Amazing SEO doesn’t happen in a vacuum. It’s not the result of hiring one really smart person, or layering search on top of marketing. Truly incredible SEO is infused in a brand’s DNA. It informs marketing, draws insight from customers, and fuels growth.

Some brands like Byrdie understand this, while others continue to view organic search as a commodity.

The marketing double standard

How would Neutrogena’s VP of Marketing react if the brand’s entire line of beauty products was suddenly yanked from the shelves of every national retailer and dumped into obscure bins in the back of stores?

What about other heads of marketing for massive beauty brands like L’Oréal, Olay, MAC Cosmetics, Dove, or Nivea?

Would they all just shrug their shoulders and move on?

No. Anyone in charge of marketing at a multi-billion dollar brand would do whatever it takes to secure prime product placement in stores where customers are most likely to see them.

So, why don’t all marketing executives approach digital marketing with that same relentless drive to win? Afterall, the first page of Google is just like a prime, top-shelf placement — and everything else is a dirty bin in the rear of the store.

Before we can answer that question — and explain how brands can claim the prized top shelf in Google — we need to look at some data.

Which beauty brands dominate Google organic market share?

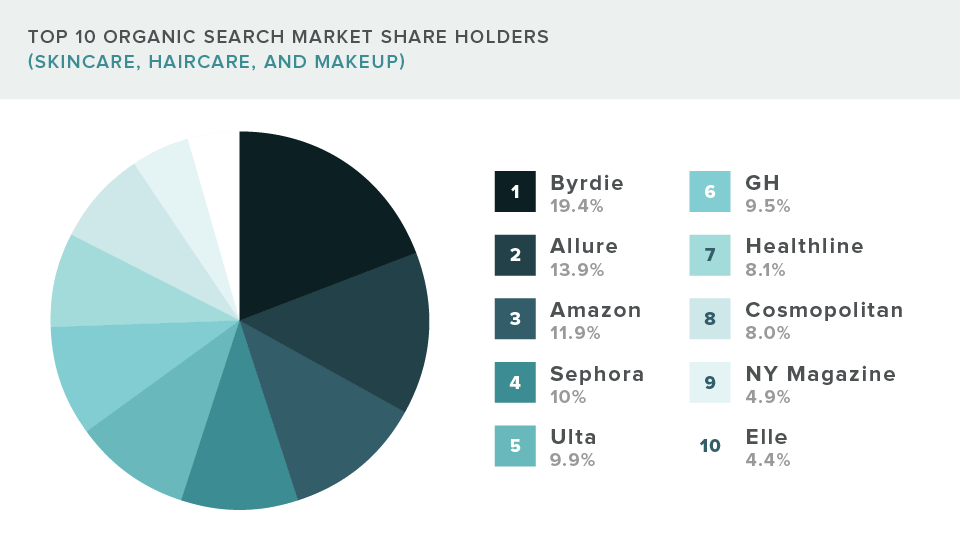

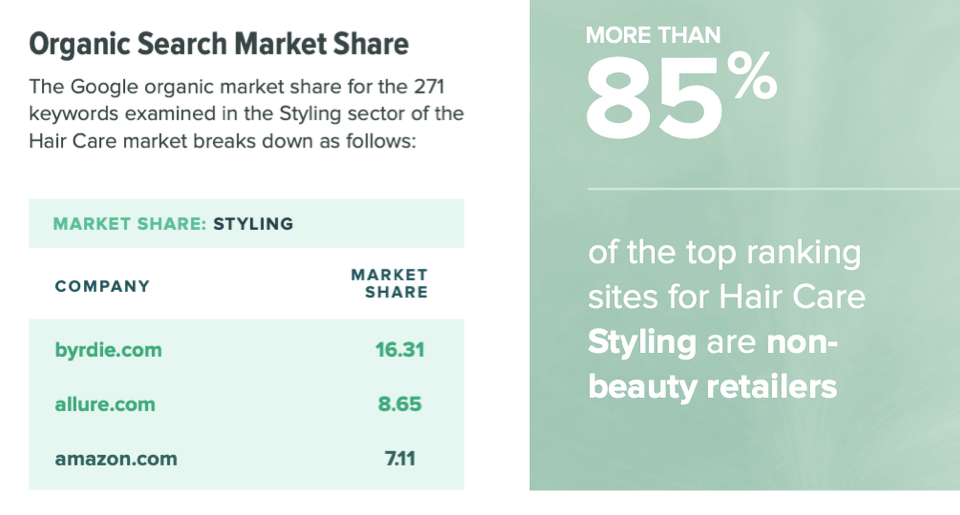

Using Terakeet’s market share analysis technology, we examined 3,168 high-value, non-branded beauty industry keywords that account for 9,393,580 monthly Google searches. Then, we calculated the market share for the top brands in each of nine different sectors and published the results of our study in a 93-page Google Market Share Report for the Beauty Industry.

The report reveals that certain brands always control the leaderboard, regardless of market sector.

You’d probably expect massive beauty brands that sell products to dominate organic search for topics like skincare, hair care, or makeup. However, familiar household names like L’Oréal, Maybelline, Garnier, YSL, Kiehl’s, Redken, Pantene, Urban Decay, Estée Lauder, Clinique, Chanel, Lancôme, Dior, or Givenchy were nowhere to be found.

Shockingly, out of all these brands, only L’Oréal made the top 10 in Google market share in any of the nine market sectors we analyzed. And even then, it only appeared in a single sector.

So, which beauty brands hoard all the organic search market share and win top-shelf placement on the first page of Google?

Online publishers edge out retailers on Google’s “top shelf”

According to Terakeet’s beauty industry analysis, online publishers control the most market share, hands down.

And, in an industry expected to top $716 billion by 2025, that’s a lot of opportunity. Especially when three markets make up 62.3% of the total industry’s sales:

- Hair care – 24%

- Skin care – 23.7%

- Cosmetics – 14.6%

Among the top 19 Google market share holders in hair care, for example, 16 are publishers or informational websites. Similarly, 14 of the top 20 in skincare are non-beauty retailers.

And what publisher consistently outperforms the rest? Byrdie.

Byrdie is an online publisher that has secured an iron grip on consumer attention in the beauty space by creating popular, engaging, long-form content.

The brand itself doesn’t sell any beauty products, yet it completely trounces the performance of beauty brands and retailers when it comes to search visibility and organic traffic from beauty keywords. Ironic, right?

So, what is Byrdie and how does it dominate organic search?

What is Byrdie?

Katherine Power and Hillary Kerr co-founded Byrdie in 2013. The business model was simple: Create amazing content users will ****, optimize it for organic search, and monetize the website through affiliate marketing.

Byrdie was originally part of media company Clique Brands. Dotdash then acquired the company in January 2019, and made SEO a major focus of its beauty content marketing initiatives.

It’s worth noting that Dotdash also owns many other prominent digital properties, including Verywell, Investopedia, The Balance, The Spruce, Simply Recipes, Brides, and many more. So, publishing and SEO are in the parent organization’s DNA.

That helps to explain Byrdie’s massive organic search success. However, there’s much more to the site than product reviews, affiliate links, and keyword-stuffed pages.

Byrdie knows its target audience and takes its content quality seriously. The content is written by award-winning writers and editors who have worked for other prominent publishers and beauty companies including Hearst, Condé Nast, Meredith, and L’Oréal.

In other words, Byrdie doesn’t guess when it comes to publishing. Its content strategy is informed by search data. Even with thousands of pieces of content, its website is lean, focused, and organized.

As a result, it drives massive business value for the brand.

Byrdie’s organic search domination

Byrdie’s top 250 posts represent 42.4% of its organic traffic

Semrush

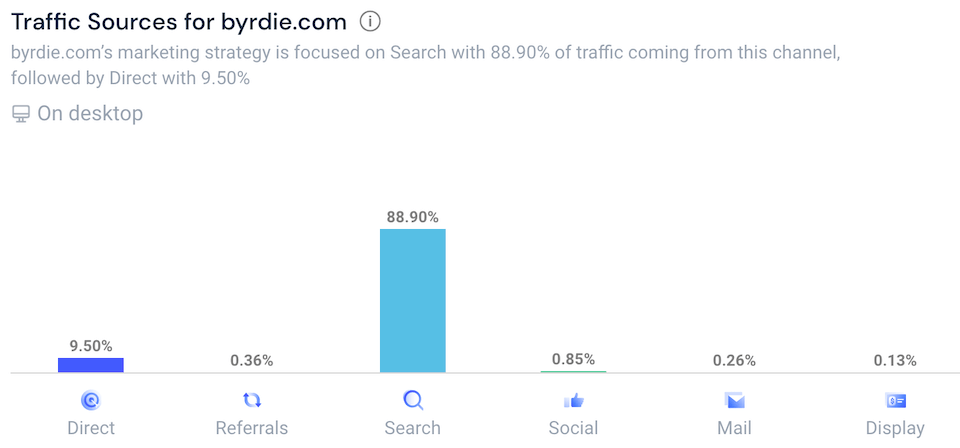

88.9% of Byrdie’s monthly traffic comes from organic search

SimilarWeb

Byrdie increased its organic market share 1,753% in the hair styling sector

Terakeet

Although Allure holds the number one spot in Terakeet’s Beauty Industry Market Report, Byrdie was a more fascinating case study because it quickly climbed the ranks to number two. Its story illustrates that even brands outside the top 20 can overtake top competitors with the right strategy.

Byrdie dominates Google organic search across several market sectors.

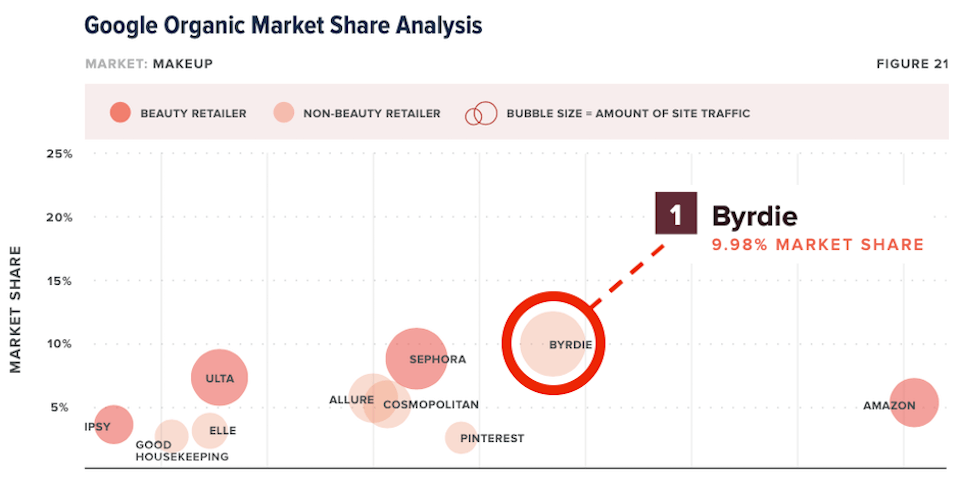

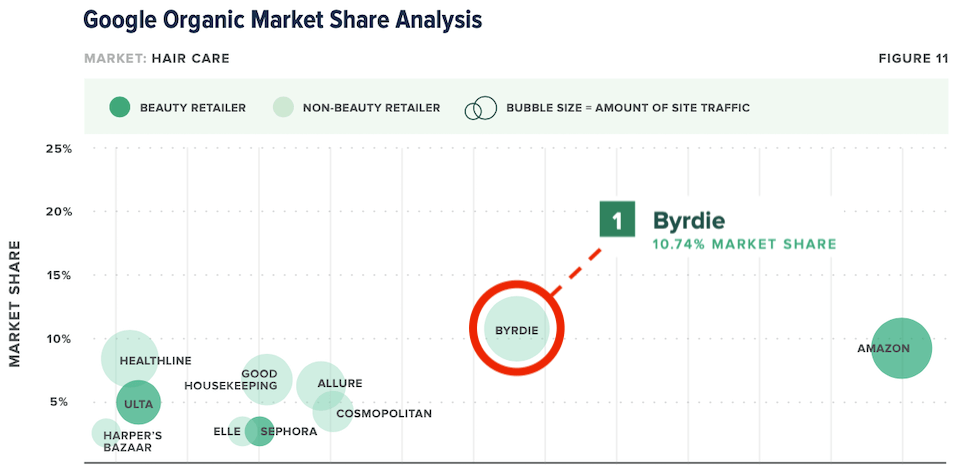

For example, in the hair care and makeup markets, with a combined sample size of 7 million monthly searches, Byrdie held the top spot with the most Google organic market share of any website.

In skincare, with a sample size of 2.2 million monthly Google searches, Byrdie captured the second highest market share for the keywords examined.

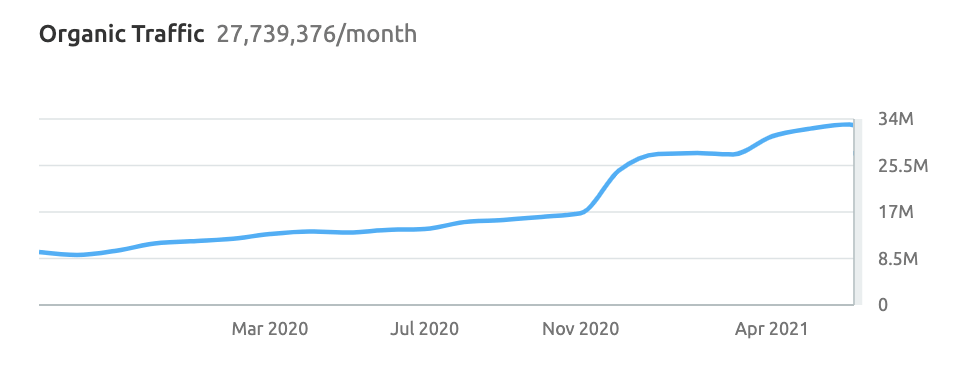

And Byrdie keeps rocketing higher over time.

The publisher surged to 1st overall in Google organic market share in the makeup market by growing its share from 1.72% to 9.98% (5.7x increase!) from February 2019 to February 2021.

Even looking granularly at individual sectors, Byrdie increased its market share across a range of areas.

For instance, in the styling sector within the hair care market representing 694K+ monthly Google searches, Byrdie increased its Google organic market share more than 1,753%, from 0.88% to 16.31%, during the two-year period February 2019 to 2021.

As a result, it captured more market share in the sector than any other website.

Byrdie boasts more than 14,000 content pieces overall and attracts nearly 88.9% of its monthly site visits through organic search (Source: SimilarWeb).

In other words, Byrdie is a sophisticated SEO engine that consistently ranks for top beauty keywords ahead of large, established brands in the industry with much larger marketing budgets.

Byrdie’s SEO performance by the numbers

We used several SEO tools to take a snapshot of Byrdie’s organic search performance, including Screaming Frog, Semrush, Ahrefs, Similarweb, and our own proprietary market share technology, Carina.

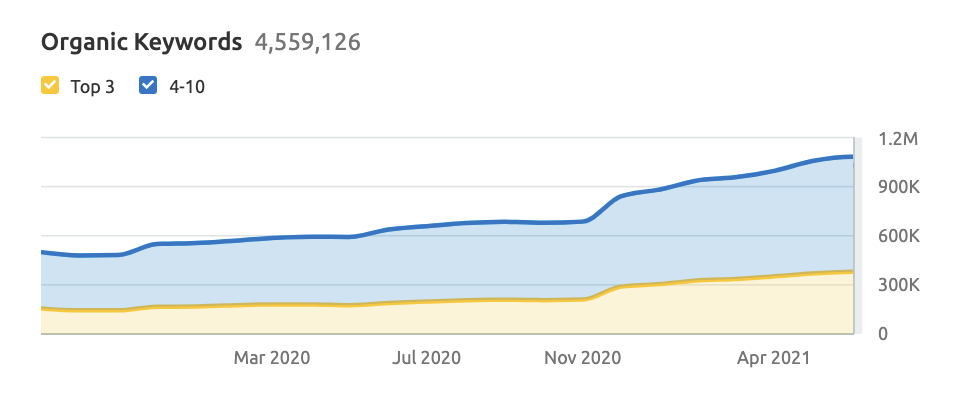

- 17.8M monthly US organic visits, 27.7M monthly worldwide (SEMrush)

- Average post among its top performing 100 posts drives 56.7K monthly visits (SEMrush)

- Average post among its top 250 posts drives 36.3K monthly visits (SEMrush)

- Top 250 posts represent about 2.4% of all posts, but drive 42.38% of all traffic (SEMrush)

- More than 1.1 million Google page one rankings (Ahrefs)

- 72.16% of all pages have a click depth within 3 clicks

- 95.25% of all pages have a click depth within 4 clicks

- Average post server response time is 0.202 (Google recommends 2 ms)

- Top 100 posts have an average word count of 2,269

- Top 250 posts have an average word count of 2,205

- All posts have an average of 40 internal links

- The top performing 100 posts have an average of 66 internal links

- 1,247 URLs receive zero traffic

- Over 1.46 million backlinks from approximately 94,000 websites (Ahrefs)

Byrdie SEO strategy breakdown

So, how did a small website that had less than 100,000 monthly visitors five years ago become a publishing Goliath that crushes billion-dollar beauty brands?

Terakeet examined the Byrdie.com SEO strategy to uncover its strategy for strong Google rankings and organic traffic.

Byrdie has well-organized website architecture

Website architecture is essential for SEO because it allows search engines to understand content hierarchy and relatedness. In other words, it clarifies what your website is all about. Site structure is defined by several factors, including navigation, URL structure, breadcrumbs, internal links, categories, etc.

Additionally, these elements are great for users because they help people quickly find the content they want.

Categories and Subcategories

Byrdie organizes its website content by categories and subcategories in the top navigation. For example, Skin, Hair, Fragrance, Wellness, Style, and Reviews are included in the top nav. Under Skin, you’ll find the subcategories:

- Skincare

- Oily

- Dry

- Acne

- Anti-Aging

- Body

- Fragrance

- Tattoos & Body Piercings

- Ask a Dermatologist

- Skincare Ingredients A-Z

Rather than using more generic subcategories, such as skin types, skin conditions, etc., Byrdie pulls in its most popular subtopics (Skincare, Oily, Dry, Acne, etc.).

This is an excellent example of breaking the expected rules of taxonomy in favor of a better user experience. In other words, Byrdie realized a “skin types” section would require additional clicks by the site visitor, because most users would then need to drill down into the specific skin type they were looking for. So, Byrdie removed a step from the process, reducing potential friction in the site experience.

Each category and subcategory page has a prominent sub-navigation system and description towards the top of the page that tells users where they are. The description helps the site visitor understand the types of information they’ll find, but also often includes the respective target SEO keyword, as can be seen in the description for the dry skin page:

URLs

The Byrdie website has a flat URL structure. For example, blog URLs live directly off of the root domain instead of being organized in subfolders or living on a subdomain. Ecommerce websites benefit from using hierarchical URL structures such as:

/category/subcategory/product

However, blogs don’t require this level of URL organization because content is less compartmentalized than products.

What Byrdie does really well, is to use short, keyword-rich URLs like these:

- https://www.byrdie.com/red-palm-oil-for-hair-5120327

- https://www.byrdie.com/purslane-extract-for-skin-5192240

- https://www.byrdie.com/gold-eyeshadow-looks-5093934

Although Byrdie doesn’t include category folders in its URLs, it does categorize its content via the CMS. For example, the red palm oil for hair example listed above is in the “HAIR” category and the “HAIRCARE” subcategory.

The well-organized information architecture and keyword-centric URLs are helpful for SEO because they make it easy for Google to understand what each page on the site is about.

Breadcrumbs

Finally, Byrdie uses breadcrumb navigation to reinforce site hierarchy. Breadcrumbs tell both users and search engines where a page lives in the taxonomy. They’re also an excellent navigation tool to jump back to a previous section.

Internal links

Byrdie clearly understands the power of internal links. The 100 top performing URLs have an average of 66 inbound internal links, which is about 50% more than the sitewide average.

What’s more, they use anchor text strategically throughout the domain. For instance, their article, 16 Hair Products That Let Your Curls Live Their Best Life has about 189 inbound internal links. About 25 of those are from related blog posts with hundreds of cumulative backlinks. The anchor text? Keyword-rich variations that unlock additional ranking potential for long-tail keywords, including:

- curl-defining cream

- big curls

- curly hair

- wavy, curly, and coily hair types

- curl-friendly products

- curl-focused styles

- volume-boosting tips for curly hair

- curly hair products

- curl-enhancing mousse

- Etc.

As a result, that article ranks for 1,763 keywords that collectively bring in about 102,744 monthly organic sessions.

Byrdie uses topic clusters to improve SEO results

One of the most effective ways to improve SEO results is to have a unified, cohesive content strategy.

And the topic cluster model is the ideal framework for blog content. It’s built on a hub-and-spoke model, and each content cluster contains three essential components:

Topic clusters enhance context, relevance, and authority.

You can see the power of this approach by looking at Byrdie’s content clusters related to various types of piercings:

- Among the top 100 traffic-driving URLs in the Byrdie site, 7,621 piercing terms drive 1.05 million+ in organic traffic each month

- Among all URLs, 66 posts are about piercings. They rank for a combined 26,355 keywords, and receive more than 1.4 million monthly visits.

Here are the top 10 piercing-related titles:

- Industrial Bar Piercing: The Complete Guide

- Nostril Piercings Info and Healing Guide

- Septum Piercings 101: Pain Level, Healing Time, and More

- What to Know Before Getting Your Belly Button Pierced

- The Best Types of Ear Piercings: See Our Chart For Ideas

- A Complete Guide to Daith Piercings

- Conch Piercings 101: What to Know Before Getting Pierced

- A Complete Guide to Tragus Piercings

- The Complete Guide to Getting a Tongue Piercing

- Rook Piercing: A Complete Guide

Additional Resources

Byrdie publishes long-form content

The way to get the most mileage out of SEO topic clusters is with long-form content. And Byrdie comes through with flying colors in this regard, as well.

In looking at the top 100 traffic-driving posts on the website, the average word count is 2,269. The average for the top 250 posts is similarly 2,205.

Long-form content can greatly help with organic rankings. According to an SEMrush Google ranking factors study, content ranking in the top 3 positions in Google is 45% longer than the content ranking in position 20 on average.

But, make no mistake, word count is not a ranking factor. Comprehensiveness is. Answer users’ questions as thoroughly as possible, with the best user experience, and you’ll win.

Byrdie invests in page-level E-A-T (expertise authority and trust)

Another factor in Byrdie’s SEO success has been its commitment to high-quality content. The editorial guidelines and other quality control measures are very well aligned with Google E-A-T.

What is E-A-T? The concept comes from Google’s Search Quality Rater guidelines and stands for Expertise, Authoritativeness, and Trustworthiness. E-A-T is one factor that Google uses to evaluate the overall quality of a web page, as well as an entire domain.

Google states that the most important factors used to determine a web page’s overall quality are:

- The Purpose of the Page (is there a beneficial purpose?)

- Expertise, Authoritativeness, and Trustworthiness

- Main Content Quality and Amount

- Information about the website or the Main Content creator

- Reputation of the website or the author of the Main Content

So, all things being equal, the more a page demonstrates expertise, authority, and trustworthiness, the higher it should rank.

Content creator credentials

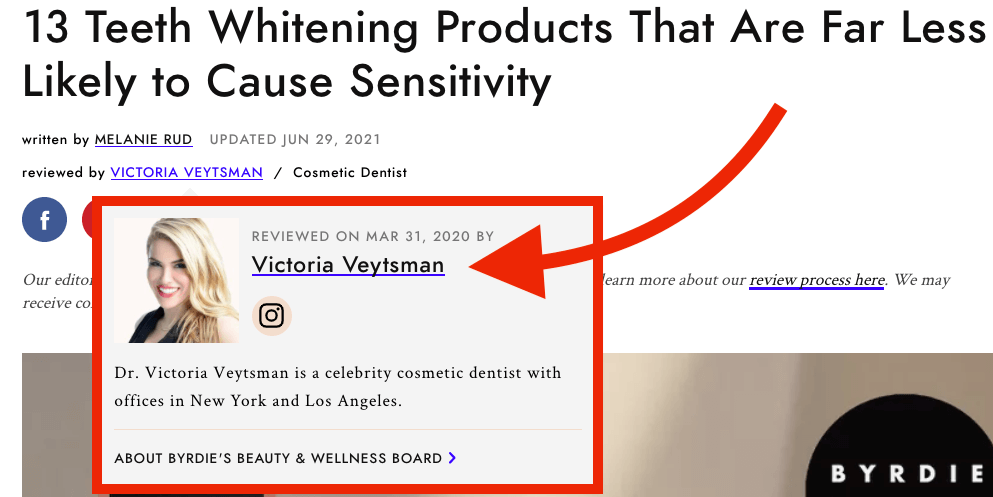

An interesting way that Byrdie deepens its E-A-T is by including detailed information about content authors as well as reviewers. For example, in its article: 13 Teeth Whitening Products That Are Far Less Likely to Cause Sensitivity, Byrdie lists the author, and links to her bio page, which in turn links to her Instagram page. Melanie Rud is a journalist who focuses on the beauty industry. She has also been featured on local television as a beauty expert multiple times.

Furthermore, the article was reviewed by Victoria Veytsman, DDS.

A simple hover effect reveals basic credentials, and her author bio page extensively covers her experience, credentials, and education. She also has a Google knowledge panel.

Content contributor credentials

But, Byrdie does a lot more than hire expert authors to enhance E-A-T. It also integrates expert advice into the body of the copy with a “Meet the Experts” section. This introduces subject-matter experts whose advice is featured in the piece and links out to the experts’ digital properties, as well.

Trustworthy source citations

In addition, Byrdie cites medical studies and research papers using footnotes to build trust. All of this is clearly focused on building E-A-T for the site.

And it works.

The teeth whitening post, by the way, ranks on Google page one for more than 2,821 keywords and is estimated to attract over 72,182 in monthly organic traffic.

Editorial guidelines drive quality content (and domain-level E-A-T)

Byrdie’s editorial guidelines are detailed and geared towards producing high-quality content. Given the more rigorous publishing standards, the brand is recognized as a trusted source of information. They include areas such as:

- Fact Checking: Each article on the site is reviewed by a staff editor and fact checked by staff or a member of a fact checking team. Articles are evaluated for “accuracy, relevance, and timeliness.”

- Corrections: Byrdie lets readers know when a factual error has been identified in the site.

- Sourcing: The site’s authors and editors rely on reputable primary sources, such as “expert interviews, scholarly articles, and peer-reviewed journals.” All data and claims are backed up by at least one reputable source.

- Experts: Byrdie’s writers are experts in various subjects. They are, for example, makeup artists, dermatologists, estheticians, etc.

- Product Reviews: The website adheres to well-defined guidelines for reviewing products, including information on why readers should trust the brand’s reviews (“The product recommendations on Byrdie are purely editorial. Occasionally, beauty brands and PR agencies will send us products for editorial consideration, but our thoughts and opinions are our own.”). Complementary to this, Byrdie discloses the methodology underlying its product rating system.

- Principles: The brand is all about quality content, especially over clickbait. It aims to deliver intent-aligned content designed to satisfy users. “Readers’ interests come first.”

BOFU product Reviews

Beauty product reviews are another mechanism by which Byrdie captures organic search traffic. Although not as powerful as Byrdie’s topic clusters in achieving rankings and traffic, the product reviews add incrementally to organic search performance.

More importantly, they drive valuable affiliate revenue because they’re primed for conversions at the bottom-of-funnel (BOFU).

For example, a review for Armani beauty concealer hydrates, blurs, and de-puffs ranks for close to 280 keywords. And a review of Bobbi Brown bronzing powder ranks for more than 350.

Byrdie’s Ask and Expert section builds trust

One of the unique aspects of Byrdie’s content is the abundance of “Ask an Expert” posts. Specifically, three sections (skin, makeup, and hair) in the site have a subcategory called “Ask an Expert” that features content from industry professionals. These sections include: Ask a Dermatologist, Ask a Hairstylist, and Ask a Makeup Artist.

These sections are fantastic for driving greater audience engagement, and they’re also beneficial for topics that require high E-A-T. For example, one of the dermatologists featured is Elyse M. ****, MD, who is a board-certified dermatologist with five years of experience in medical and cosmetic dermatology. Similar to the example above, she also has her own Google knowledge panel that confirms her expertise.

Byrdie also leverages different types of content in its Ask the Expert categories. For example, “10 TikTok Makeup Products That Are Actually Worth It” includes a TikTok video with each of the 10 recommended products. Not only that, but there’s product imagery as well as shopping links to retailers for each product.

Hard-hitting, contemporary content draws users back

Byrdie is all about beauty. Anyone visiting the website can immediately see that.

But, one of the things that makes Byrdie special is that it doesn’t limit its content to traditional beauty topics. It recognizes that there are many other areas that contribute to beauty perception, including social, economic and mental health issues.

Byrdie is fearless in writing about contemporary, real-world issues, such as the Black Lives Matter movement, an election, or bipolar disorder. These topics aren’t technically related to beauty, but Byrdie smartly recognizes the relationship with people’s lives.

These topical posts may not neatly fit into an SEO topic cluster or produce the same organic search results as more keyword-focused posts, but it’s an ingredient in the powerful Byrdie content formula for creating brand ****. And ultimately, that type of brand building helps the publisher receive more clicks, more word of mouth (WOM), more shares, and more backlinks.

Offline events amplify online brand power

Byrdie’s brand doesn’t just exist online. It also builds excitement and relationships with its readers through its annual event, The Byrdie Beauty Lab. With the impact of Covid in 2020, Byrdie took the event online, providing readers and consumers a peek behind the scenes of the beauty industry.

Within merely an hour of releasing tickets, 800 curated gift boxes (valued at $250 each) filled with editor-approved products were claimed.

During the event itself, Byrdie offered eight sessions, with an average view time of more than 19 minutes and an overall watch time of 26,600 minutes.

In the past, Beauty Lab pop ups have landed in L.A. and Manhattan, giving readers the ability to experience the digital brand in real life.

So, although not an SEO tactic, Byrdie understands that its brand exists both online and offline. Building brand awareness and loyalty in the real world, as well as better digital experiences, results in a much stronger overall brand.

The Byrdie organic content marketing machine

Byrdie has evolved into a content and organic search powerhouse. It’s rise in Google organic search market share through the years validates the content strategies and approaches that the beauty publisher has taken.

From clean URL structures to SEO topic clusters, long-form content, investments in E-A-T, and a focus on interesting topics, ingredients, and keywords, Byrdie is building a deep marketing moat. And it deepens that moat even further by going beyond the page with events that build engagement and brand ****.

As Terakeet’s Google Market Share Report for the Beauty Industry reveals, Byrdie isn’t just strong in organic search, it continues to achieve better performance and steal additional market share from others.

If Google were a brick and mortar store, Byrdie would have top-shelf placement.

Beauty content marketing matters. And Byrdie offers a master class in how to grab Google market share from more established players through doubling down on high-quality content.

![YMYL Websites: SEO & EEAT Tips [Lumar Podcast] YMYL Websites: SEO & EEAT Tips [Lumar Podcast]](https://www.lumar.io/wp-content/uploads/2024/11/thumb-Lumar-HFD-Podcast-Episode-6-YMYL-Websites-SEO-EEAT-blue-1024x503.png)