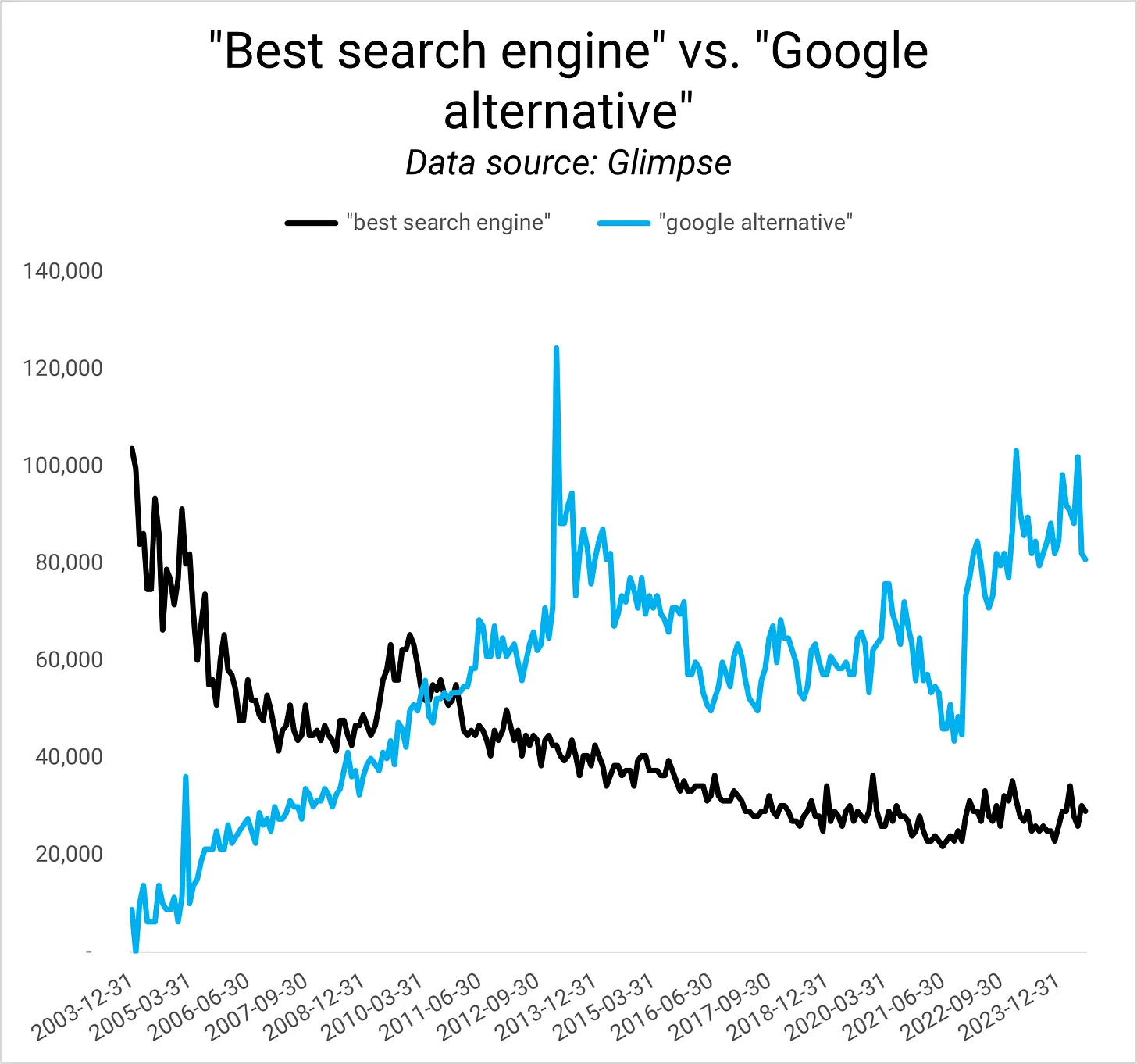

Google searches for “best search engine” vs. “google alternative” (Image Credit: Kevin Indig)

Google searches for “best search engine” vs. “google alternative” (Image Credit: Kevin Indig)If Apple lets users choose a search engine, 30% of searches from iOS and 70% from MacOS could go to non-Google search engines: “In 2020, Google estimated that if it lost the Safari default placement, it would claw back more search volume on desktop than on mobile.” Apparently, users are less inclined to change their default search engine on mobile devices.

Google would take a big hit but survive because its brand is so strong that even worse search results wouldn’t scare users away. From the document:

In 2020, Google conducted a quality degradation study, which showed that it would not lose search revenue if were to significantly reduce the quality of its search product. Just as the power to raise price “when it is desired to do so” is proof of monopoly power, so too is the ability to degrade product quality without concern of losing consumers […]. The fact that Google makes product changes without concern that its users might go elsewhere is something only a firm with monopoly power could do.

Most of you had some feelings about this test when I brought it up on Twitter.

2/ Consequence For Apple

Apple wouldn’t be able to make another exclusive deal. I doubt that the court would forbid only Google to make distribution agreements.

Even if Apple could partner with someone else, they don’t want to: Eddy Cue, Apple’s senior vice president of Services, said publicly in court, “There’s no price that Microsoft could ever offer“ to replace Google. “They offered to give us Bing for free. They could give us the whole company.” Woof.

But Apple’s bottom line would certainly take a hit. In the short term, Apple would miss about $20 billion from Google, which makes up 11.5% of its $173 billion profits (trailing the last 12 months in Q1 ‘24). In the long term, the losses would amount to $12 billion over 5 years:

Internal Apple assessment from 2018, which concluded that, even assuming that Apple would retain 80% of queries should it launch a GSE, it would lose over $12 billion in revenue during the first five years following a potential separation from Google.

Mind you, not only Apple’s bottom line would take a hit, but also Google’s other distribution partners. Mozilla, for example, gets over 80% of its revenue from Google.2 Without the revenue share, it’s likely the company wouldn’t survive. Bing should buy Mozilla to keep the company alive and slightly balance Google’s power with Chrome.

3/ Consequence For The web

The web could be the big winner from a separation of Google’s distribution agreements. More traffic to other search engines could result in a broader distribution of web traffic. Here is my thought process:

- Search is a zero-sum game that follows Zipf’s law in click distribution: the first result gets a lot more clicks than the second, which gets more than the third and so on.

- In theory, you can get near-infinite reach on social networks because they customize the feed for audiences. On Google, the feed is not customized, meaning there are only so many results for a keyword.

- If more users would use other search engines on Apple devices, those non-Google search engines get more traffic, which they could pass on to the web.

- Assuming not every search engine would rank the same site at the top (otherwise, what’s the point?), the available amount of traffic for websites would expand because there are now more search results across several search engines that websites could get traffic from.

The big question is, “How many users would choose search engines that are not google if given a choice?” Google estimated in 2020 that it would lose $28.2 – $32.7 billion in net revenue (~$30 billion to keep the math simple) and over double that in gross revenue from losing 30% of iOS searches and 70% of MacOS.

Net revenue is the amount of money from selling goods or services minus discounts, returns, or deductions. Since we don’t have that number, we have to use total revenues as a ceiling because we know that net revenue has to be lower than revenue.

In 2020, Google’s total revenue was $182.5 billion, meaning~$30 billion would be 16.5% of total revenue. The actual number is likely higher.

Other search engines would likely catch some of Google’s lost revenue. A study by DuckDuckGo from 2019 3 found that mobile market share of non-Google search engines would increase by 300%-800% if users could choose a default.

The next logical question is “Who would get the search traffic Google loses?” Bing and DuckDuckGo are the obvious ones, but what about Perplexity and OpenAI? As I wrote in Search GPT:

OpenAI might bet on regulators breaking up Google’s exclusive search engine deal with Apple and hope to become part of a search engine choice set on Apple devices.

At the time of writing, I thought the likelihood of OpenAI intentionally launching Search GPT to catch some of the Apple traffic is small. I don’t think that anymore.

If Open AI got just 10% of the $30b in revenue Google would lose, it could make up over half of the $5b in annual expenses it runs on now. And all that without having to build much more functionality. Good timing.

According to Judge Mehta, Chat GPT is not considered a search engine: “AI cannot replace the fundamental building blocks of search, including web crawling, indexing, and ranking.”

I don’t agree, for what it’s worth. Most LLMs ground answers in search results. From What Google I/O 2023 reveals about the future of SEO:

Most search engines use a tech called Retrieval Augmented Generation, which cross-references AI answers from LLMs (large language ******) with classic search results to decrease hallucination.

2nd-Order Effects

I want to take my scenarios one step further to uncover 2nd-order effects:

First, Would only Apple be forced to let users choose a default search engine when setting up their device or could Android as well? Mobile operating systems could be seen as a market bottleneck to search traffic.

A blanket ruling for all mobile OSs could mean that Google has to let users choose and potentially lose some of the advantages of owning Android.

Second, if Google were forced to cut all distribution agreements, it would have ~$25b to spend. What would they do with the money? Would it simply compensate for the ~$30 billion it would lose by taking a massive hit in Apple search traffic?

Third, if Apple wasn’t contractually obligated to not innovate in Search across Spotlight, Safari, and Siri, would it build its own search engine?

It might be better off building what comes after search and/or charge to use LLMs. The court documents reveal that Apple estimated a cost of at least $6 billion per year to build a general search engine.

Source link : Searchenginejournal.com

![YMYL Websites: SEO & EEAT Tips [Lumar Podcast] YMYL Websites: SEO & EEAT Tips [Lumar Podcast]](https://www.lumar.io/wp-content/uploads/2024/11/thumb-Lumar-HFD-Podcast-Episode-6-YMYL-Websites-SEO-EEAT-blue-1024x503.png)