Posted by

Mordy Oberstein

On September 24th, Google sent forth its latest core algorithm update incarnation – the September 2019 Core Update. The third official algorithm update of 2019, like all other core updates, presented a unique set of ranking data at the niche level. More than that, a look at some of the sites impacted may shed some light on how Google looks at Your Money Your Life content.

Here’s a look at what the data says about the September 2019 Core Update’s size, scope, and overall impact!

The Size & Scope of Google’s September 2019 Update

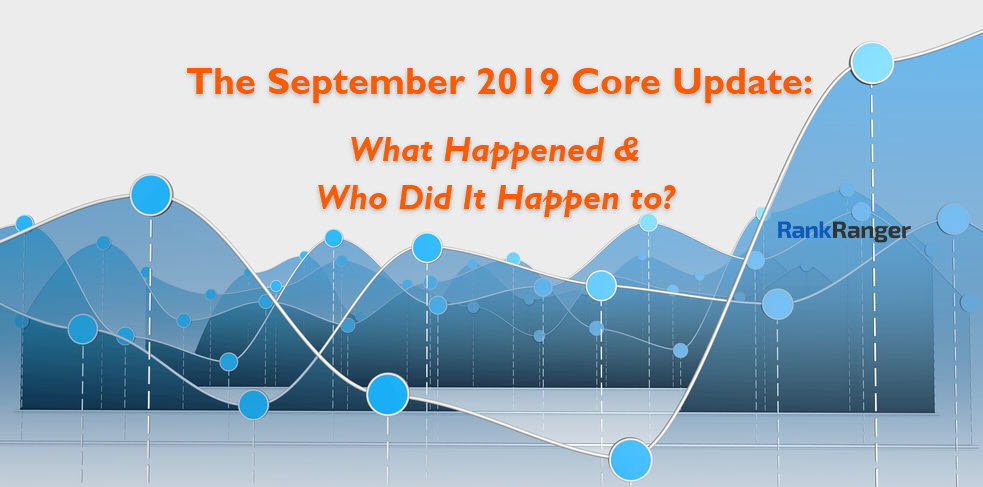

Oddly enough, the September 2019 Core Update wasn’t the sort of prolonged event you might have expected it to be. Per the Rank Risk Index, the update lasted only two days. And while the index did show heightened levels of rank fluctuations, those levels were not astronomically high. In fact, the unconfirmed update that Google released a week earlier was both longer and showed steeper increases in rank fluctuations.

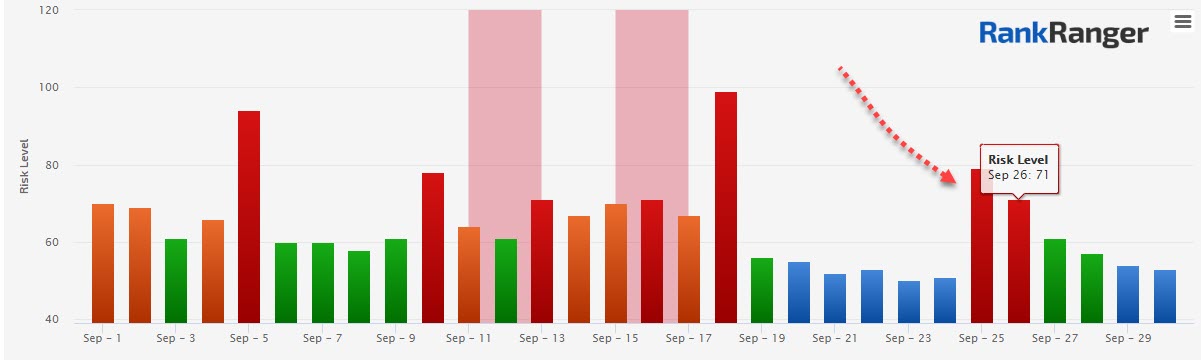

What was typical about the update was its focus on Your Money Your Life (YMYL) sites. As with The Medic Update and beyond, there was clearly a tilt towards YMYL sites being more greatly impacted by the update than other niches:

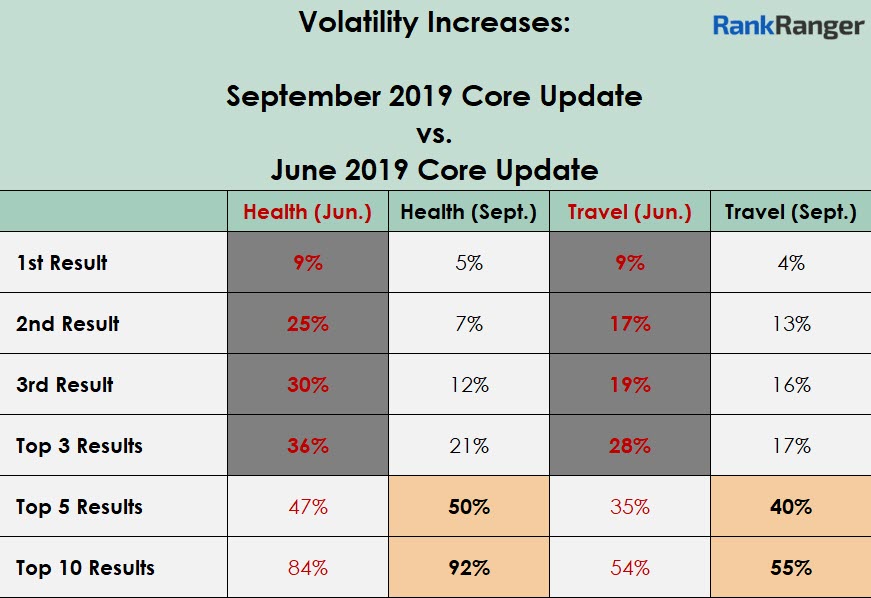

The update’s full-on YMYL leanings, interestingly enough, only become manifest as you move down the SERP. That is, when looking at the top 5 and top 10 results overall there is a vividly wide gap between the volatility increases seen within the Health and Finance niches when compared with the Retail and Travel industries.

That considered, the Finance industry showed extensive rank fluctuations from the 1st result and on. Even when compared to its YMYL counterpart, the Health niche, finance sites showed far more volatility at the 1st, 2nd, and 3rd ranking positions during the September update. There were some peculiarities at the site level within the Finance niche as well, but I’ll get to that in just a bit.

Comparing the September 2019 Core Update to the June 2019 Core Update

Comparing two core updates to each other is one of my favorite things to do as it really helps give a bit of perspective. When stacking the September update next to the June 2019 Core Update, the clear “winner” was Google’s early summer offering. Despite some of the metrics indicating that the September update was a bit more impactful, it’s clear from the data overall that the June update was far more powerful.

Don’t be fooled by the data above. Yes, the September update presented us with more rank volatility than the June update when looking at the top 5 and top 10 results. However, not by much. The gap between the two updates for the aforementioned metrics ranges from being small to marginal. The difference between a 55% increase in rank volatility within the Travel niche during September as compared to a 54% increase during the June update for the same niche is statistically irrelevant.

The same cannot be said for the volatility seen at the top of the SERP during the June update. In almost all cases, and covering both the Health and Travel niche, the volatility increases seen during the June update far outweighed the increases seen during the September update. Here, at the top of the SERP, the gap in increased volatility between the two updates is 18 points at its “widest point” (see the 2nd Result metric within the Health niche).

All-in-all, the quick roll-out and only moderately high levels of rank fluctuations translated into the September update not being in the same league as some of the previous core updates we’ve seen.

Finance Site Content Patterns – A Core Update Emergence

Now for the hard part… site-level patterns. I dug and I dug, and then I dug some more and I found what might be a telling little pattern. One of the things that stands out in the data above is the volatility that the Finance niche presented. Oddly enough, at the site level, there was a nice mix of finance sites that showed significant ranking losses. Actually, that’s not odd at all. What is odd is that there were a large number of finance sites that offer loans on my list and there may be a connection between them…

Before I say another word:

- What’s to follow is not a definitive analysis of what the core update was after. Rather, what’s to follow is just one small pattern I noticed.

- There’s a lot of room for interpretation with the type of analysis one does when looking to find a site-level pattern within a core update. What’s to follow is my best analysis based on my own interpretation of what the sites presented to me.

Was the September Core Update a Continuation of the Preceding Unconfirmed Update?

Before I get into a nitty-gritty content analysis… here’s an interesting theory for you – the core update was a continuation of the unconfirmed update that hit peak fluctuations on September 18th.

One of the patterns I saw when I was looking at some of the finance sites impacted by the September update is that they also underwent heavy losses as a result of the mid-September unconfirmed update.

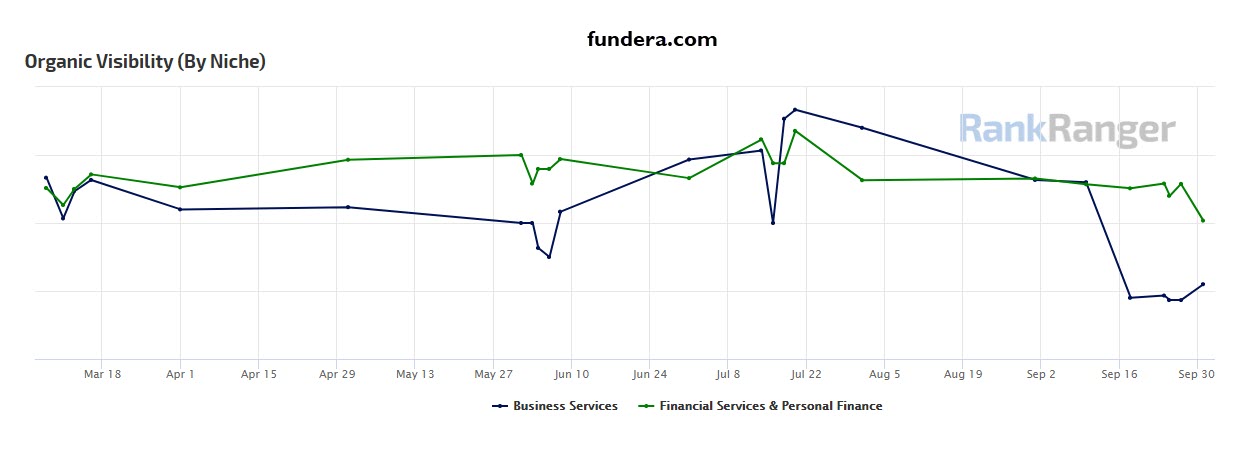

For example, here’s the visibility for the site fundera.com:

As you can obviously see, keywords we’ve categorized as falling within the Business Services sub-industry tanked on September 15th when the mid-month unconfirmed update hit the SERP. At the same time, the site’s keywords within the Financial Services & Personal Finance sub-category were hit during the core update itself.

Here’s the same pattern on display for the site nationalfunding.com:

That’s not to say this pattern was pervasive across all such sites. The site lendio.com underwent a sharp ranking decline as a result of and only as a result of the September 2019 Core Update. There was no initial ranking loss that took place during September’s mid-month unconfirmed update:

Take it or leave it, the connection between September’s core update and its unconfirmed update is interesting to both note and possibly explore further.

The Content Connection: Why Loan Sites Hit Hard Times During the September Update

On to what we all came here for… site-level patterns that were manifest during a core algorithm update…. What did these sites have in common? Why did the three sites I just showed you all lose some of their rankings?

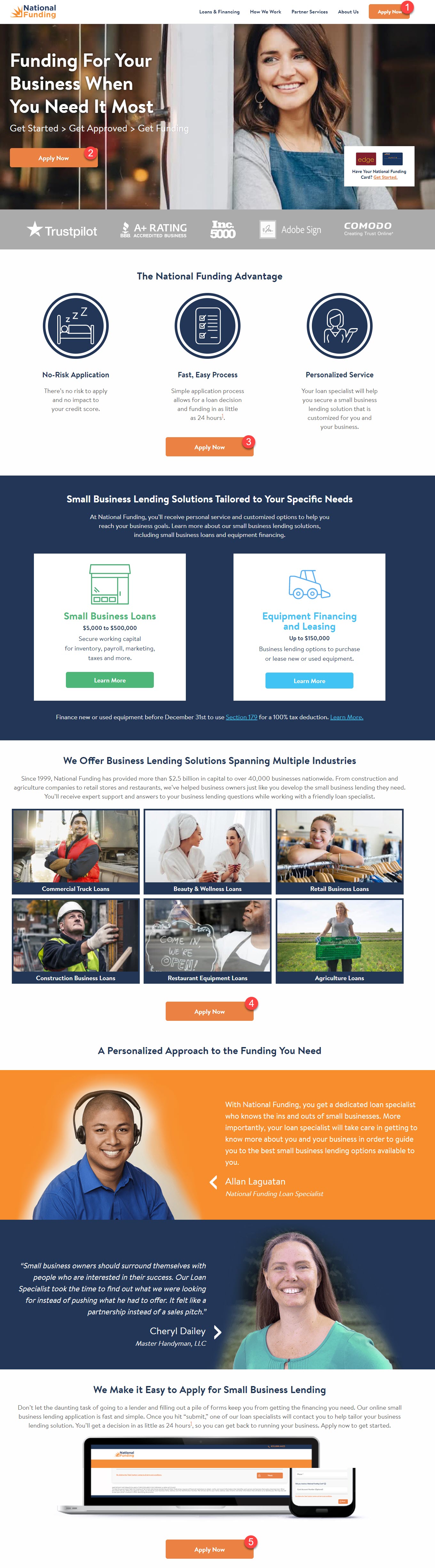

Let me take you through my thought process a bit. I started with nationalfunding.com where my initial thought was ‘too many CTAs’, too much of pushing users to Apply Now:

A lot of CTAs there! However, when I started looking at the loan sites that do rank well, the number of CTAs asking me to apply on the National Funding site was not out of the ordinary.

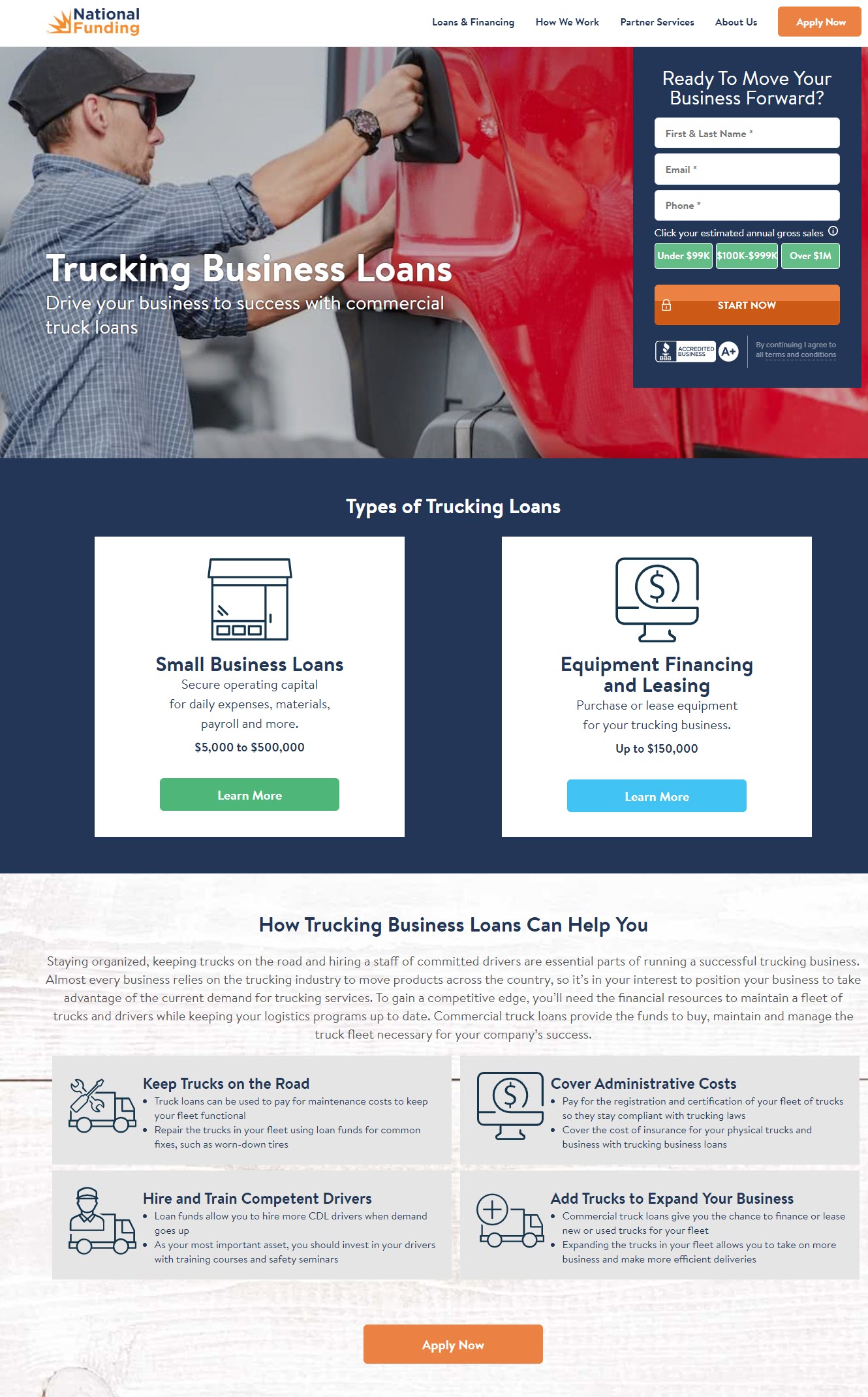

So, I clicked deeper into the site and found something peculiar. No matter the loan type, the site uses a template for all of the industries that it services. That template looks like this:

My first thought was that the content here was perhaps a little thin and most certainly generic! So I went to some of the other sites that rank well to see what they offered. Oddly enough, most don’t break down their loans by industry, but by type. With the help of Rank Ranger’s Search Gap Tool, I found some keywords common for the sites I was analyzing and as a result, I decided to focus on their page about small business loans. The idea was to use the page these sites offer on small business loans as an exemplar or baseline of sorts… a common way to compare their content practices.

Here’s where it gets interesting.

Below is the page on small business loans found on the National Funding site:

Thin content, right? That’s the first thing that stands out. Thus, the pattern here must have to do with thin content! Wrong.

Here’s what fundera.com, which also suffered a ranking lost during the update, offers on small business loans:

That’s not thin to me. There’s a nice amount of content there. We get all sorts of small business loan types with all sorts of loan metrics. Looks good, no?

Not exactly.

Let’s have a look at a site that’s been doing pretty well with finance queries, kabbage.com. Here’s what they give us on small business loans:

The difference between a site like Kabbage and a site like Fundera is not the “fullness” of their content. Neither site has what I would characterize as ‘thin’ content. Rather, the difference is in the quality and purpose of the content.

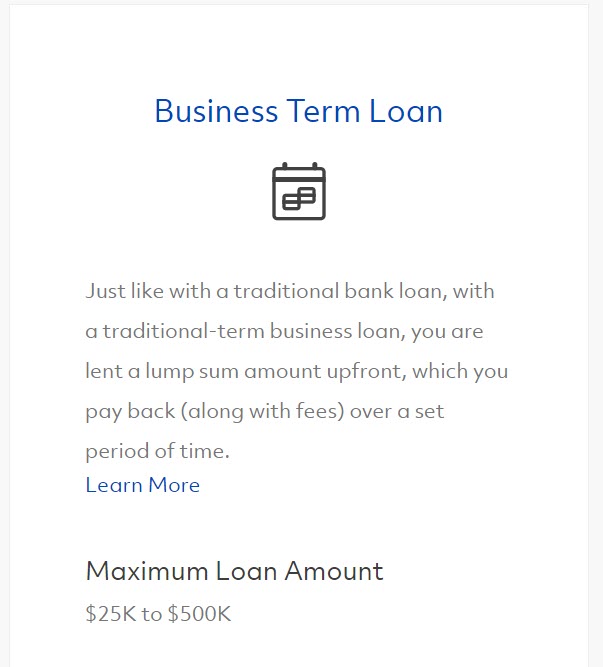

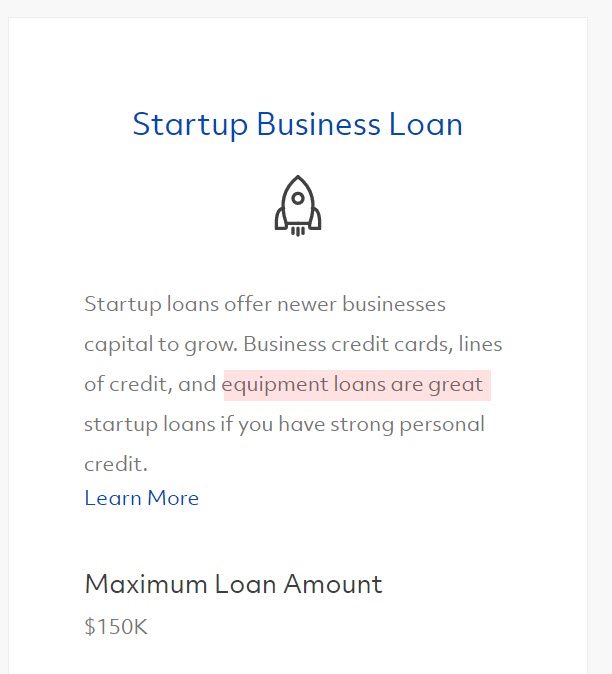

If you look back to the Fundera page I presented above the content at times tends to help define the different loan types. For example, when looking at a Business Term Loan the site offers a little snippet on what that type of loan this is:

At the same time, the Fundera site uses the space within the loan types as a means of sublime marketing, telling you why the loan-type is the best thing since sliced bread:

Let’s compare this to a snippet of content from Kabbage. Now, the site (and this page in particular) certainly tells the user why taking a loan can be a good thing. The site is a for-profit business so it’s going to use the page to try to convert users. However, when it comes to loan-types, the content is purely about explaining the loan and the page does so in a detailed manner:

By the way, like the National Funding site, I did find industry-specific loans on kabbage.com. Except on kabbage.com the content looks like this:

That’s a lot more in-depth and detailed than a few lines within a generic template.

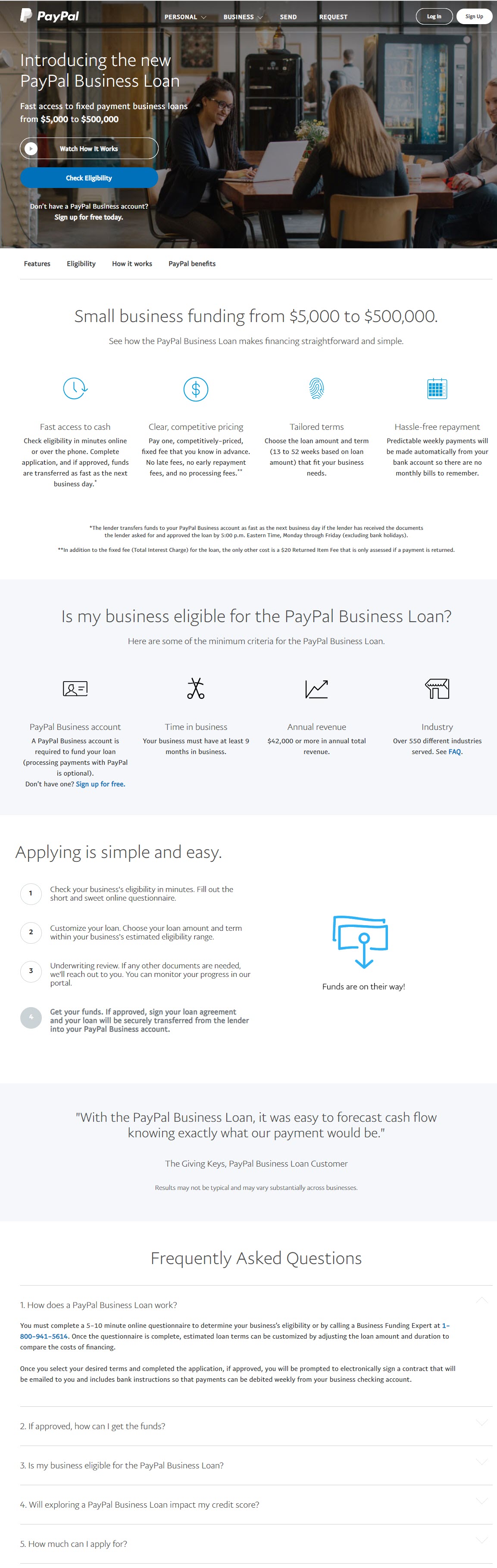

That said, the icing on this site-level pattern cake was PayPal. Yep, PayPal got hit by the September core update, but recovered quite quickly:

And you’re thinking, “How does this help prove the point here?” That’s a valid question. The answer is because PayPal offers loans and its page looks like this:

There’s more here on the process of getting a loan via PayPal than there is information about the loans themselves. A pattern that’s a bit similar to what we saw above with National Funding and Fundera.

What I speculate happened is that the PayPal site was hit on finance keywords because of the type of content it’s offering on the pages relevant to those queries (such as the page shown above). That the absence of financial information was a problem for the site. So why did the site’s rankings go right back up? Who knows… maybe because PayPal is a super-authority?!

Summarizing the Site-Level Patterns

I still have one more site to show you, lendio.com. Before we do that, let me just summarize what I’m trying to get at here. It’s my intuitive understanding that at least part of the reason why the sites I’ve shown here lost rankings is due to the type of content they’re offering. That is, for the financial queries relevant to these sites, Google is not only looking if there is thin content or not but if the robust content offered is purposeful from an informative point of view.

In other words, Google knows these sites can have significant financial implications on a person’s life and as such the search engine wants deep information to be presented by the site. That’s why sites like Fundera with its long-form content and even PayPal with its inwards focus have had ranking problems whereas a site like kabbage.com has not. The difference-maker, as I see it, is not related to thin or full content, but to the content’s purpose. For finance sites, it seems that user safety demands less marketing talk, less talk about your lending process (or whatever service you offer), and more information about the nature of the financial services themselves.

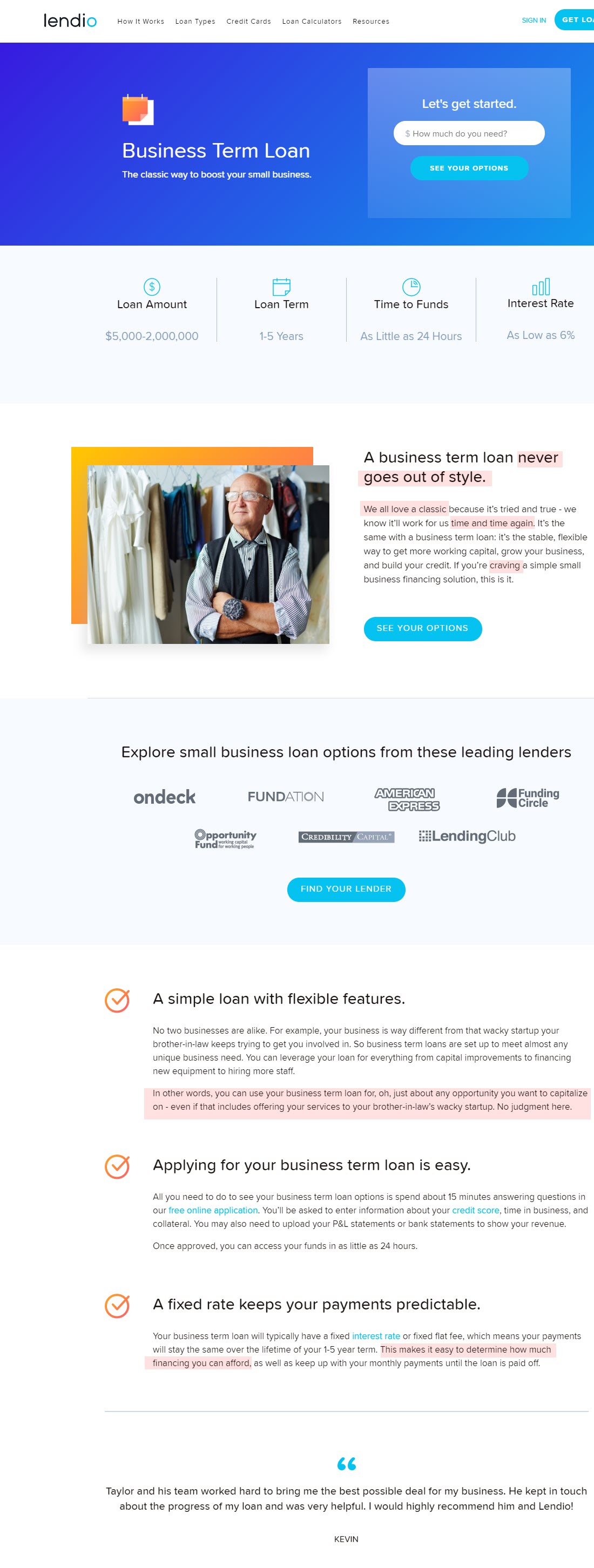

Now we’re ready to have a look at the last site I indicated earlier, lendio.com. Because what you’re going to see here is a prime example of the problem I just laid out. Pay attention to the tone of the content, to the word choice, to the overall focus of the content, because it’s not what I think it should be. Here we go:

I tried to highlight some of the language that I thought was problematic. The first paragraph on the page is pure marketing and I don’t think it serves this page well in light of my ‘theory’. We get more of the same heavy marketing language within a paragraph meant to discuss why business term loans are used. I understand the fun and friendly tactic taken, I’m certainly not trying to critique anyone here, but I think the language helps establish a poor profile of the page vis-a-vis financial safety. I’m not saying you can’t use “fun” language on a finance page, but it should be part of a much larger piece that is staunchly focused on helping the user understand the services in question. Even when the Lendio page gives the user details about the loan, it does so in a way that tries to push the advantages of taking the loan. Again, a more sales type of profile when it seems Google wants more information and less marketing.

Simply, despite there being a good deal of content on the Lendio page, there is not a substantial amount of content that helps the user understand the loans they are looking at. Coupled with the sites we looked at earlier, there is a strong case to make that financial service sites should focus less on marketing, sales, and even the process of their services and more on making sure the user is unquestionably informed about the transaction they are looking to make!

The September 2019 Core Update – A New Level of Content Scrutiny?

When looking at the September update what sticks out to me is the strong possibility that Google is going deeper into your content. Specifically, the search engine seems better adept at understanding your content and if its purpose aligns with what users ought to see on the page. In the case of loans, what Google thinks users ought to see is a barrage of detailed information for better decision making.

You could make the argument that the cases I’ve shown redefine Google’s ability to scrutinize content so that it aligns with the latent intent of the user. It would seem that Google is closing the gap between understanding what the user wants and needs and being able to provide content that aligns with those underlying wants and needs. In a way, it brings into focus the age-old question of how important tone is to content. We’re faced with the very real possibility that Google is able to decipher language to such an extreme that it can distinguish between that which is laden with a marketing tone versus that which is purely informative. In such a world, carefully considering your content’s tone is a ‘sound’ strategy.