Competitive Intelligence: What It Is & How to Gather It

What Is Competitive Intelligence?

Competitive intelligence (also known as corporate intelligence or CI) involves gathering and analyzing information about your competitors, target customers, and market. Which enables you to make contextual, data-led business decisions.

The ultimate goal is to establish or enhance a competitive advantage.

Unlike corporate espionage, corporate intelligence does not rely on unethical methods of data collection. It involves detailed analysis of openly accessible information and information you compile yourself.

Let’s say you’re in charge of a new product’s pricing strategy.

As part of competitive intelligence gathering, you could:

- Collect pricing information from rival websites

- Survey target customers about what they’re willing to pay

- Learn about economic conditions in each sales region

This data would help you set a pricing strategy that maximizes profit potential.

Why Is Competitive Intelligence Important?

Competitive intelligence is important because it allows businesses to make decisions designed to help them outperform their rivals based on data rather than guesswork.

This can streamline the decision-making process. And generate better outcomes.

For example:

- Sales teams can modify pitches based on competitor claims and shortcomings

- Marketing teams can refine messages to stand apart from their rivals’

- Product teams can strategize roadmaps around features their competitors’ overlooked

Plus, competitive intelligence enables companies to identify and react to trends more quickly.

This helps them capitalize on market demands and anticipate challenges. So they can stay ahead of competitors.

Types of Competitive Intelligence

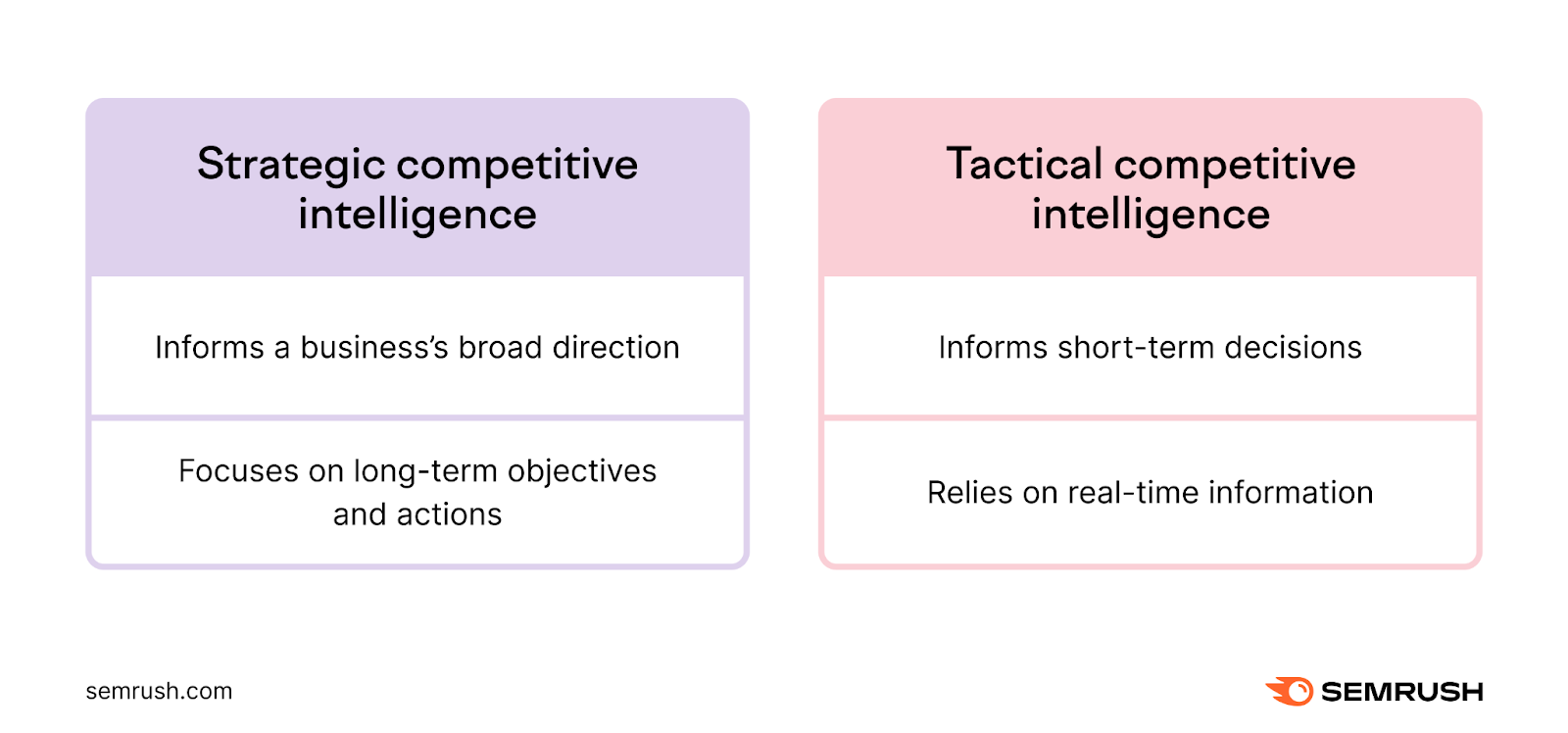

There are two main types of competitive intelligence.

Strategic competitive intelligence informs a business’s broad direction. It focuses on long-term objectives and actions.

For example, insights from this kind of intelligence can help companies to plan out mergers and acquisitions. Or expand into new markets.

Tactical competitive intelligence informs short-term decisions. It relies on real-time information, and helps businesses respond to immediate threats and opportunities.

For example, insights from this type of intelligence can help companies respond to supply chain disruptions. Or fine-tune their existing marketing campaigns.

Using both types of CI helps companies better reach their goals.

How to Do Competitive Intelligence Research

Learn how to do competitive intelligence research—step by step:

1. Identify Your Main Competitors

Conducting a competitor analysis is a central part of gathering competitive intelligence. So, you need to decide which rivals to evaluate.

We recommend focusing on the two to three companies that pose the biggest threats.

They’re not necessarily the industry giants—they’re whoever your ideal customer would opt for if your offering were unavailable.

And don’t be tempted to focus on just one competitor. Intelligence that’s accurate and reliable needs to include at least a few rivals.

This approach yields higher-quality data. And makes analysis more manageable.

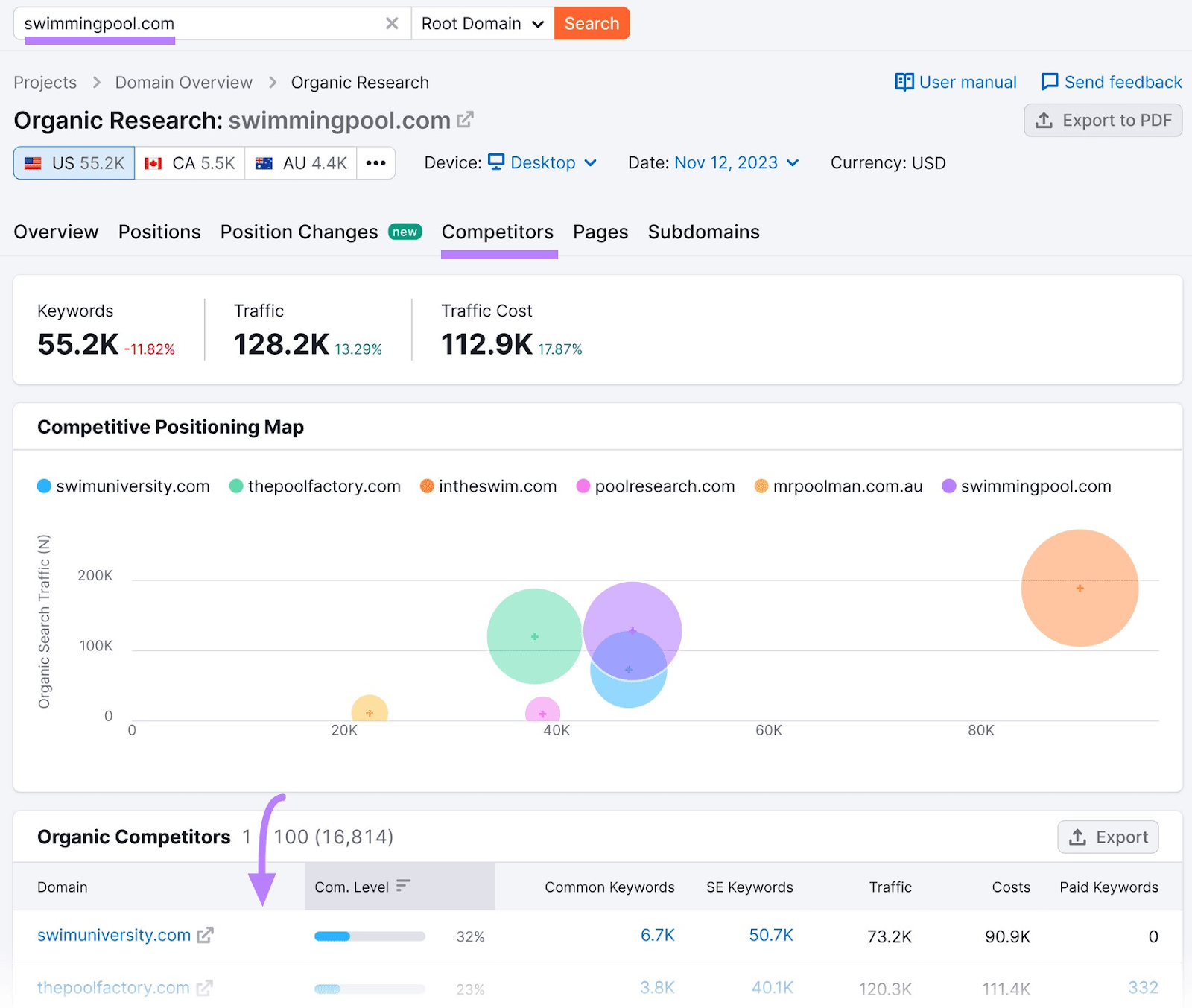

There are various ways to identify competitors with Semrush.

For example, the Competitors report in Organic Research shows which sites commonly appear alongside yours in Google results.

2. Gather and Organize Data

In competitive intelligence, gathering relevant and reliable data is crucial.

It’s not about getting as much information as possible. It’s about collecting high-quality data that provides useful insights about your target audience, competitors, and market.

Let’s say you’re an online-only business with no interest in opening a physical store.

You shouldn’t waste time gathering data about rivals’ physical locations. Instead, you should focus on collecting information about their online presence.

And be careful where you get it.

Inaccurate, outdated, or incomplete data can lead you to false conclusions. And do more harm than good.

For example, if you falsely believe that a marketing channel delivers great results for a competitor, you might waste money trying to mimic their success.

Later, we’ll share some of the competitive intelligence tools and resources you can use for ethical data gathering. Using a variety of techniques can help you yield the best results.

Whatever methods you choose, keep your data organized. So analysis is easier.

Here are some best practices to employ:

- Use descriptive file names, tags, and metadata to make lookups easier

- Group data by type (e.g., folders for each competitor)

- Use spreadsheets or purpose-built tools so you can manipulate data more easily

- Provide data access to relevant decision-makers

- Keep records about your data collection methods

3. Analyze Your Data

Competitive intelligence analysis is about transforming raw information into valuable insights.

Let’s say you’ve gathered this product pricing data:

|

Competitor |

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

|

Competitor A |

$999 |

$949 |

$899 |

$899 |

$849 |

$849 |

|

Competitor B |

$1,049 |

$1,049 |

$999 |

$999 |

$949 |

$949 |

|

Competitor C |

$899 |

$849 |

$799 |

$799 |

$799 |

$799 |

From this, you can get insights like:

- The highest-ever price was $1,049

- The average price peaked in Month 1

- Competitor B had the highest prices in every month

Some competitive intelligence tools streamline the analysis process. By making calculations and drawing conclusions for you.

4. Tailor Your Business Strategy

Next, you need to transform insights into a plan for action.

Combine insights from competitor research, audience research, and market research to get a well-rounded view of opportunities and threats.

Then, consider what you learned in the context of your business goals.

For example, you might find that there’s consumer demand for a cheaper product due to economic conditions. So you try to beat competitors’ prices while taking revenue goals into account.

5. Track Results and Keep Adapting

Don’t create one competitive intelligence report and rely on it forever.

To maintain business growth and success, you should regularly monitor:

- Your own performance metrics

- Market trends

- Competitor activities

- Consumer habits

And adapt your strategy accordingly.

It’s a good idea to do this around once per month, depending on your resources. Or, use tools that send reports and alerts automatically.

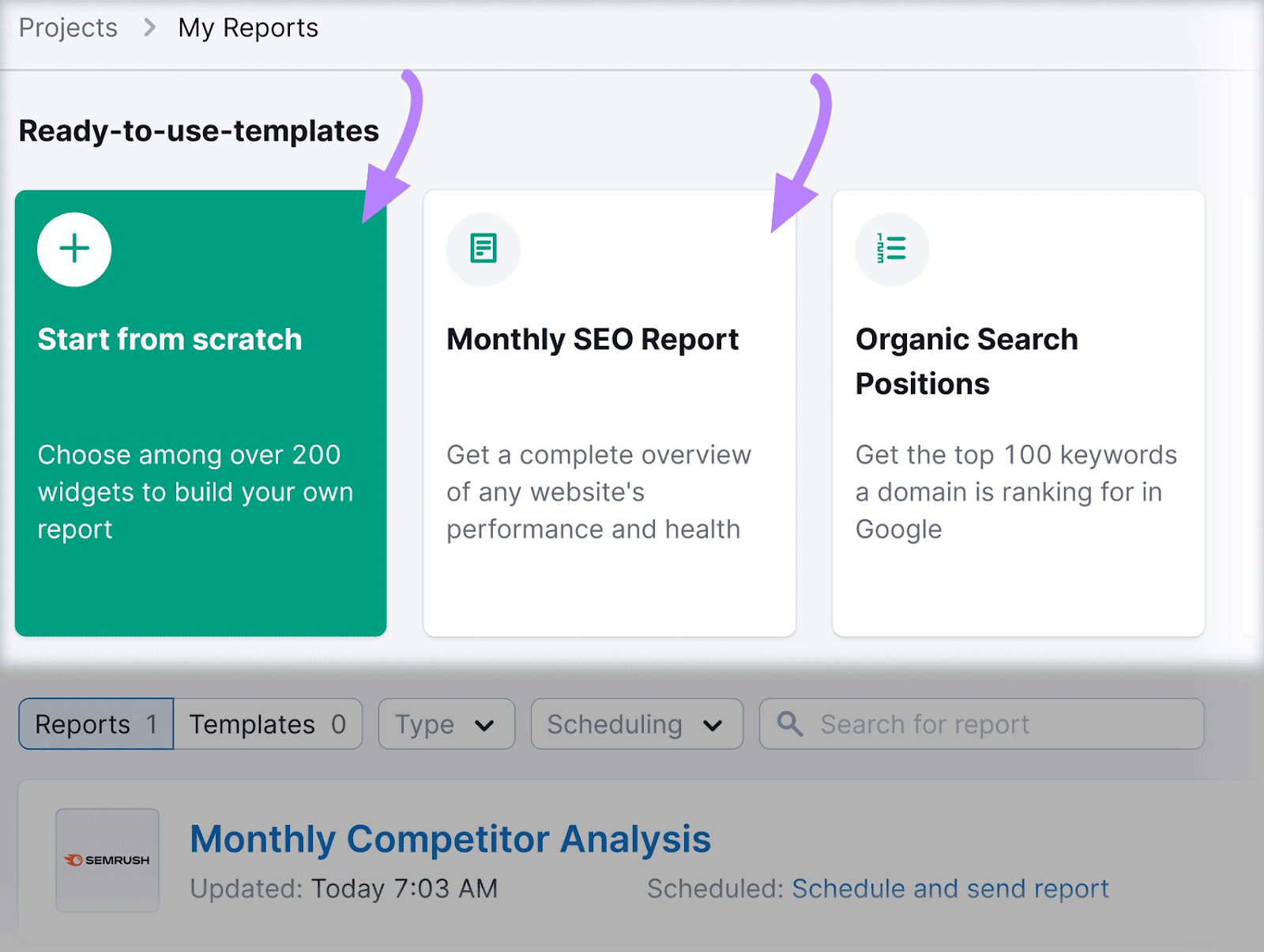

With My Reports in Semrush, you can schedule performance reports on you and your competitors.

Just choose one of the ready-to-use templates after setting up your project. Or start from scratch.

Then, follow the instructions provided.

To create a custom report like this:

Where to Gather Competitive Intelligence

These competitive intelligence tools and sources allow you to gather valuable data:

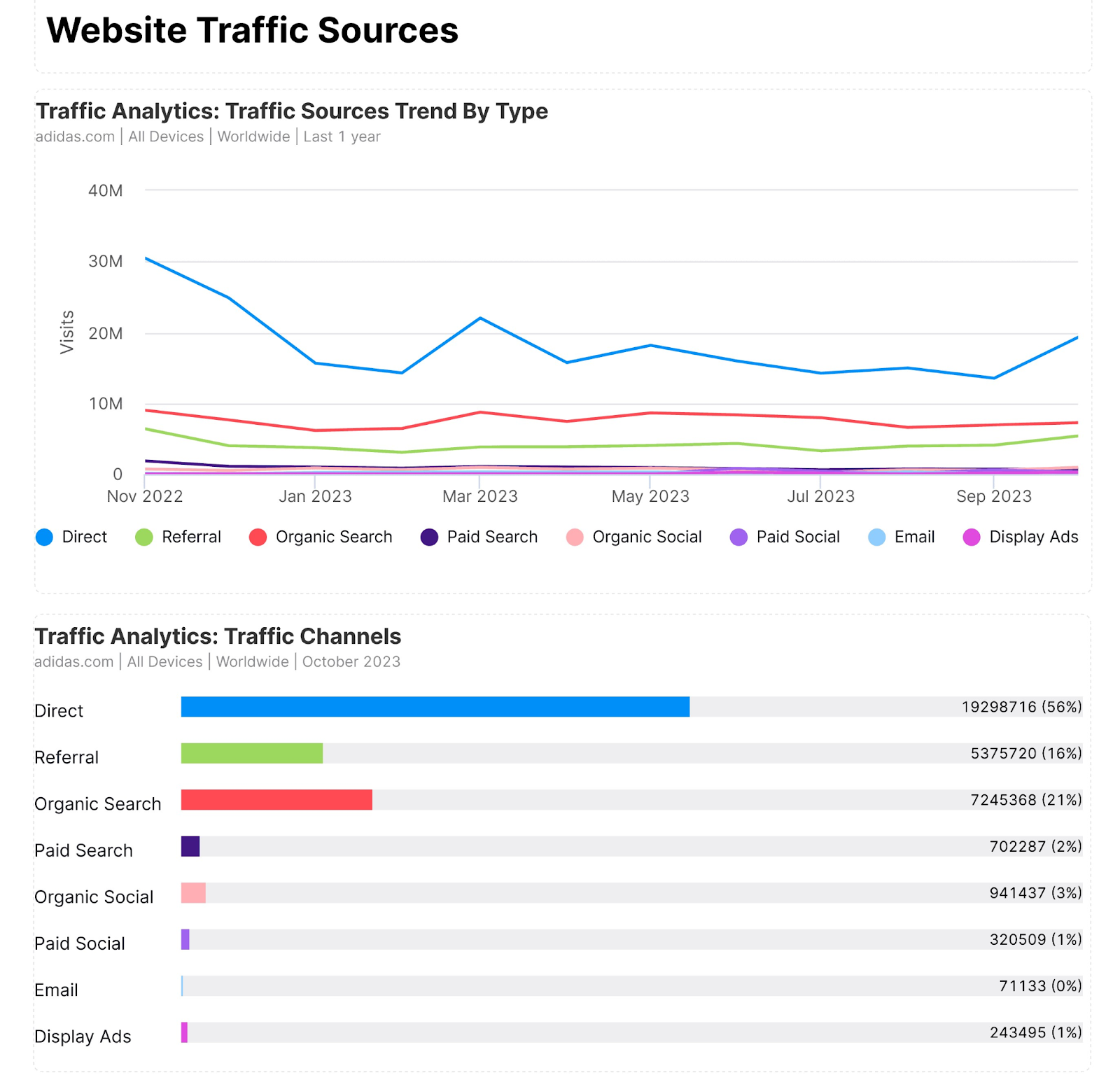

Market Intelligence Tools

Market intelligence tools collect and analyze data from various sources to help businesses understand their target market. Making it easy to gather competitive market intelligence.

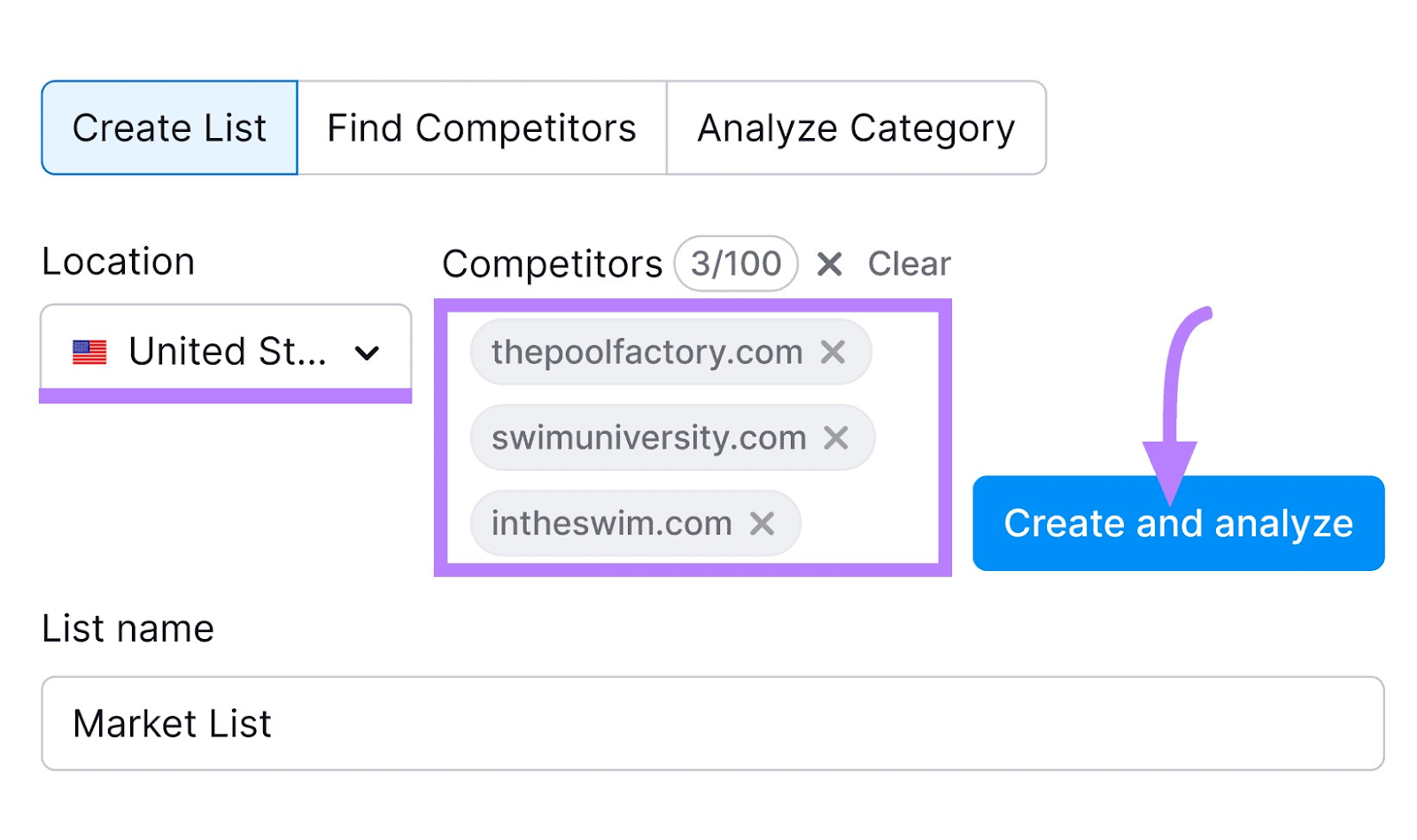

Get started with Semrush’s Market Explorer tool.

Choose your country, enter a few rival domains, then click “Create and analyze.”

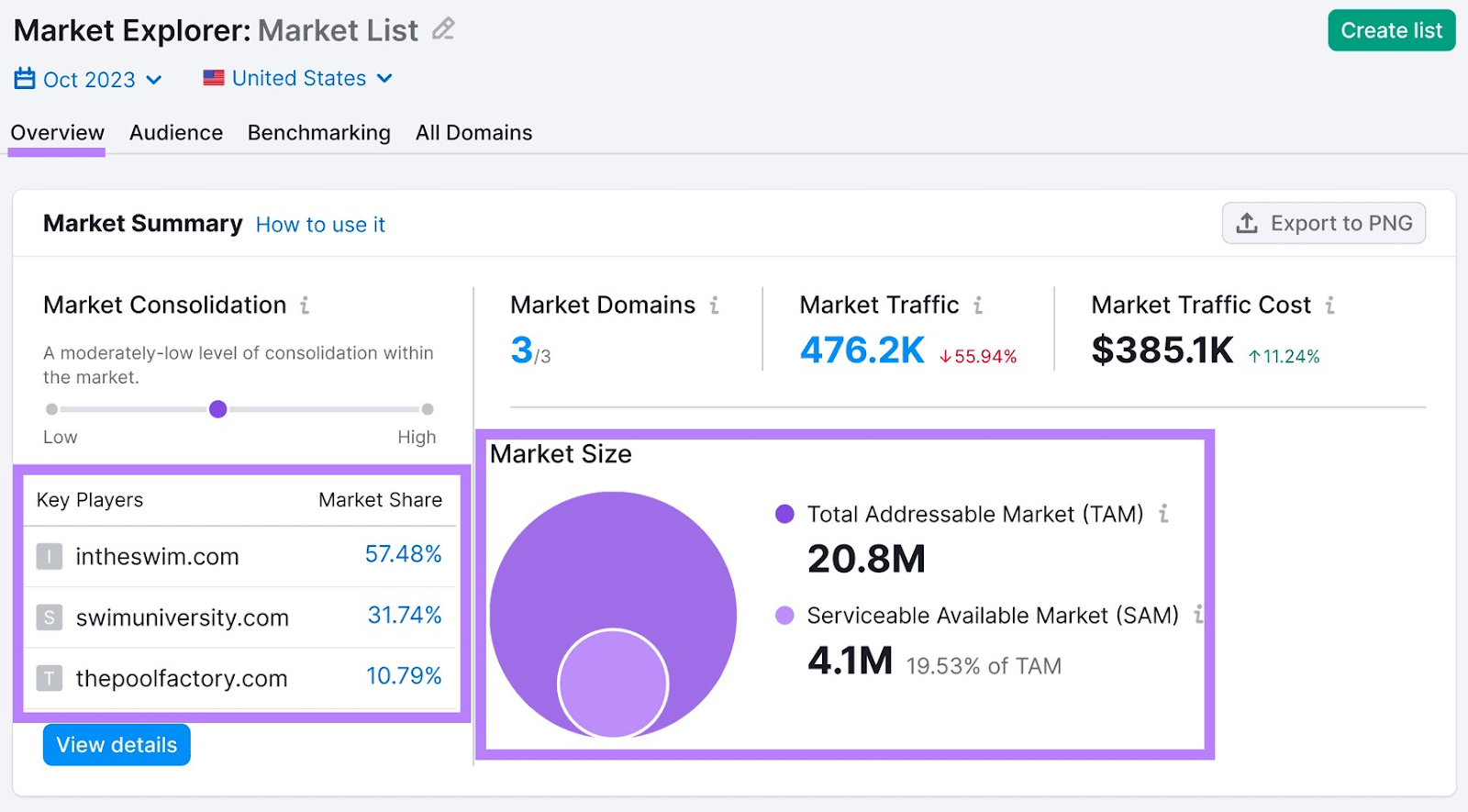

In the “Overview” report, you’ll see each competitor’s market share. And the market’s size.

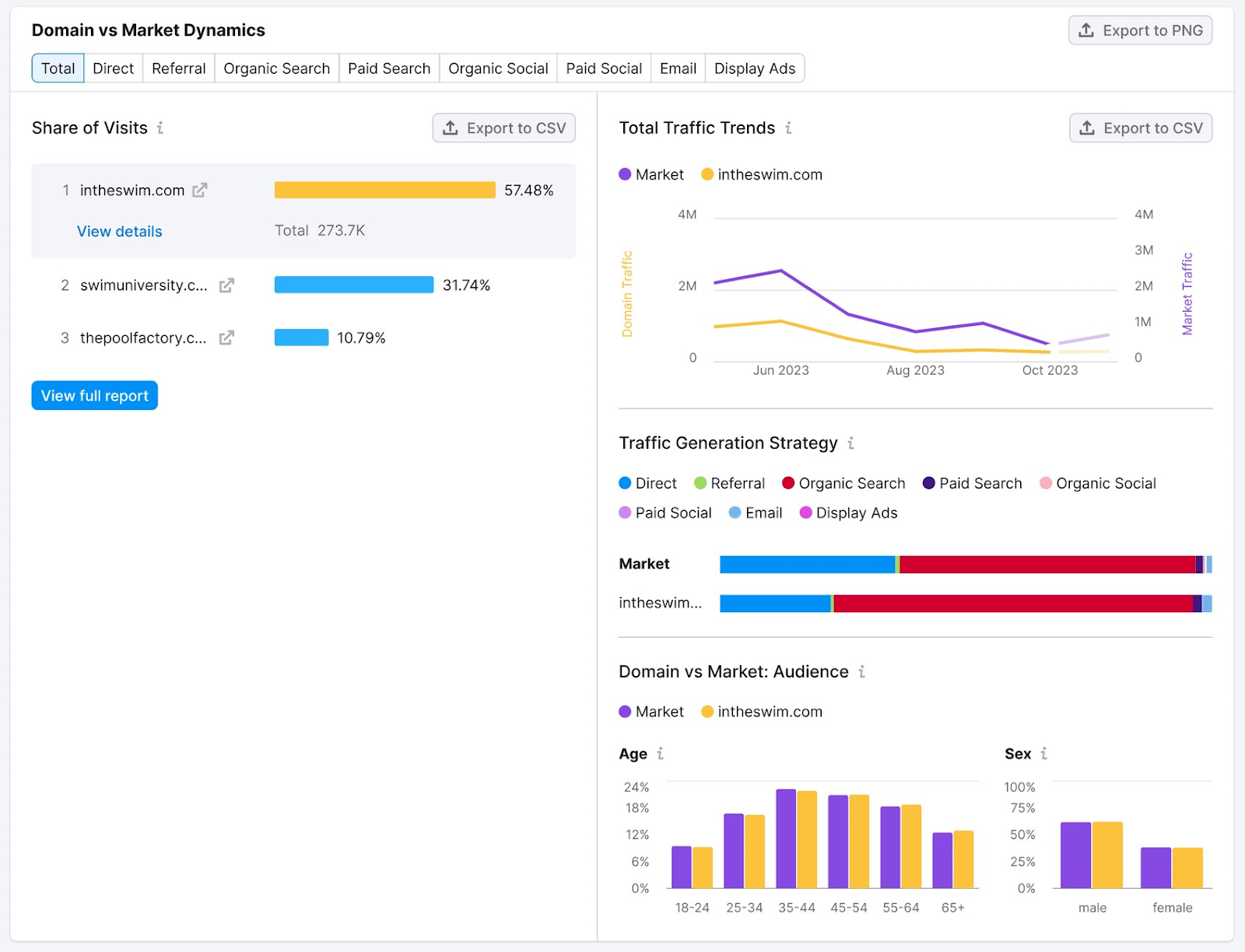

Scroll down to “Domain vs Market Dynamics” to see where each rival gets their traffic.

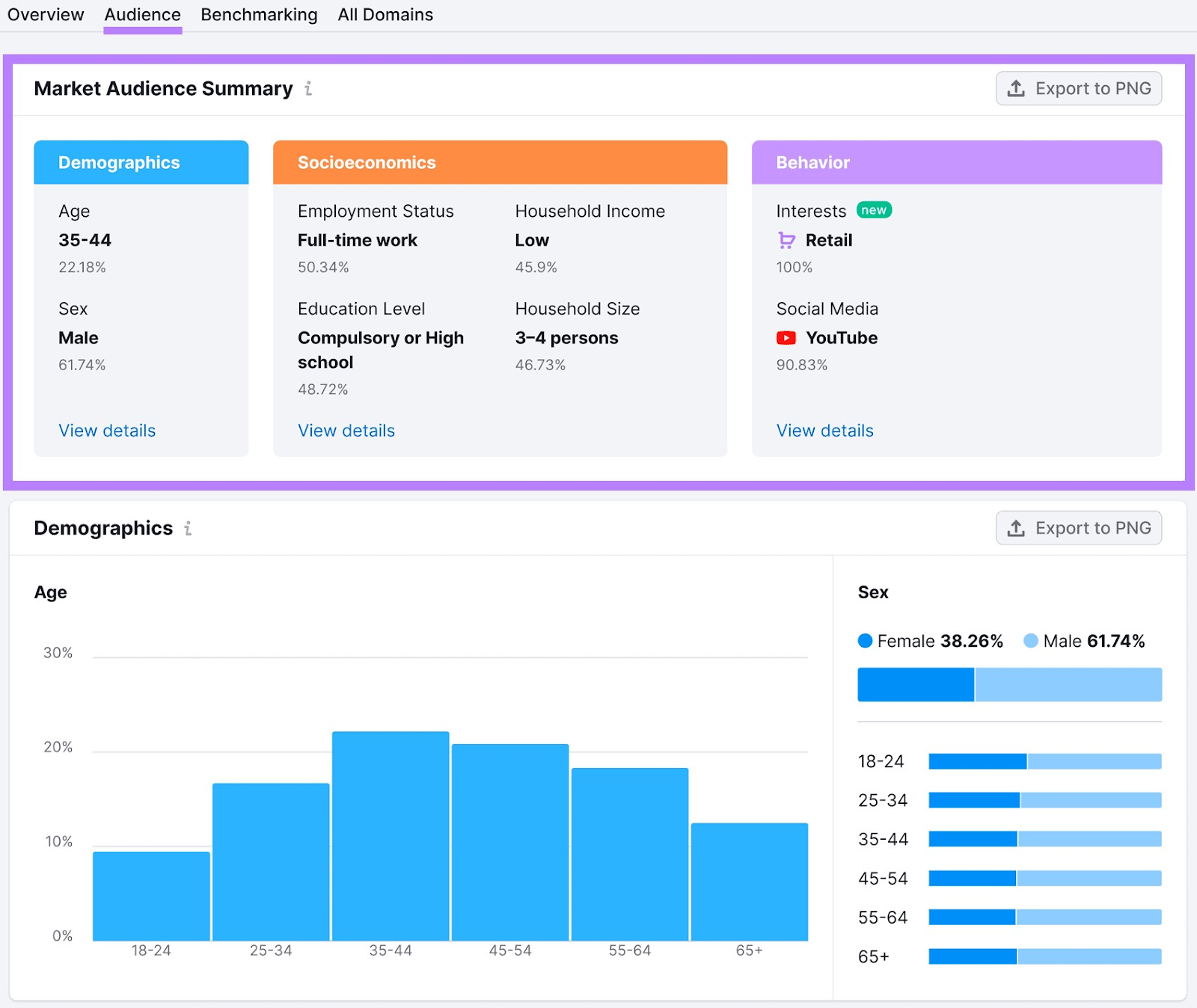

And go to the “Audience” report to learn about the people who visit your competitors’ sites.

You’ll find demographic, socioeconomic, and behavior data.

Competitors’ Websites

Competitors’ websites contain reliable information about their business, products, and services.

But you can also gain glimpses into their marketing and sales strategies.

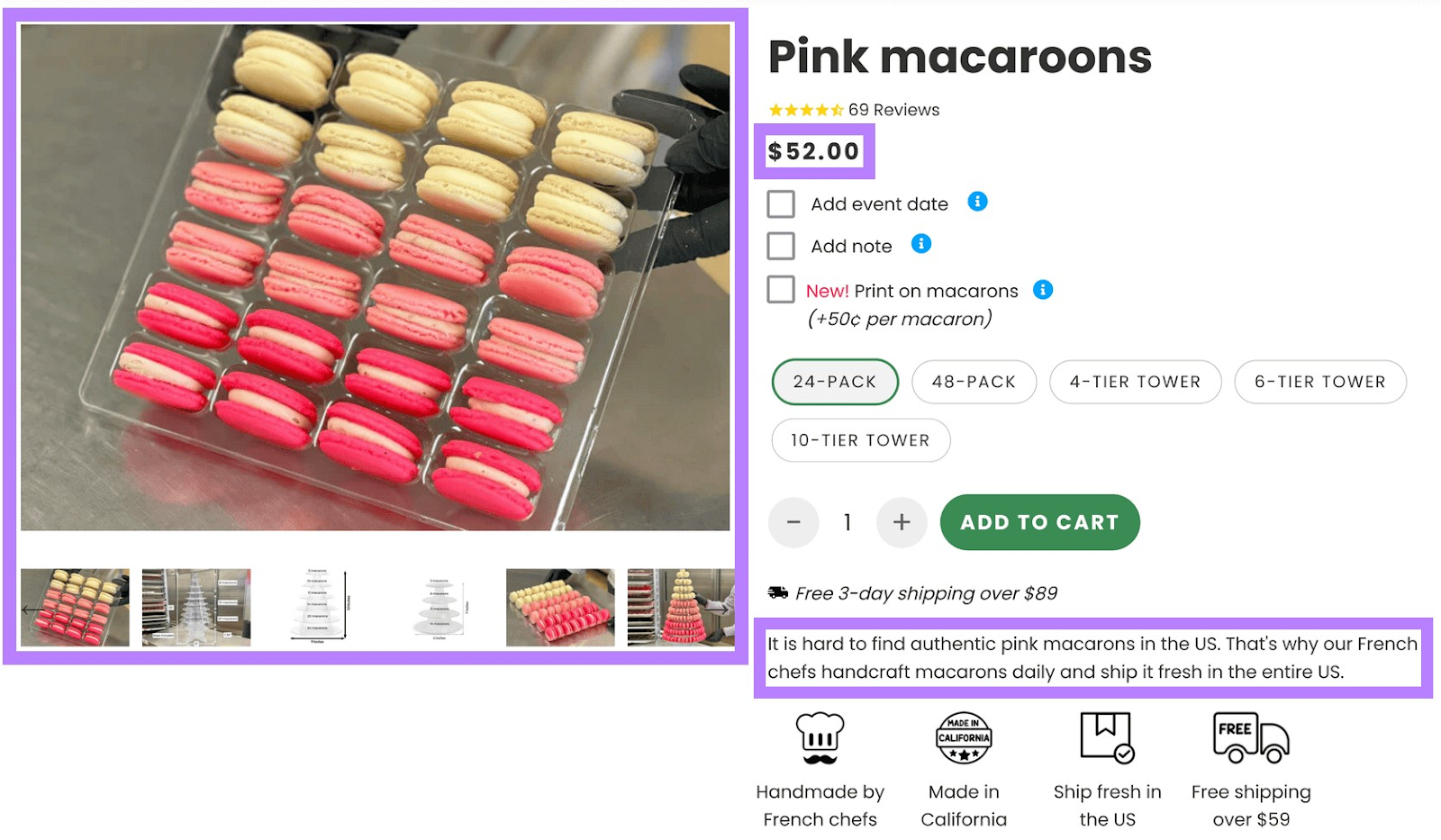

For example, an macaron bakery could look at the Pastreez website to:

- Check out their product prices, photos, and descriptions

- See what kinds of content they publish on their blog

- Learn about their unique selling propositions (USPs)

And much more.

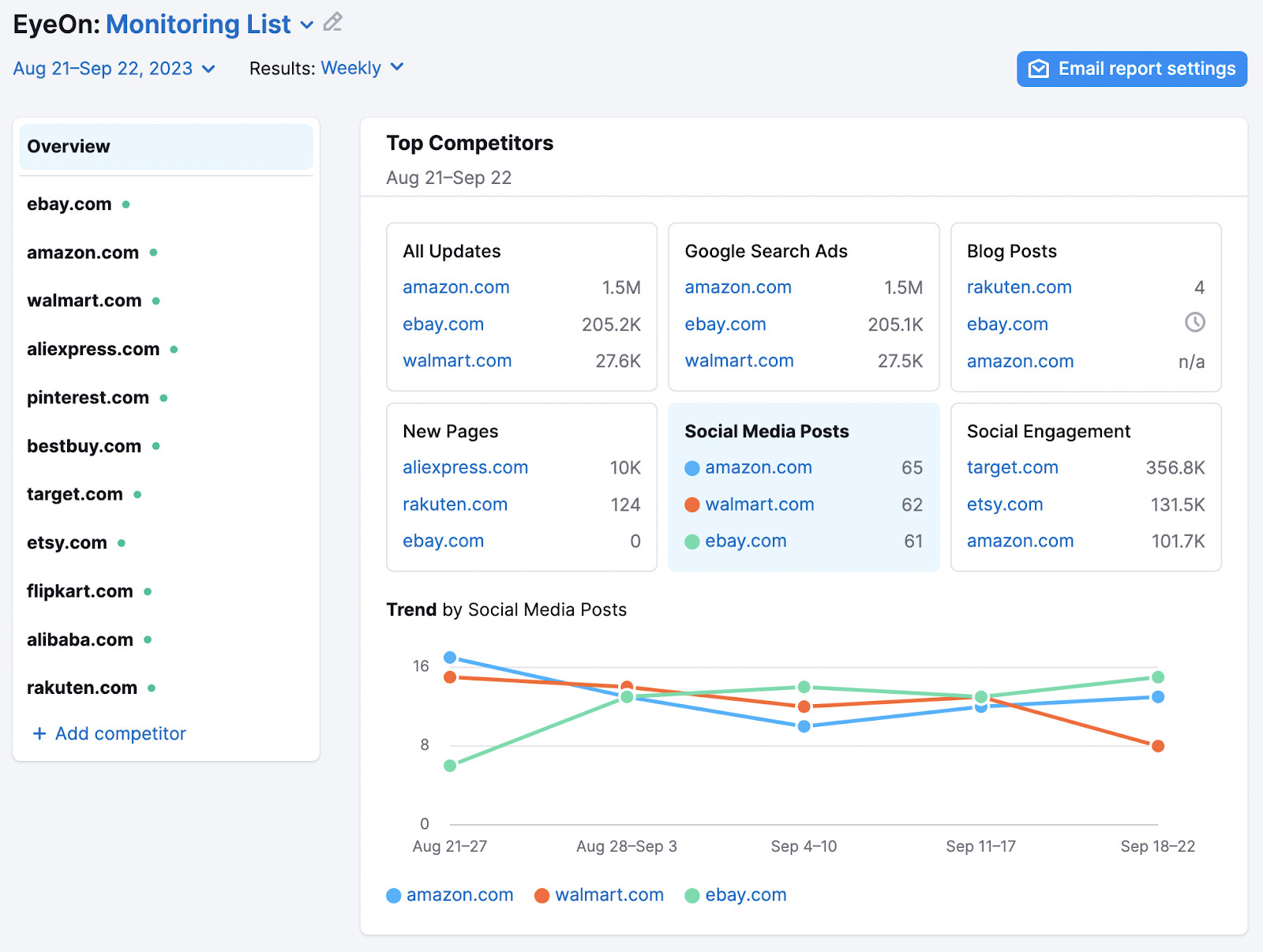

With the EyeOn app, you can get daily, weekly, or monthly reports about competitors’ activities. It’ll notify you about new webpages, blog posts, social posts, and more.

You can also access real-time updates in the dashboard:

CRM Platforms

Customer relationship management (CRM) platforms allow you to store information about leads and customers.

By collecting the right data, storing it in your CRM, and analyzing it at scale, you can gain competitive intelligence.

For example:

During the sales cycle, ask prospects which rival products they’re using or considering. And record their demographic data and information about their needs.

That way, you can see which rivals pose the biggest threat in each audience segment. And adjust your sales pitches accordingly.

Industry Publications

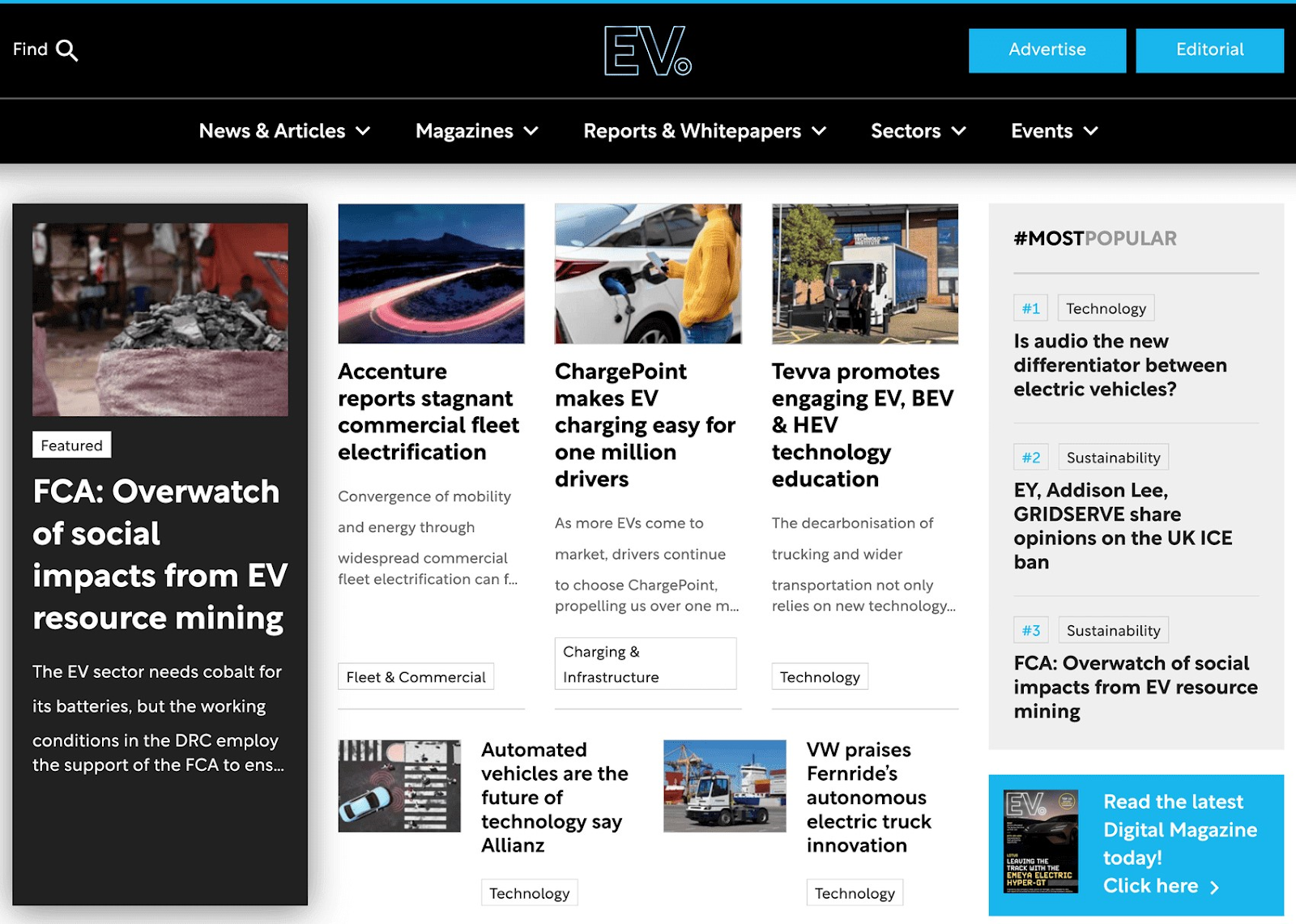

Industry publications often publish useful content about your competitors and/or market.

For example, EV Magazine is a great place for businesses in the electric vehicle industry (or related niches) to gather competitive intelligence.

Readers can:

- Learn about rival strategies through interviews

- Keep up to **** with regulatory changes

- Get insights into consumer outlook

To ensure you don’t miss out on relevant coverage, set up Google Alerts for relevant keywords (e.g., “electric cars” or “Nissan”).

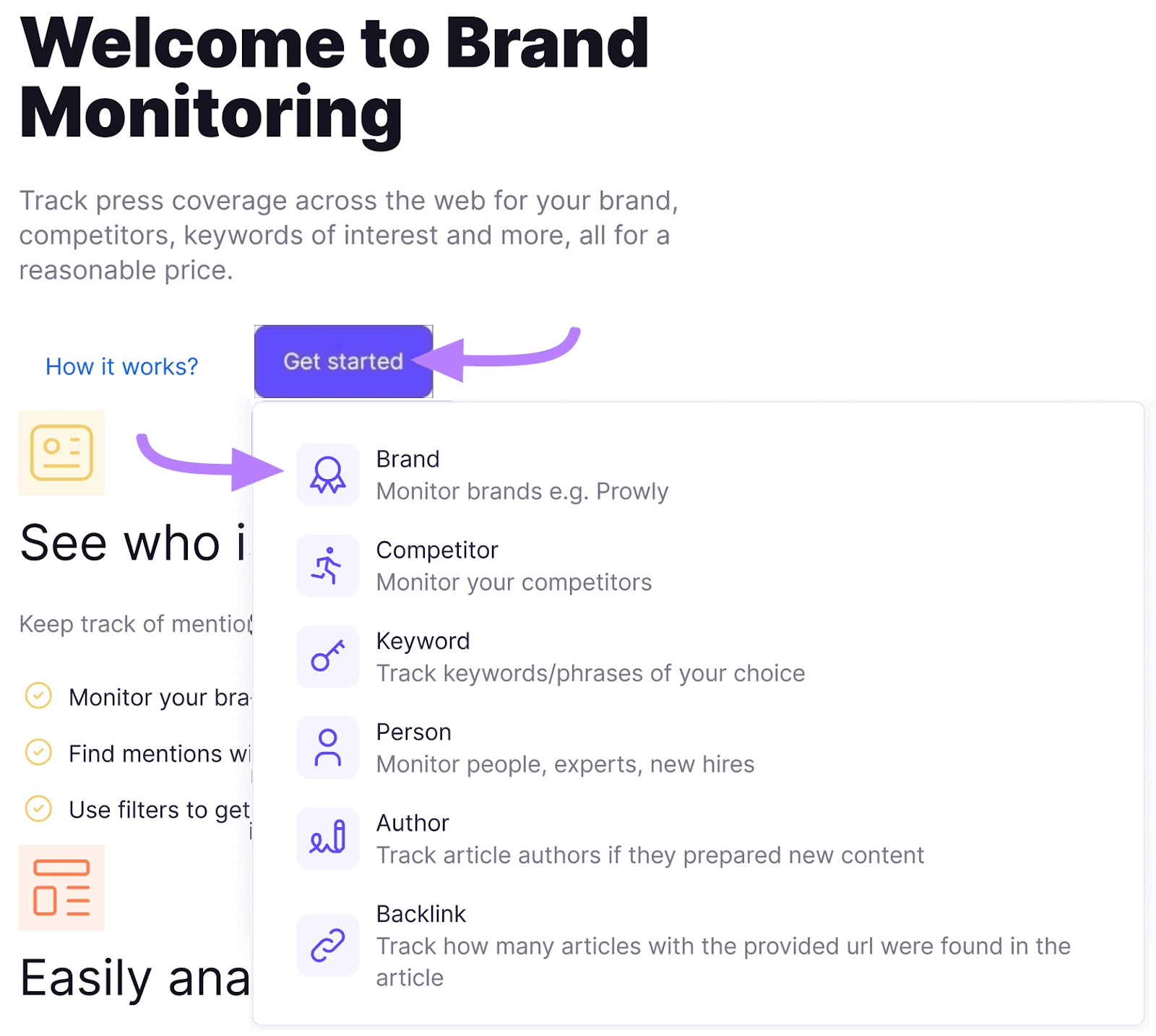

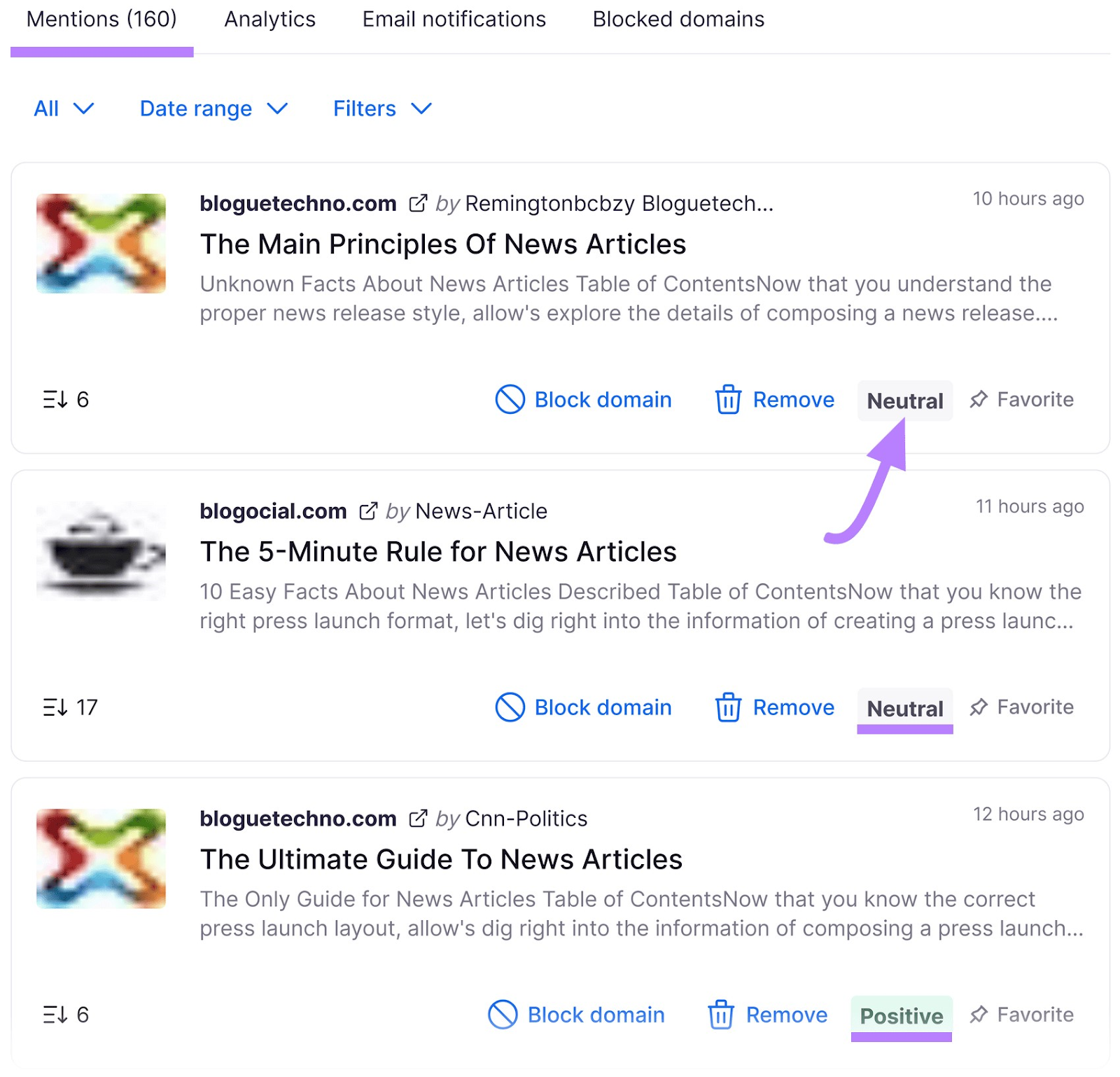

Or, use the Brand Monitoring app.

It lets you track mentions of your brand, competitors, keywords, or even people.

And see whether those mentions have positive, neutral, or negative sentiment.

Customer Reviews

Customer reviews provide insight into your competitors’ strengths and weaknesses. And what prospects are looking for.

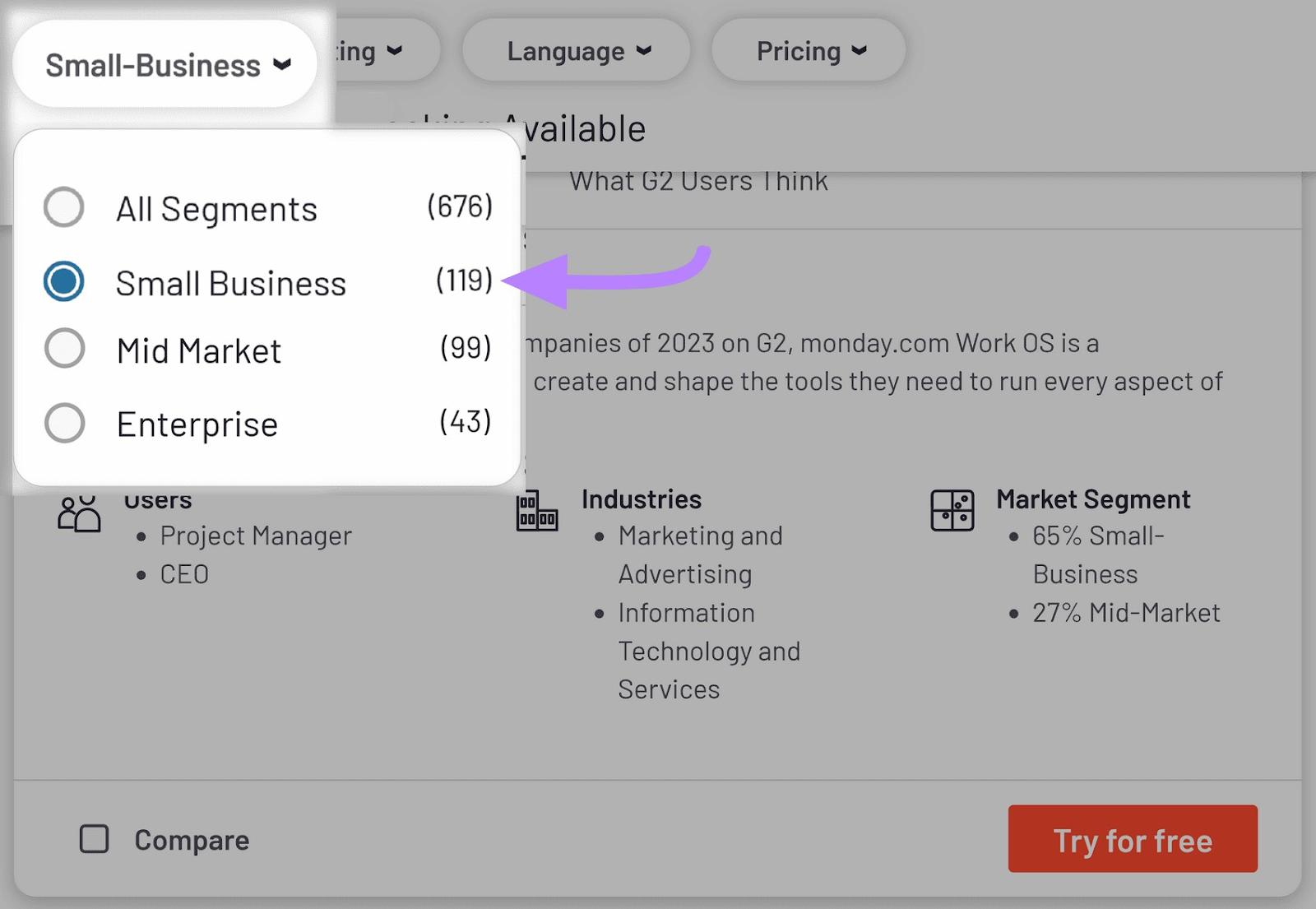

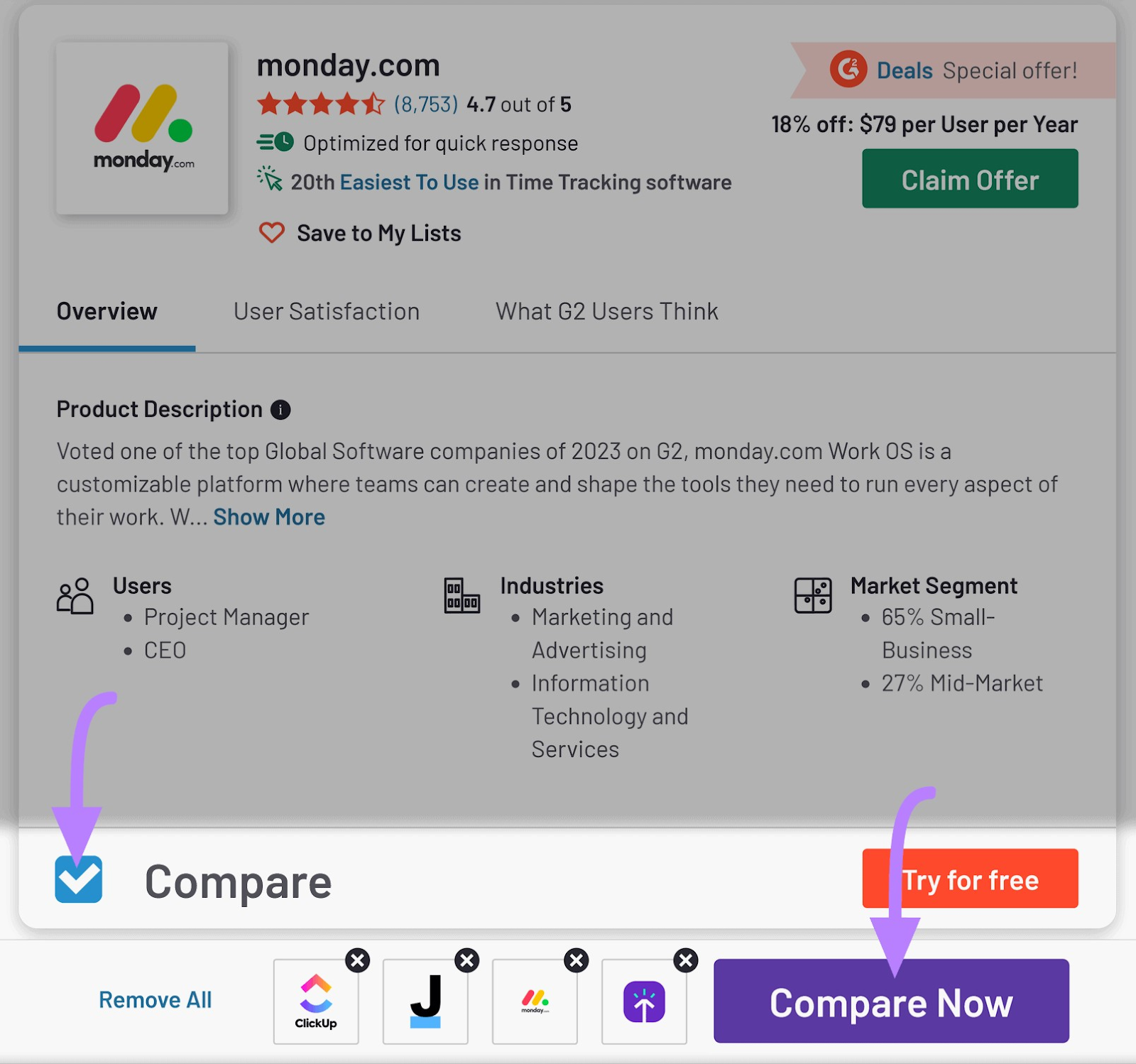

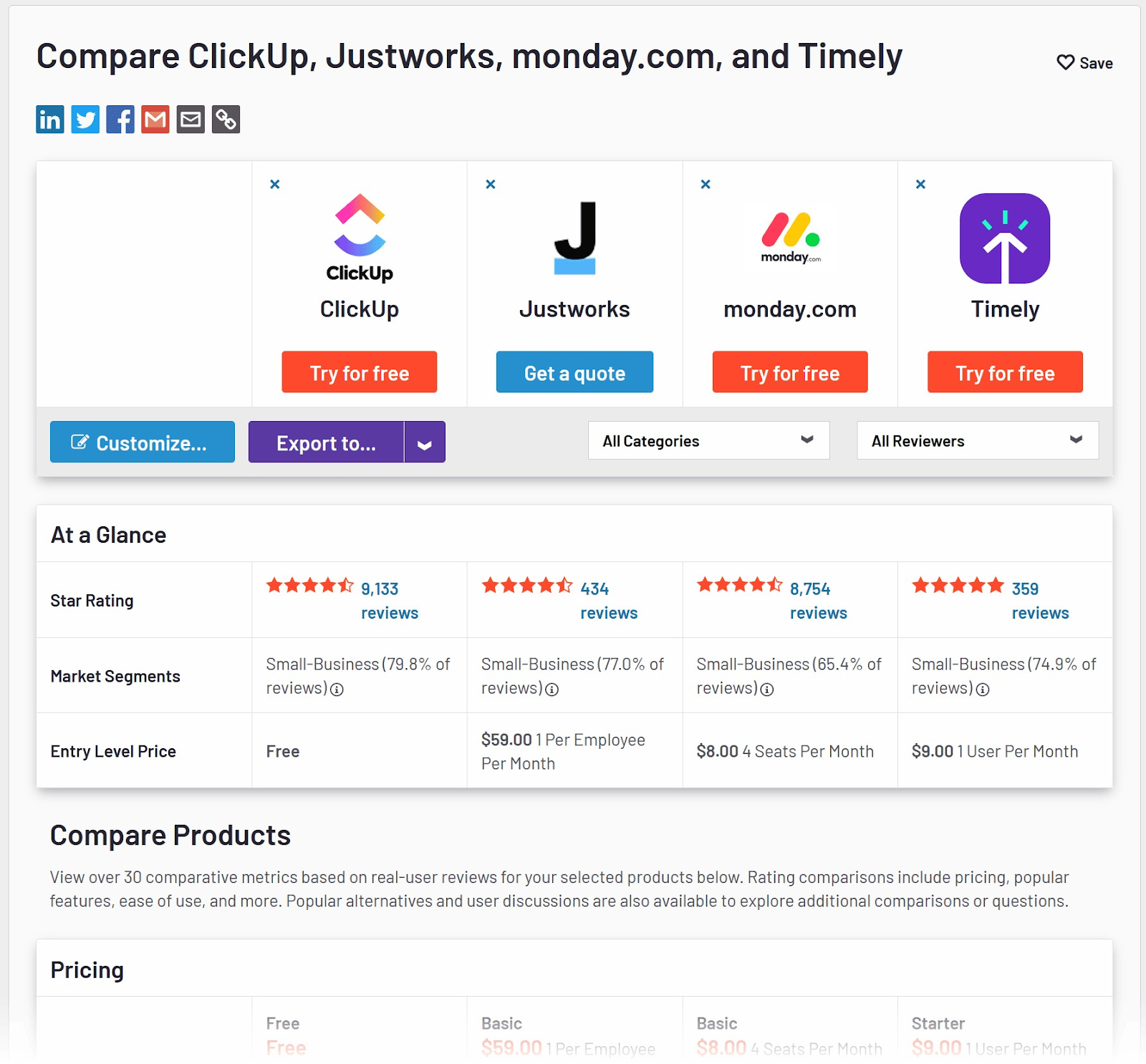

On review aggregator sites like G2, you can filter reviews based on different criteria.

For example, you can focus on particular audience segments (e.g., small businesses):

Plus, you can easily compare up to four businesses.

Check the boxes alongside your competitors. Then, click “Compare Now.”

To compare prices, rating breakdowns, features, and more.

And remember that a lot of valuable information lies in the stories that customers tell. So, read reviews on multiple platforms to get insight into customers’ needs, pain points, and values.

Social Media

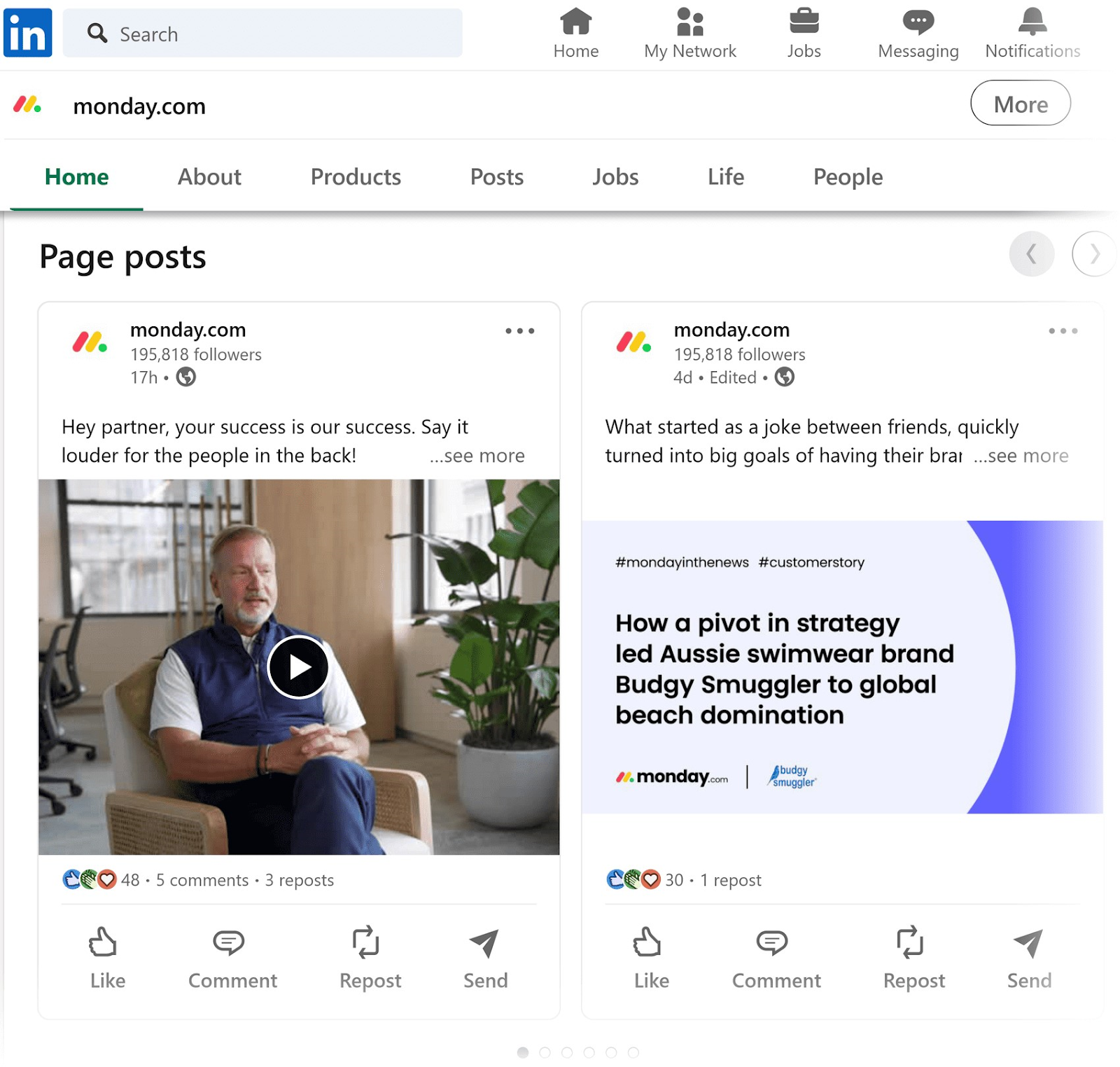

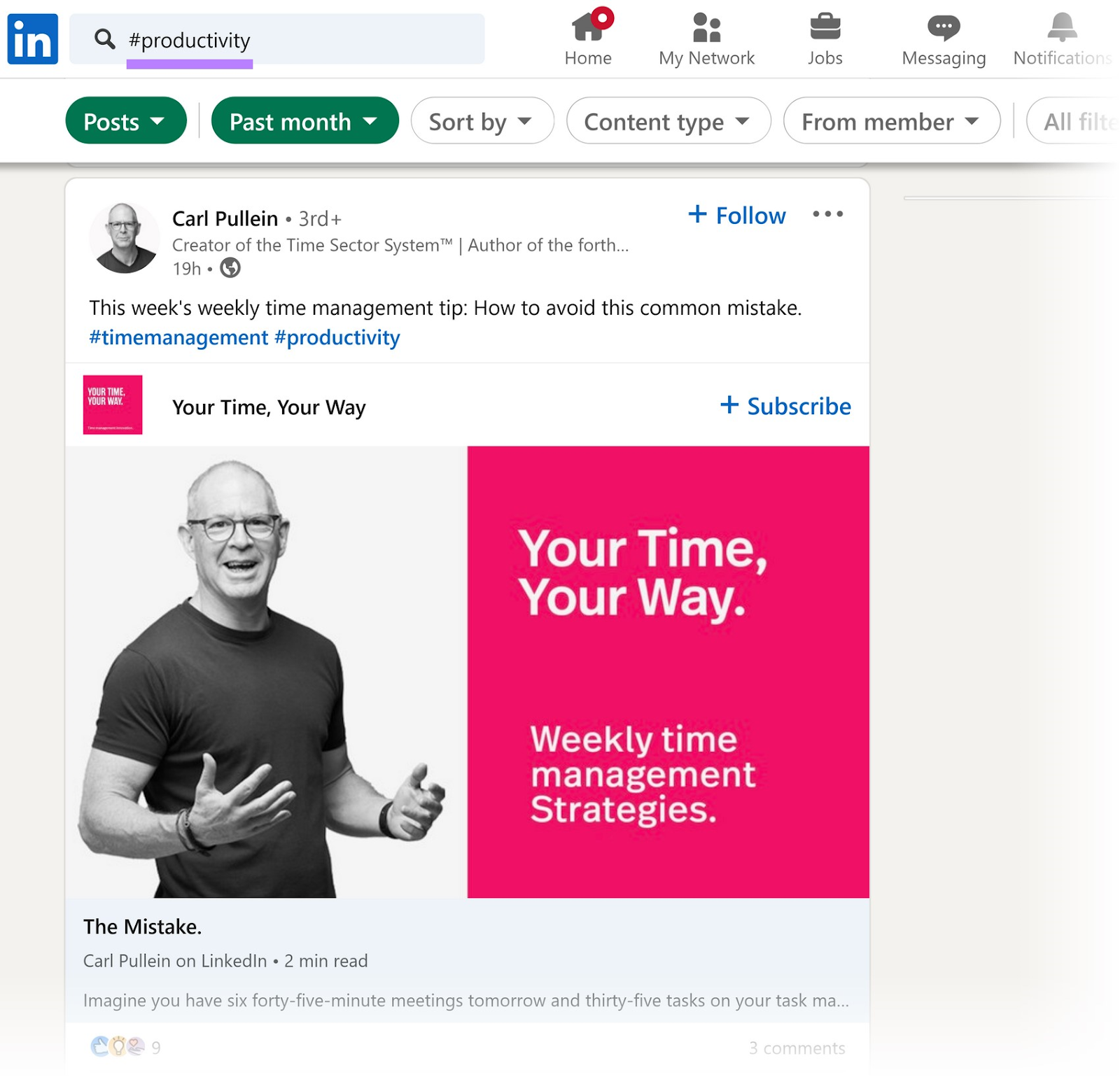

Social media platforms can provide real-time (and often unfiltered) insights into your competitors and audience.

Visit rivals’ profiles to see what content they publish. And how they engage with their followers.

Or monitor industry hashtags and conversations. To learn about your audience’s preferences, opinions, and behaviors.

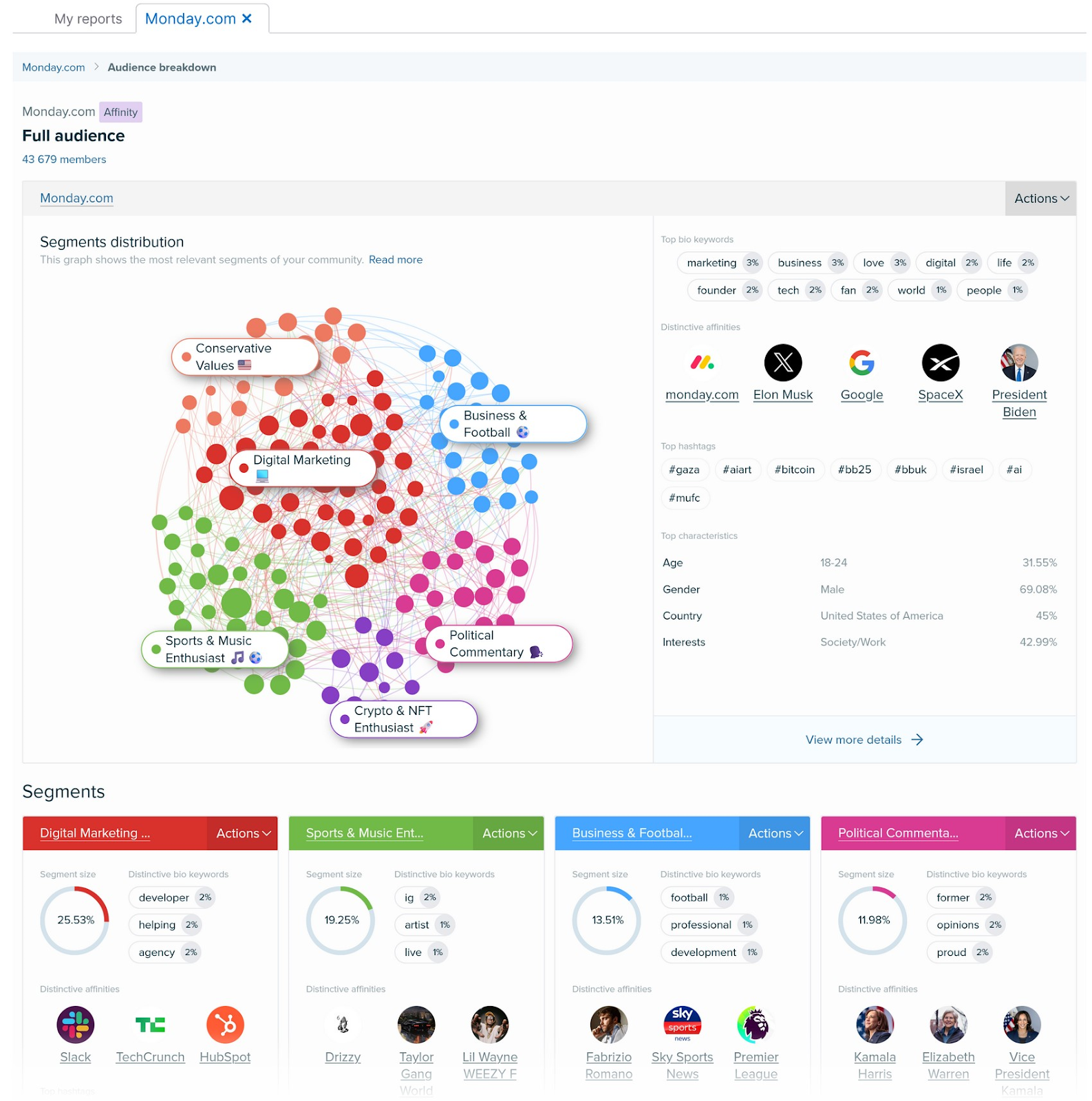

Alternatively, use a tool like Audience Intelligence to gather information at scale.

Enter an X (formerly Twitter) username, and the tool will identify relevant audience segments.

You can learn about each segment’s demographics, favorite brands, top hashtags, and more.

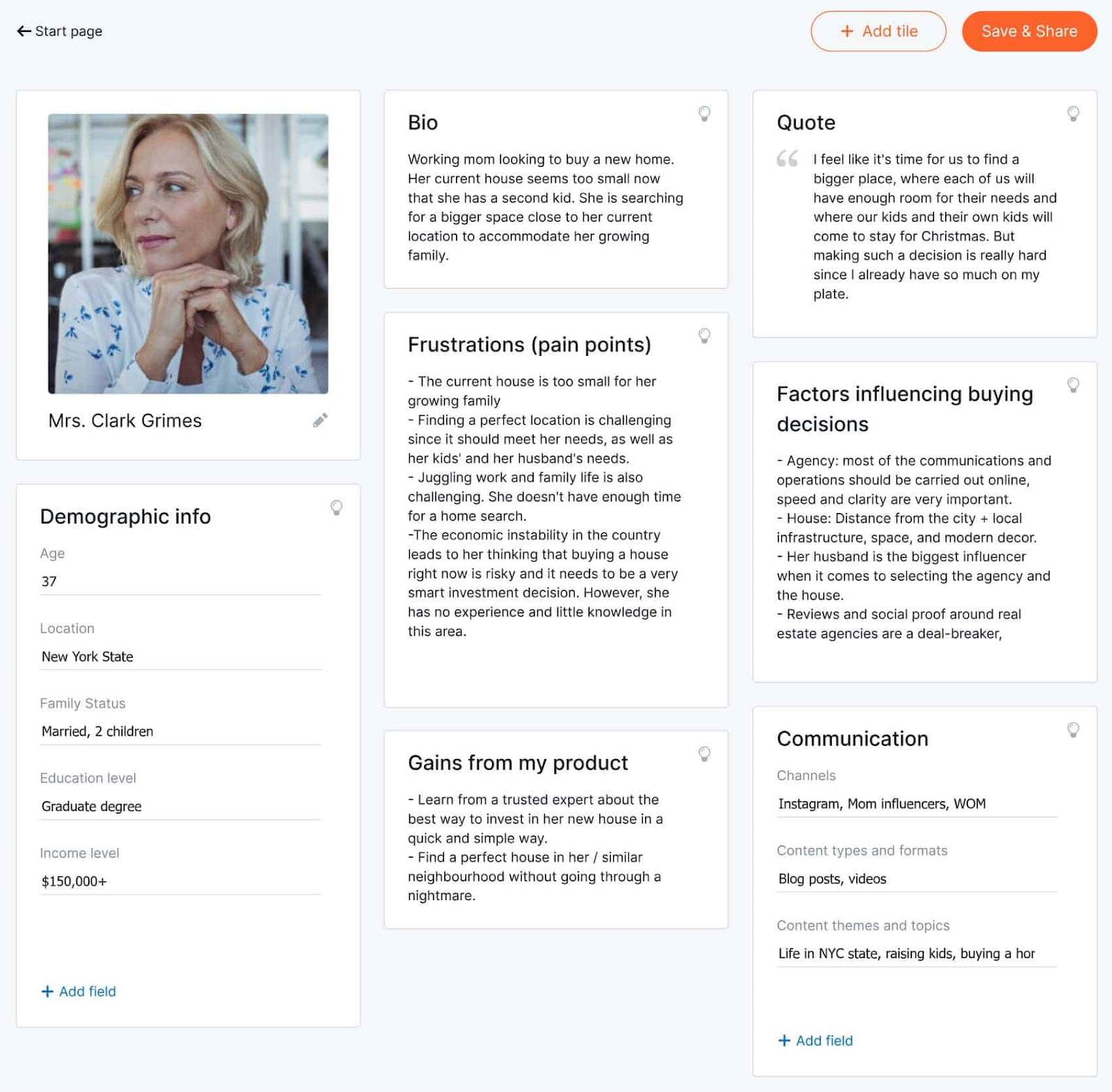

This data can be used to build detailed buyer personas (profiles for target customers).

Like this one:

SEO Tools

With the right SEO tools, you can see how much organic traffic (unpaid search engine traffic) competitors get. And how they’re earning it.

Organic traffic is often a major source of revenue. So, this information can be extremely valuable.

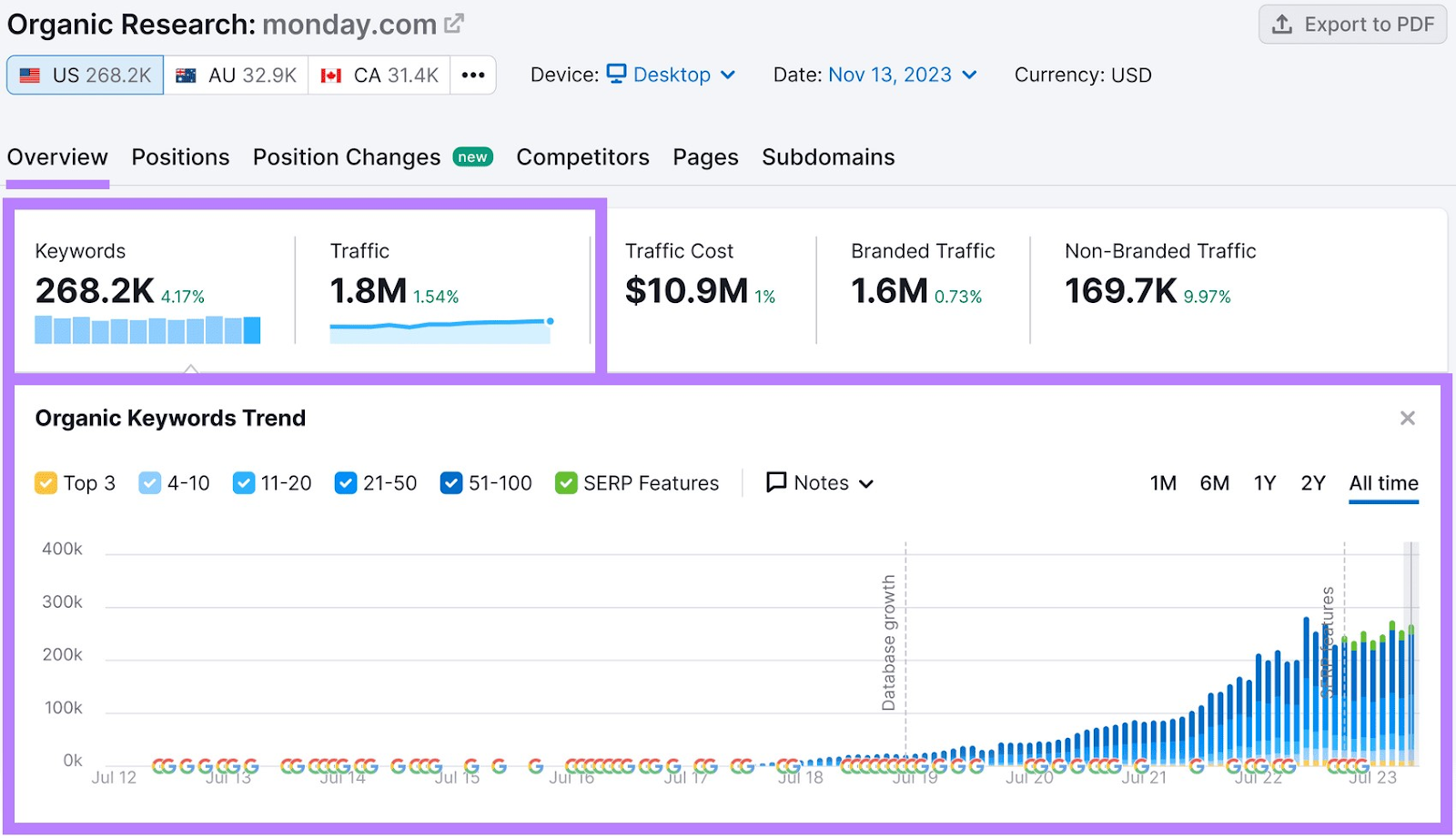

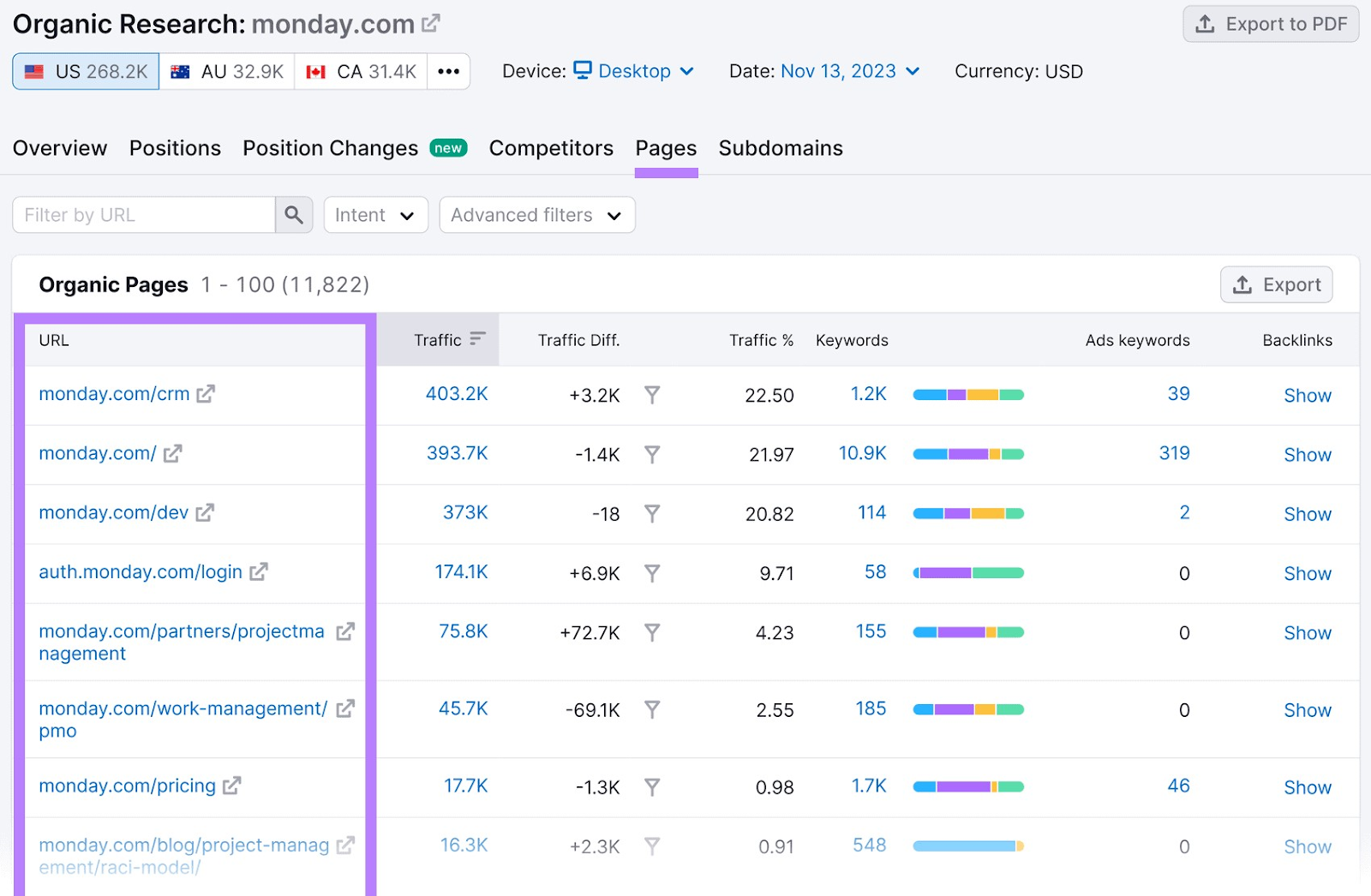

Try entering a rival domain into Semrush’s Organic Research tool.

You’ll immediately see:

- How many keywords they rank for

- Estimated organic traffic for the upcoming month

- How their traffic has changed over time

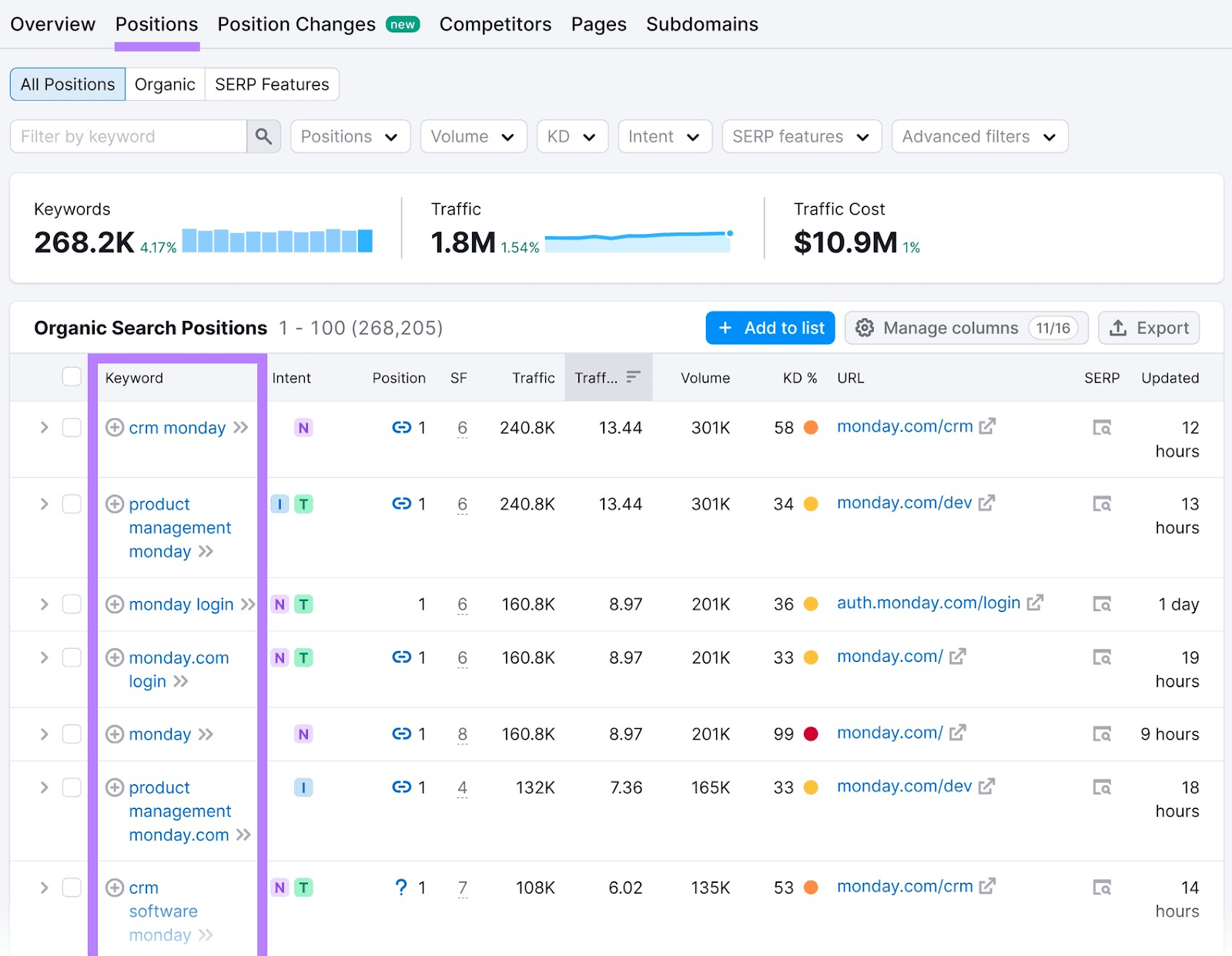

Go to the “Positions” tab to see a full keyword breakdown.

This is a great place to get inspiration for your own keyword strategy.

Or head to the “Pages” report to see which URLs attract the most search traffic.

By analyzing these pages, you can learn how to improve your own content.

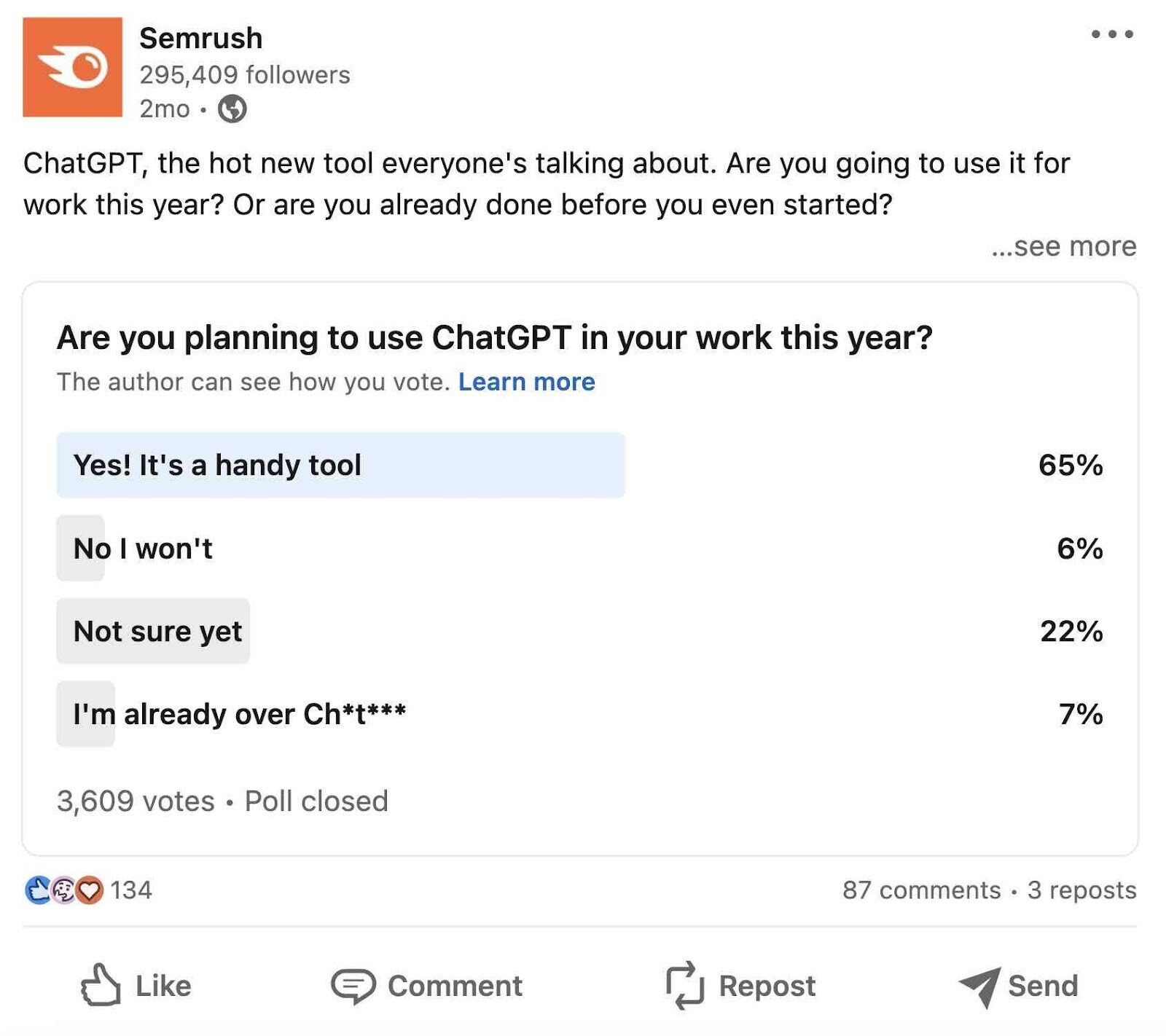

Consumer Interviews and Surveys

Through interviews and surveys, you can gather competitive intelligence on highly specific topics. And from highly specific audiences.

For example, you can send a product feedback survey to email subscribers. Or conduct a social media poll about the latest industry trend.

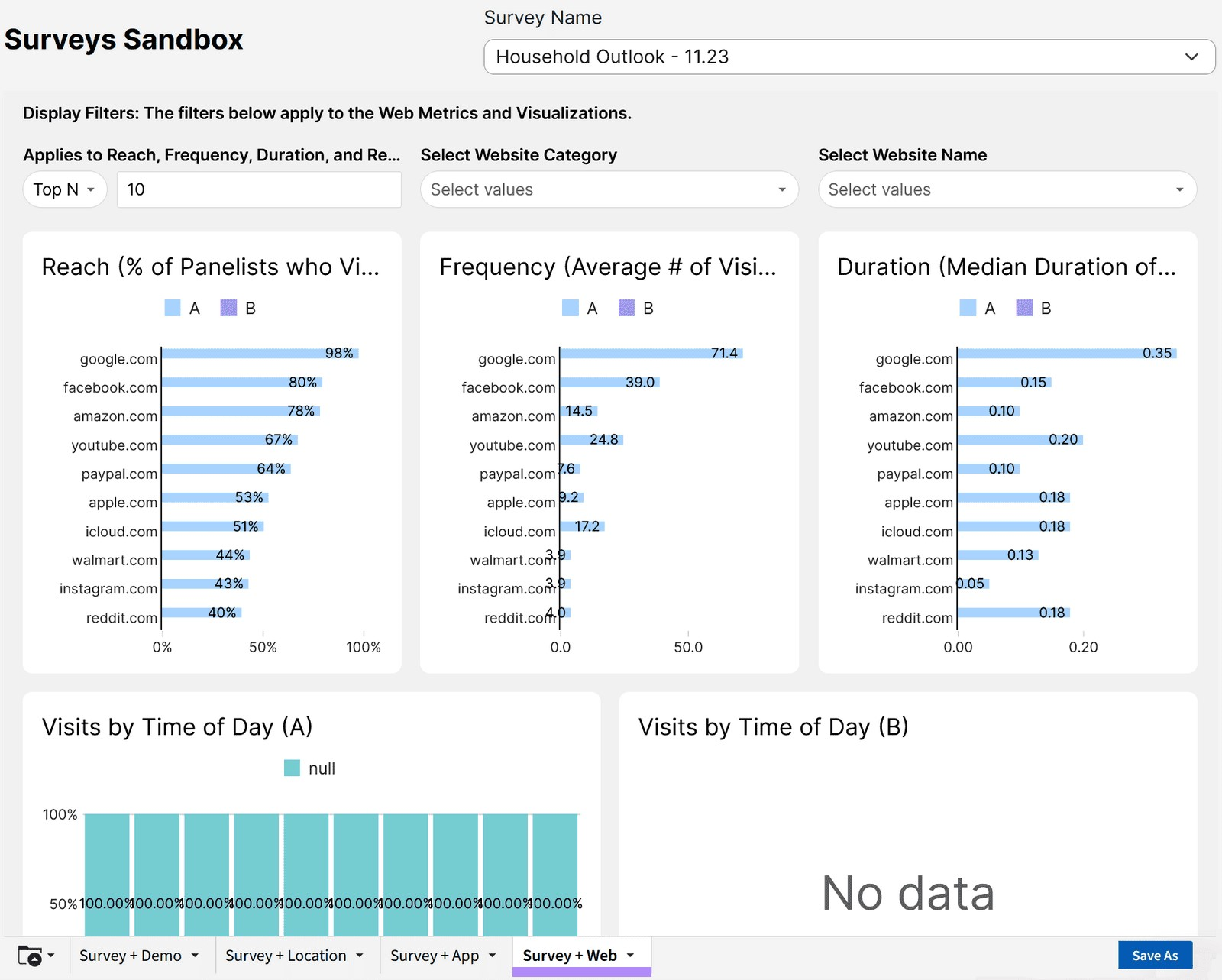

With the Consumer Surveys app, you can access results from six surveys that are conducted each month:

- Household Outlook

- Entertainment Habits

- Health Habits

- Shopper Habits

- Technology Outlook

- Seasonal Outlook

Use the Surveys Sandbox to focus on the results and segments that matter to you.

Alternatively, request a custom survey. To get answers to your most pressing questions.

Whatever surveying method you choose, it’s crucial to maintain respect for people’s data privacy. And adhere to any rules and regulations.

Competitive intelligence tools make it easy to gather valuable insights, streamline decision-making, and sharpen your competitive edge.

With a Semrush .Trends subscription, you get access to:

Source link : Semrush.com